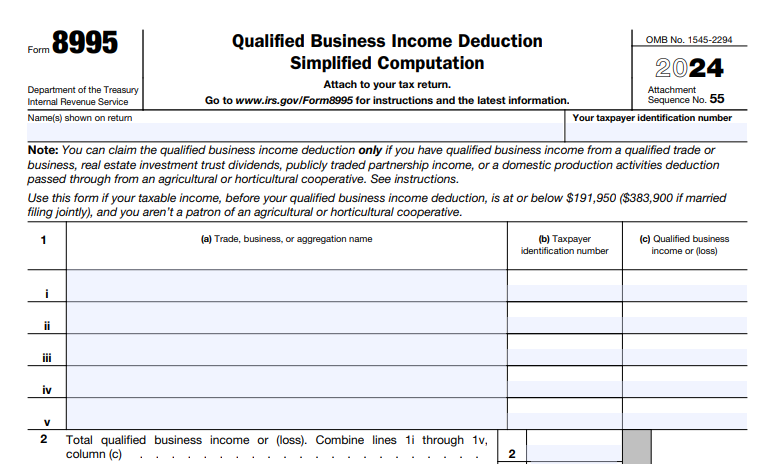

IRS Form 8995, Qualified Business Income Deduction Simplified Computation, is one of the most valuable yet often misunderstood tax forms for small business owners. It calculates the Qualified Business Income (QBI) deduction, which is often called the 20% pass-through deduction. For eligible business owners, this deduction can significantly reduce taxable income, making it essential to learn how to correctly complete Form 8995 as part of your annual tax preparation activities.

Most taxpayers use the simplified version of the form when their taxable income falls below the IRS threshold. Even though the form is shorter, completing it correctly requires an accurate understanding of your business income, expenses, and prior year adjustments. Many business owners work with a professional to ensure that their books and tax filings support the maximum deduction. However, you can use this overview of Form 8995 and how to complete it if you'll claim the deduction independently.

Key Highlights

Form 8995 calculates the QBI deduction for eligible pass-through business owners.

The deduction can reduce taxable income by up to 20% of qualified business income.

The simplified Form 8995 is used by taxpayers whose taxable income is below the annual IRS threshold of $197,300 for single filers.

Accurate bookkeeping is essential because QBI is based directly on your business profit.

IRS Form 8995-A, Qualified Business Income Deduction, is required for higher-income taxpayers or more complex situations.

Professional support can help avoid mistakes that reduce or eliminate this valuable deduction.

What Is Form 8995?

Purpose of the Form

Form 8995 is the simplified version of the calculation worksheet used to determine a taxpayer’s QBI deduction. The IRS allows eligible business owners to use this simpler form if their taxable income is at or below $197,300 ($394,600 if married filing jointly).

Taxpayers with income above those limits or with more complex business structures must file Form 8995-A instead. This longer form provides additional worksheets and rules that apply to high-income filers.

How the QBI Deduction Works

The QBI deduction allows eligible owners of pass-through entities to deduct up to 20% of their qualified business income. According to IRS QBI deduction guidance, this applies to businesses such as:

Sole proprietorships

Partnerships

S corporations

Certain LLCs that are taxed as pass-through entities

Qualified business income generally includes your net profit from the business. It does not include:

Wages paid to yourself

Capital gains or losses

Interest

Dividends

Income earned as an employee

If your taxable income is low enough to qualify for the simplified method, Form 8995 provides a streamlined calculation to determine your allowable deduction.

Who Should File Form 8995?

Eligible Business Owners

Form 8995 is designed for most owners of pass-through entities, including:

Sole proprietors

Freelancers and independent contractors

Single-member LLCs

Partners in partnerships

S corporation shareholders

It's important to note that QBI is calculated on a per-business basis, not per owner. If you operate multiple qualifying businesses, each one requires its own QBI calculation before being combined on the form.

Income Requirements

The primary requirement for using Form 8995 instead of Form 8995-A is that your taxable income must fall below the IRS threshold for the year. The threshold changes annually and determines whether limitations apply related to:

W-2 wages

Qualified property

Specified service trades or businesses (SSTBs)

SSTBs are subject to phase-outs once taxable income exceeds the threshold. These businesses include consulting, law, accounting, health care, and other service industries, where income is tied to the owner’s reputation or skill.

How to Complete Form 8995 Step-by-Step

Before filling out the form, gather your tax documents, bookkeeping records, and any prior year adjustments that affect the current year’s deduction.

Gather Required Information First

You will need:

Total qualified business income per business

W-2 wages paid by the business, if applicable

Unadjusted basis of qualified property (UBIA), although the simplified form uses this minimally

Any QBI loss carryovers from prior years

Accurate income and expense tracking makes this process far easier, especially when paired with year-round bookkeeping.

Step 1: Enter Your Qualified Business Income

Form 8995 begins by listing each qualified trade or business:

Line 1: Enter the name of each business, its taxpayer ID number, and its QBI. You can list up to five separate activities (1i through 1v).

Then:

Line 2: Combine all QBI amounts from line 1 into a single total. If the result is zero or negative, this affects the rest of the form and may reduce the deduction.

QBI numbers typically come from:

Schedule C Line 31 for sole proprietors

Schedule K-1 for partnerships and S corporations

Step 2: Apply the 20% Calculation

Apply the 20 percent business income deduction at this step. If you had a negative QBI in a prior year, enter that amount on Line 3. This number directly offsets current-year QBI.

Line 3: Qualified business net loss carryforward from the prior year

Now calculate the main QBI deduction:

Line 4: Add lines 2 and 3. If the result is zero or less, enter 0.

Line 5: Multiply the amount on line 4 by 20% (0.20). This is your QBI component.

Example: If total QBI (after carryovers) is $60,000:

60,000 × 0.20 = $12,000

Professional bookkeeping support ensures you do not lose track of these carryovers, since they reduce this year’s deduction.

Step 3: Apply Loss Carryovers

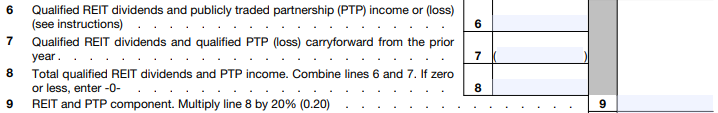

If you received Qualified REIT dividends or Publicly Traded Partnership (PTP) income:

Line 6: Enter REIT dividends and PTP income for the year

Line 7: Enter any REIT/PTP loss carryovers from prior years

Line 8: Combine lines 6 and 7. If zero or less, enter 0

Line 9: Multiply line 8 by 20 percent (0.20)

This becomes your REIT/PTP component. If you do not receive REIT or PTP income, these lines will likely be zero.

Then, add your QBI and REIT/PTP Components:

Line 10: Add line 5 (QBI component) and line 9 (REIT/PTP component)This number represents your deduction before any income limitations are applied.

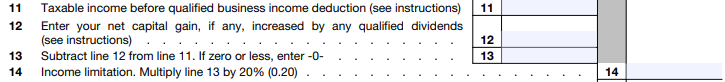

This ensures the deduction does not exceed the IRS limit, giving you the taxable income limitation, which caps your QBI deduction.

Line 11: Enter your taxable income before the QBI deduction

Line 12: Enter net capital gain

Line 13: Subtract line 12 from line 11If this number is zero or less, enter 0

Line 14: Multiply line 13 by 20 percent (0.20)

This is your final allowable deduction for the tax year:

Line 15: Your Qualified Business Income deduction is the smaller of line 10 or line 14. This amount is also carried over to your IRS Form 1040, U.S. Individual Income Tax Return.

If lines 2–3 or lines 6–7 produced negative amounts:

Line 16: Total QBI loss carryforward to next year

Line 17: Total REIT/PTP loss carryforward to next year

These numbers will apply to next year’s Form 8995.

Step 4: Finalize and Report on Form 1040

After making adjustments for losses and limits, the final QBI deduction amount is transferred to Form 1040. Errors in the calculation or missing documentation can lead to IRS notices and other disruptions.

Form 8995 vs. Form 8995-A

When the Simplified Form Is Not Enough

Taxpayers whose income exceeds the IRS threshold cannot use Form 8995 simplified. Instead, they must complete Form 8995-A, which includes more complex calculations for:

W-2 wage limits

UBIA of qualified property

Multiple deduction phase-outs for SSTBs

High-income taxpayers and those with complex business structures typically fall into this category.

Overview of Additional Schedules

Form 8995-A includes several worksheets, such as:

QBI component worksheets

Statements for W-2 wage and UBIA limitations

Phase-out calculations for SSTBs

If you are unsure which form applies to your situation, working with a professional via year-round tax advisory support ensures you always follow the correct path.

Common Mistakes Small Business Owners Make with QBI

Miscalculating QBI Due to Bad Bookkeeping

Errors in income or expenses lead to incorrect QBI calculations. If your books are not reconciled each month, it becomes difficult to accurately capture deductible expenses or net profit. This often results in a smaller deduction than the business is entitled to claim.

Affordable, full-service bookkeeping from 1-800Accountant ensures you receive the maximum eligible QBI deduction.

Not Tracking Carryovers or Negative QBI

Failing to track prior-year losses creates miscalculations that affect future deductions. Because QBI loss carryovers reduce your ability to claim the deduction, losing track of them can distort your tax position for years.

Confusing SSTB Rules

SSTBs often face reduced or eliminated deductions when income exceeds the threshold. Many business owners misunderstand whether their industry qualifies as an SSTB. Clarifying this classification early can prevent costly errors at tax time.

How Accurate Bookkeeping Supports Your QBI Deduction

Why Good Records Matter

The IRS requires accurate reporting of income and expenses to support any claimed QBI deduction. Monthly reconciliation and organized recordkeeping help ensure that:

Profit figures reflect your true income

Adjustments and carryovers are applied correctly

Deduction amounts can be substantiated if the IRS requests documentation

How 1-800Accountant Helps

With accurate year-round bookkeeping and tax advisory services, business owners receive proactive guidance and expert support for a transparent, flat-rate fee. Our CPAs help track your QBI throughout the year and plan ahead to maximize your deduction.

If an IRS notice ever arises, our team also provides professional audit defense support to help resolve issues quickly and in your favor.

When to Get Professional Help with Form 8995

Situations That Require a CPA

The following scenarios make professional guidance especially valuable, including:

Operating multiple businesses

Uncertainty about SSTB classification

High taxable income near or above the threshold

Large negative QBI carryovers

Complex ownership or partnership structures

A CPA can help you navigate these rules confidently and avoid errors that reduce your deduction.

Benefits of Working With 1-800Accountant

1-800Accountant, America's leading virtual accounting firm, gives business owners direct access to experienced CPAs, EAs, bookkeepers, and tax professionals who understand your industry and tax situation. Clients benefit from:

Trusted advisors who know how to optimize QBI

Year-round planning to prevent surprises at tax time

Peace of mind knowing filings are accurate and compliant

Final Thoughts

QBI is a valuable deduction that can significantly reduce your taxable income, assuming you take the proper steps to claim it. Completing Form 8995 correctly protects deductions and lowers taxes, which can be challenging for busy business owners.

Schedule a free consultation today to ensure you claim every eligible small business tax deduction.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. 1-800Accountant assumes no liability for actions taken in reliance upon the information contained herein.