Small Business Payroll Services

We offer quick, easy, affordable payroll, powered by experts. We’ll run your payroll for you, ensuring accuracy and compliance.

Fast, affordable payroll services for small business

State ID registration

We work with your state to obtain important state identification pertaining to unemployment and withholding.

Transparent pricing.

Flat pricing with no hourly rates or hidden fees. No surprises.

Your expert will set you up for success

As a small business owner, we'll help you determine the ideal mix of online payroll and accounting services for your business.

Powerful features give you freedom to focus

Pay your employees in just a few clicks. Spend minutes on payroll each month instead of hours with our online payroll service for small businesses.

We file your payroll taxes automatically

Our accountants submit your small business payroll taxes every time we run payroll for no additional charge.

Time-saving strategies

Spend less time running payroll and more time running your day-to-day business.

Talk to an expert anytime

Get advice on creating procedures for payroll processing, tax payments, and reporting.

Experience you can rely on

100,000 small business served. We have accounting teams in every region and experts in every industry.

Get a free quote. Schedule a free call.

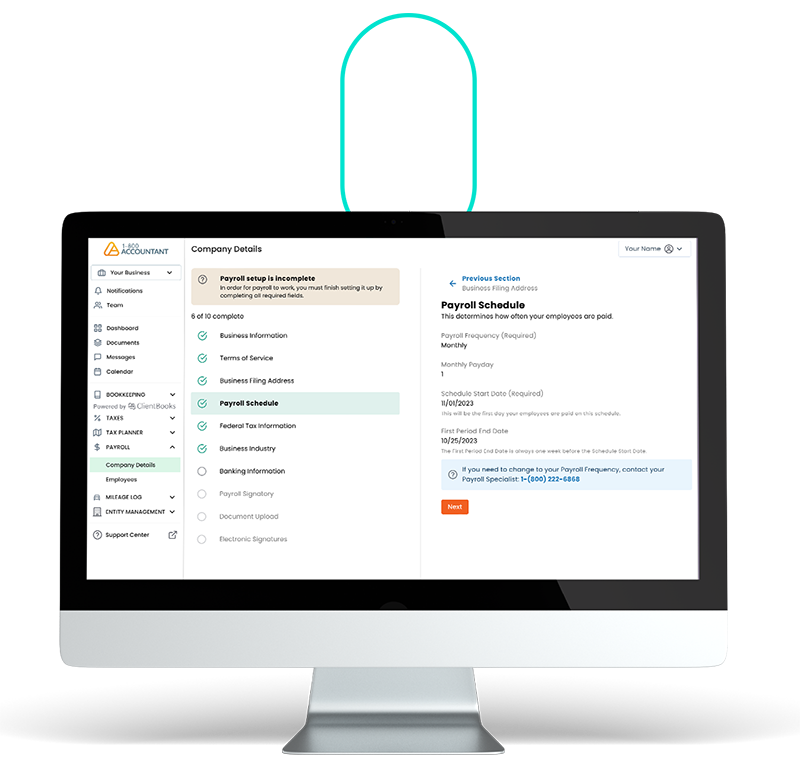

- Schedule your free consultation with a payroll expert.

- Discuss your business and how our small business payroll service fits in.

- We set it up for you. Pay your team in a few clicks.

Frequently Asked Questions about Payroll

We maintain your business's compliance with federal and state laws in several ways. Compliance is achieved by ensuring your employees are classified correctly, your payroll is calculated accurately, and it is run on time each pay period. We'll also keep accurate records detailing all hours worked, wages paid, deductions, and withholdings associated with your employees' pay.

We provide financial services to small businesses in established and emerging industries in all 50 states. In addition to payroll, we offer business tax preparation, tax advisory, and other essential financial services that maximize your tax savings.

We serve all localities in each state, some of which can be viewed via our locations hub.

Unlike other payroll services that are do-it-yourself and require your time and participation, our payroll solution is full-service and done for you. There is a one-time $200 setup fee. After setup, our payroll service costs $89/month or $979 annually for your first employee and $39/month or $429 annually per additional employee.

Review our affordable service packages for your business via our pricing page.

Talk to 1-800Accountant. Say hello to easier payroll.

Everything Accounting, All in One Place

Tax and Advisory

Bookkeeping

Entity Formation

*Based on a $12.2k average 2022 tax refund per client, which is 4x the cost of a full-service package. Source: first-party data.

**Includes average business tax preparation, form completion and submission, record keeping, and other misc admin time. Source.

***Historical first-party data.