Tax Preparation for Freelancers & Self-Employed Entrepreneurs

Tax Filing for Self-Employed & Freelancers

Have you ever wondered how to file self-employment taxes or how to pay taxes as a freelancer? You’re not alone.

Owning your own business can be an amazing experience, both personally and professionally. You get to be your own boss and call the shots! Some of the decisions you’ll have to make can be agonizing, but not when it comes to taxes. Look no further than the leaders in filing taxes for self-employed and freelance individuals (also known as independent contractors), 1-800Accountant.

Simple Income Reporting

Talk to Your Accountant

Personalized Advisory

Discussing your business taxes with 1-800Accountant is quick and easy:

1. Set up a time for us to give you a call.

2. Tell us what’s going on with your business.

3. Get matched with an accountant who knows your industry & local regulations.

Track Income

1-800Accountant ensures your books are in order, including the introduction of tactics that make tracking your self-employed income simpler and easier. One way to promote that clarity in your recordkeeping is to open a business bank account to create a single source of your self-employment income.

Track Expenses

Tracking your outgoing expenses is another important aspect of bookkeeping for your self-employed business activities. Broadly speaking, these expenses are the normal costs you will incur over the course of conducting your business operations.

Calculate Net Income

1-800Accountant handles the essential financial tasks associated with your self-employed business activities, including net income calculations. Our experts take your gross income and subtract expenses to make this important calculation that impacts your business.

Following Up on Invoices

Tracking and following up on unpaid invoices is essential to your self-employed business operations. Regularly following up ensures your business income is uninterrupted while decreasing the volume of past-due notices. The difficulty of collecting payment increases the longer an invoice is past due.

Self-Employed & Freelancer Accounting FAQs

Typically, you are required to file an annual return and pay an estimated tax quarterly. You have to file an income tax return if your net earnings from self-employment are $400 or more. If your net earnings from self-employment were less than $400, you still have to file an income tax return if you meet any other filing requirement listed in Form 1040 and 1040-SR.

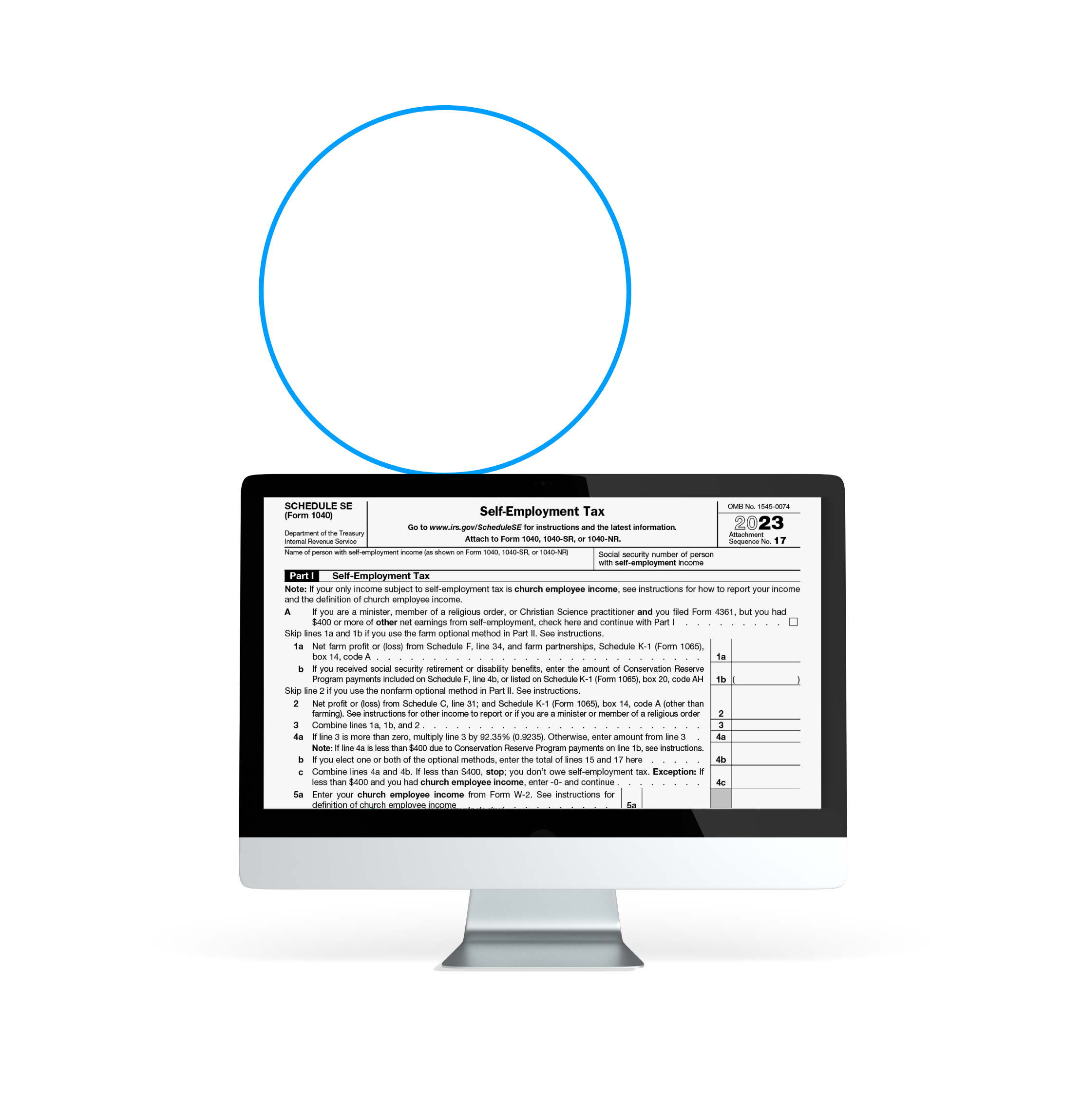

Stay Informed on Every Freelance Tax Form Self-Employed Individuals and Freelancers Must File

- Federal Form W-9

- Schedule C (Form 1040)

- Schedule SE (Form 1040)

- Form 1040-ES

- 1099 Forms

- 1099-MISC

- 1099-K

.png)

.png?w=1080)