Full-Service Tax Filing & Preparation Solutions for Small Businesses

Efficiently maximize your tax savings with affordable small business tax services from the leaders in virtual accounting, ensuring confidence in your tax situation.

.png?w=1080)

Save the most with affordable business tax services from 1-800Accountant.

The small business tax accountants at 1-800Accoutant, America's leading virtual accounting firm, save business clients an average of $12,000 annually.

Results are achieved by combining their expertise with our suite of affordable, tax-deductible financial services. Gain peace of mind and the freedom to focus, knowing that your business's quarterly estimated taxes, income tax filing, and potential audit defense are expertly handled on your behalf throughout the tax year.

Unlimited Support With No Hourly Charges

Let your designated bookkeeper address detailed bookkeeping tasks while generating real-time insights, so you can focus on building your business.

Your Maximum Tax Savings, Guaranteed

Real-time transaction categorization and account reconciliation support critical long-term business decisions, enhancing your ability to compete in the market.

Simplified Business Accounting Services

Maximize your results with our suite of centralized tax, bookkeeping, payroll, and entity formation solutions, powered by experts in your state and industry.

Powered by Real CPAs

Our CPAs, with over 17 years of experience on average, are your business's best allies. They help you solve problems and answer your most challenging questions whenever you need them.

Accounting Services

Accounting services built for you. From entity formation to online tax filing for small businesses, we offer scalable solutions that ensure your paperwork and financials are expertly covered year-round.

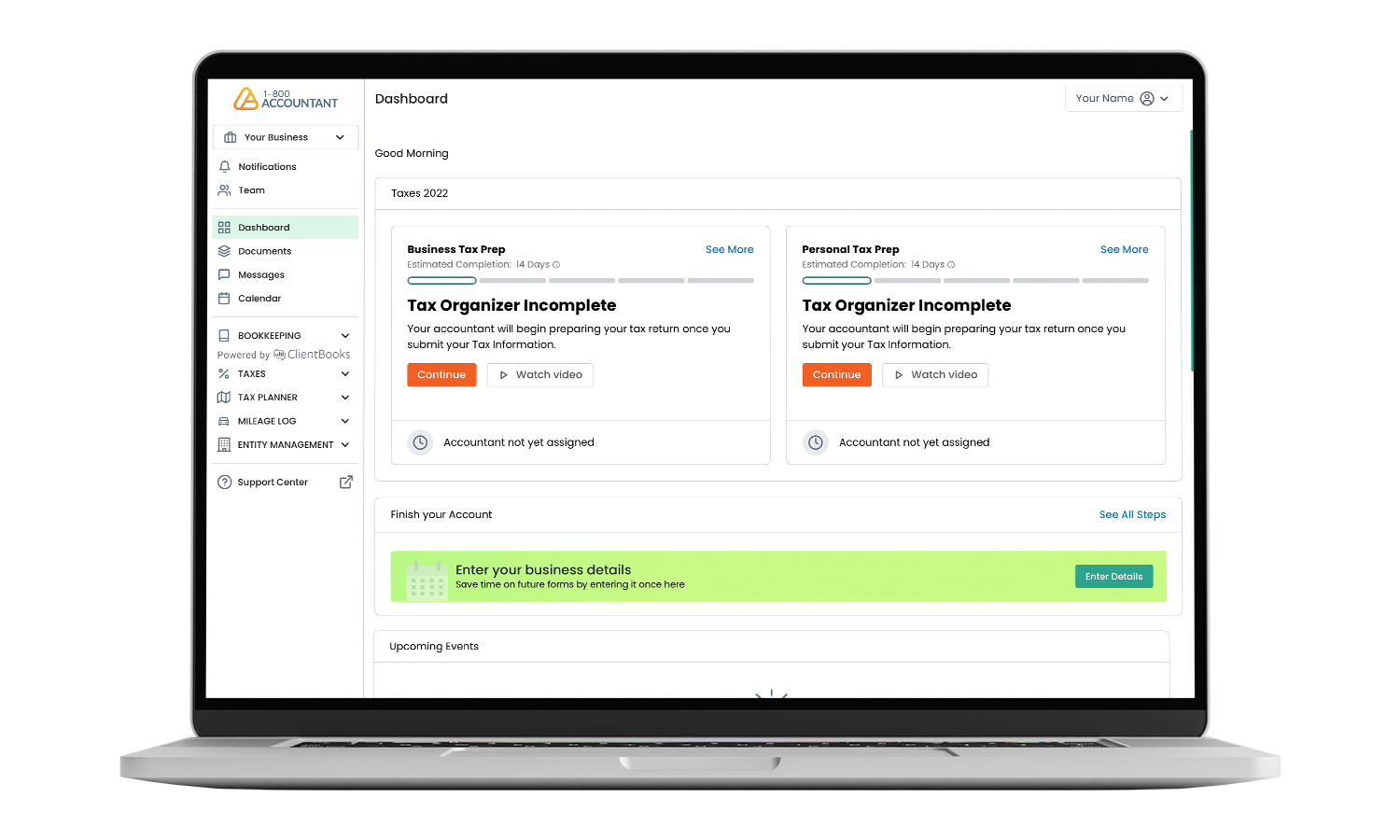

Small Business Tax Services with Unlimited Support

- Dedicated Accountant

- Unlimited Support

- Secure Online Portal

- Business Tax Preparation

- Amended Business Tax Return

Sales Tax

Looking to file sales taxes online? Business taxes are prepared and filed for you with a maximum savings guarantee.

Franchise Tax

Avoid penalties; avoid overpaying. Annual franchise taxes are prepared and filed by your designated business accounting team.

Payroll Tax

State-specific tax advisory and accounting services. Let us handle the nuances of your payroll and sales tax, saving time while ensuring compliance.

Saving thousands in annual business taxes with 1-800Accountant is quick and easy:

Select a time that works within your schedule, and we'll give you a call.

Tell us about your business challenges.

Get matched with an accountant or team familiar with your industry and the nuances of local regulations for the best results.

Frequently Asked Questions about Small Business Taxes

Several factors determine that amount, including revenue and your business structure. Small businesses pay an estimated average federal tax rate of 19.8%. The estimated average for S corporations is 26.9%, while the average for sole proprietorships is 13.3%, and the partnership average is 23.6%.

While it may seem like S corporations pay more in taxes, they typically pay less than sole proprietorships or partnerships with similar income levels because they are more profitable.

In most instances, you will have to file business taxes even if there’s no income to report. If your business is no longer active and you do not plan to reactivate it in the future, we recommend considering the dissolution of your company.

If you don’t file business taxes, there will be consequences from the IRS. Some of the potential consequences include levies and liens, fees and penalties, and criminal charges for the most egregious violations. The IRS will typically send a warning notice before implementing punitive actions.

You may file small business taxes yourself or enjoy the professional, tax-deductible services of 1-800Accountant. If you’re interested in tax preparation or any of our services, please schedule a free consultation call with our experts. They’ll gather information about your business, industry, state, and tax situation to recommend the best path forward to maximize your tax savings.

Your designated accounting team can not only handle federal and state business tax preparation and filings on your behalf, but they can also address your personal income tax return. Whether you use business or personal tax preparation, or both, these services are supported by our maximum tax savings guarantee, ensuring you retain the most of your hard-earned money.

Whether you operate your business as a sole proprietorship, partnership, limited liability company (LLC), S corporation, or C corporation, we support your initiatives with professional business tax preparation. New 1-800Accountant clients receive a business entity analysis that evaluates their current entity for substantial tax-saving opportunities.

Labor costs, operating expenses, and virtual accounting costs are typically deductible for small businesses. When you trust 1-800Accountant with your complex financial work, your team ensures that your business takes eligible tax deductions, minimizing your tax liability. Learn about potential deductions available for your business by reading our popular blog, The Ultimate Small Business Tax Deductions Checklist.

Your business entity and whether your business is a calendar-year filer will help determine when your small business taxes are due. For example, partnerships must file by March 16, 2026, while C corporations must file by April 15, 2026. Use our great blog When Are Business Taxes Due in 2026? Dates & Strategy Guide to help determine your filing and tax obligations.

Speak to our experts about accounting today!

Everything Accounting, All in one Place

Entity Formation

Entity selection is the key to tax savings. Partner with us to ensure you pick the best one for your situation.

Bookkeeping

Bookkeepers save you time and money. Focus on running your business and let us handle your day-to-day accounting.

Payroll

Simple integrations, automatic calculations. Running payroll and benefits is easy with experts on your team.

*Based on a $12.2k average 2022 tax refund per client, which is 4x the cost of a full-service package. Source: first-party data.

**Includes average business tax preparation, form completion and submission, record keeping, and other misc admin time. Source.

***Historical first-party data.

.jpg?w=1080)