Obtain an EIN / Tax ID Number for Your Business

Save yourself the hassle, let us handle the paperwork. Talk to a small business tax expert today.

What's an Employer Identification Number (EIN)?

An EIN (aka Federal Tax ID) is like a Social Security number for your business entity. The Internal Revenue Service (IRS) uses it to identify you for tax purposes. Let our experts help you apply for an EIN online today.

Required for Most Businesses

You need a new EIN if you plan on having employees or filing business taxes.

We Make it Easy

Internal Revenue Service (IRS) forms can be complicated. We'll file form SS-4 and work with the government on your behalf.

Required by Most Banks

Banks usually ask for your federal tax ID when you open a business bank account or line of credit.

Frequently Asked Questions about EINs

You can apply online to obtain an EIN immediately as long as the IRS can verify your Social Security number. Other methods, including fax and mail, will take days or weeks to process. Foreign owners without a Social Security number must apply via fax or mail.

An EIN (aka Federal Tax ID) is like a Social Security number for your business entity that the IRS uses to identify you for tax purposes. You will need your EIN for many business-related purposes, including paying your federal taxes.

Without an EIN, your business will be severely restricted. If you want to have employees or plan to hire employees, you need an EIN. If you’re interested in running a corporation or partnership or filing Employment, Excise, or ATF returns, you’ll need an EIN.

EINs do not expire. Once an EIN has been issued to your business, it will not be issued again. If you have an EIN but lost, misplaced, or cannot remember it, you can contact the IRS to search their database for it.

Most banks will require you to provide an EIN or a Federal Tax Identification Number to open a business bank account. Some banks may allow Sole Proprietors to open a business bank account by using their Social Security number instead.

Who needs an EIN?

Your business needs an EIN if you:

- Have employees

- Plan to have employees

- Run a corporation - LLC, S corp, or C corp

- Run a partnership - LLP, LP, or GP

- File Employment, Excise, or ATF returns

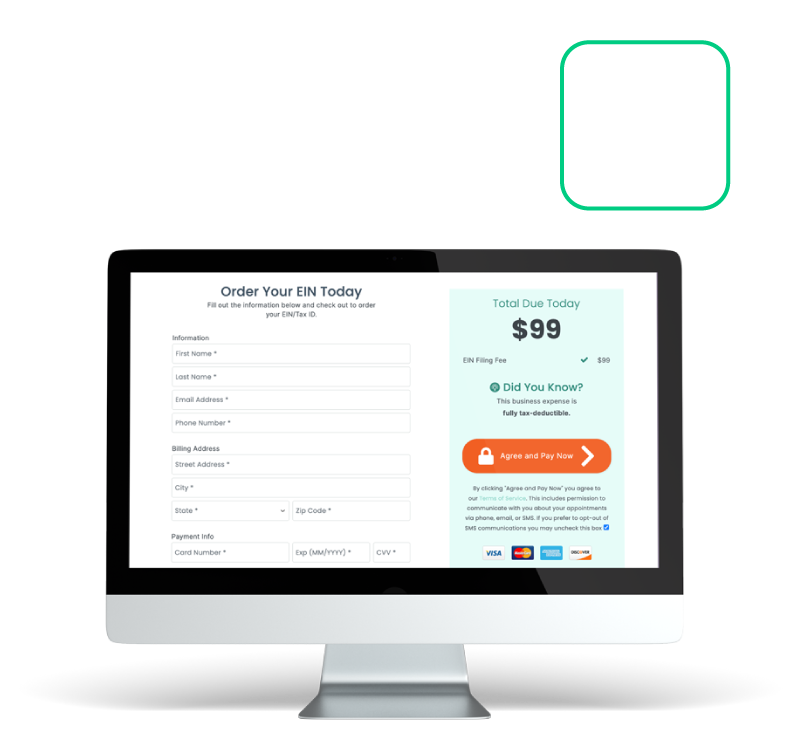

Apply for your EIN Tax ID Today

Everything Accounting, All in one Place

Tax and Advisory

We save small businesses more than $12,000 per year on taxes. We guarantee your largest possible refund.

Bookkeeping

Bookkeeping saves you time and money. Focus on running your business and let us handle your day-to-day accounting.

Payroll

Simple integrations, automatic calculations. Running payroll and benefits is easy with experts on your team.

*Based on a $12.2k average 2022 tax refund per client, which is 4x the cost of a full-service package. Source: first-party data.

*Includes average business tax preparation, form completion and submission, record keeping, and other misc admin time. Source.

*Historical first-party data.