Navigating Small Business Quarterly Estimated Taxes

Learn what IRS quarterly taxes mean for your business and how 1-800Accountant can help.

Quarterly Estimated Taxes for Your Business

Most small business owners, entrepreneurs, and self-employed individuals who earn above a certain income threshold must pay federal estimated taxes every quarter. Calculating an estimated tax payment can be complicated, and mistakes can be costly.

That's why thousands of business owners like you rely on 1-800Accountant to calculate their federal estimated tax payments.

Year-Round Tax Advisory

We support you all year, quarterly tax dates included.

Quarterly Estimated Taxes

We'll calculate what you owe in IRS quarterly payments so you can avoid underpayment penalties and interest.

Identify Additional Savings

We'll find opportunities for tax deductions that generic firms often miss.

Work with the Professionals

If you're concerned about how to pay quarterly taxes, meeting hard-to-understand IRS requirements, or don't have the time or capacity to figure them out, work with the professionals at 1-800Accountant. We make small business estimated taxes easy and stress-free, so you can focus on growing your business. Our small business experts specialize in every industry, including real estate, trucking, and e-commerce, across all 50 states.

Frequently Asked Questions about Quarterly Estimated Taxes

- Calculate your taxable income based on your marital status and income.

- Compute any credits and deductions you may get, such as child tax credits or credits for taxes already withheld.

- Calculate your remaining tax due.

- Electronic.

- Phone.

Speak to our experts about your quarterly estimated taxes today

Everything Accounting, All in One Place

Entity Formation

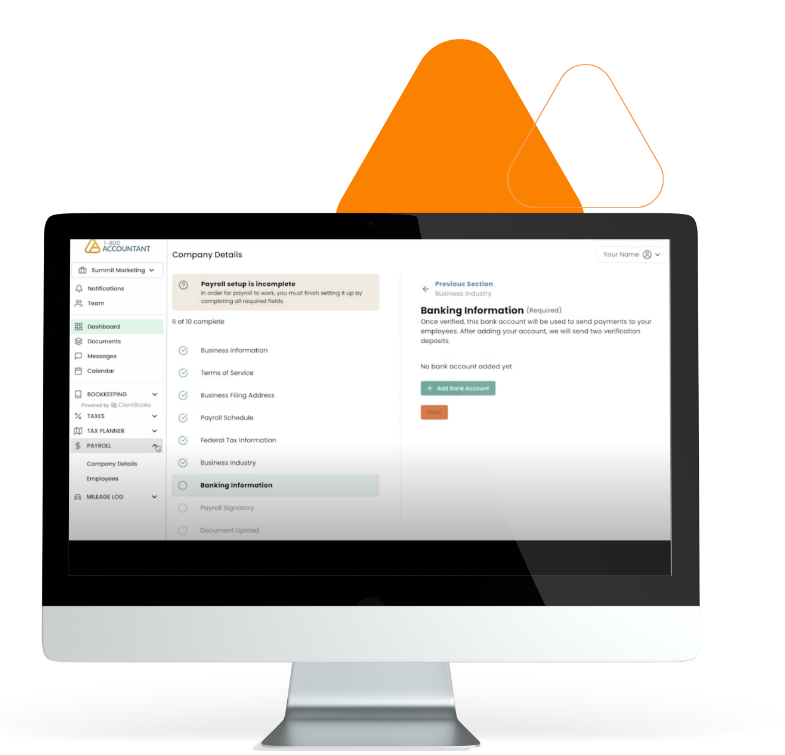

Payroll

Bookkeeping

*Based on a $12.2k average 2022 tax refund per client, which is 4x the cost of a full-service package. Source: first-party data.

**Includes average business tax preparation, form completion and submission, record keeping, and other misc admin time. Source.

***Historical first-party data.