Law Firm Bookkeeping Services: Boost Your Financial Efficiency

Unlock expert bookkeeping and tax solutions for law firms with 1-800Accountant. Ensure compliance, optimize your firm’s finances, and streamline operations effortlessly.

Bookkeeping for Law Firms

Whether it's legal expertise, guidance, representation, contract review, or dispute resolution, law firms provide valuable services to their clients. People view these firms as their advocates, advisors, and problem-solvers, helping them move toward a favorable legal outcome. Due to the long hours and intense focus required to generate wins for clients, other important obligations, such as managing bookkeeping and complex tax matters, can often fall by the wayside. If your firm struggles to maintain tax compliance while serving your clients, full-service, tax-deductible financial solutions can help.

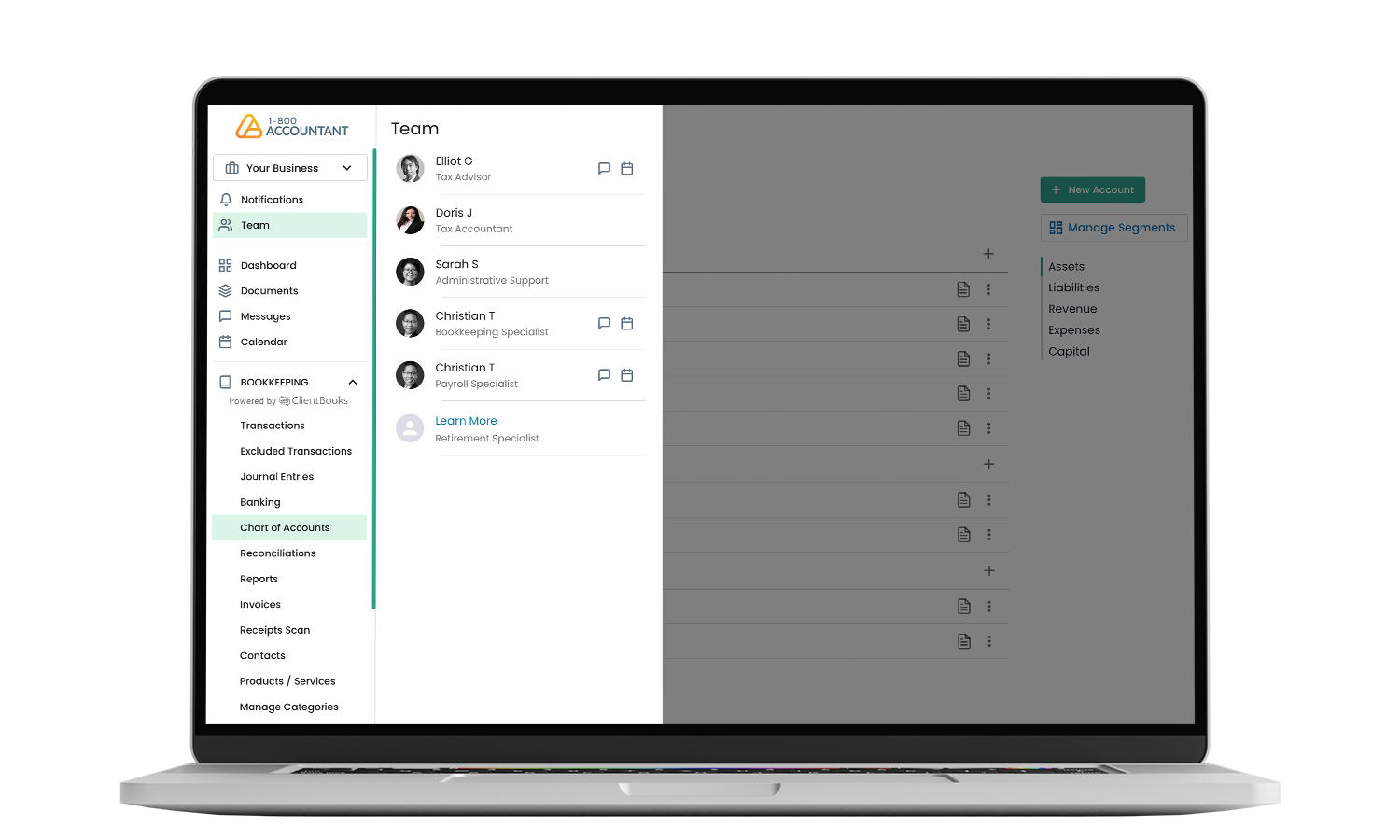

When you trust 1-800Accountant, America's leading virtual accounting firm, with your law firm's bookkeeping and accounting work, you benefit from financial solutions and expertise powered by real accounting professionals. Your dedicated team will work closely with your firm, providing full-service bookkeeping, personalized advisory support, budgeting, and efficient, year-round financial management. This level of support provides peace of mind and the freedom to focus on your clients, knowing your financial work is up to date and error-free.

Bookkeeping for Law Firms

We track your law firm's revenue and operating business expenses and share findings with easy-to-understand reporting in real-time.

Talk to Your Accountant

Schedule a call or send a quick message whenever you have a question about your firm’s financial health, accounting system, bank statement, or if you need advice.

All Law Firms Welcome

We offer accounting and bookkeeping solutions to law firms in all 50 states.

Getting started is easy and free.

Connecting with 1-800Accountant, the law firm bookkeeping experts, is easy and free. Here's what to do:

- Select a convenient date and time that suits your schedule to speak with one of our professionals.

- During this 30-minute call, a $199 value, tell us about the goals and direction of your firm.

- Once fully onboarded, we’ll create and implement a year-round income tax strategy that empowers you to reach your firm's bookkeeping and accounting goals. Your tax advisor will guide you through each step, ready to offer solutions to even the most complex tax challenges throughout the year.

Bookkeeping for Law Firms

- Tax Advisory

- Tax Preparation and Filing

- Sales Tax Compliance

- Quarterly Estimated Taxes

- Business Bookkeeping Services

- Entity Formation

- Payroll Services

Law Firm Bookkeeping FAQs

Unlike spreadsheets or do-it-yourself (DIY) bookkeeping software and accounting services, 1-800Accountant provides dedicated bookkeeping and back bookkeeping services done-for-you (DFY). Your dedicated bookkeeper will work closely with you, providing personalized support and ensuring your books are managed accurately and efficiently, giving you the insights you need to make critical, data-backed business decisions for your law firm

1-800Accountant supports your firm's preferred legal billing model, whether you've adopted contingency-fee, hourly, or flat-fee billing. Your designated team, experienced in serving law firms in your region, can evaluate your billing model and offer recommendations to optimize billing protocols and procedures.

1-800Accountant can help your law firm stay compliant with legal accounting and trust account rules via the strategic implementation of trust account management, trust reconciliation and financial reporting, invoice and billing management, among other tried and true accounting processes. This will help your law firm avoid costly penalties while upholding the highest ethical standards set by the American Bar Association and other bodies, which is particularly important to prospective clients.

While legal bookkeeping and law firm accounting intersect, they provide different services to your business. Recording and organizing your law firm's financial transactions, including payments, retainers, and disbursements, is how legal bookkeeping is used. Legal accounting will provide your firm with high-level financial analysis, forecasting, financial statements, financial data, and planning, utilizing the detailed information provided by your legal bookkeeper.

If your law firm or partners are required to pay quarterly taxes while meeting hard-to-understand IRS requirements, or don't have the time or capacity to figure them out, trust our professionals with this complex work. We make the entire estimated tax process easy and stress-free with a full-service solution that results in accurate calculations and timely submissions, ensuring compliance.

Software features for effective law firm bookkeeping should ensure compliance and accuracy while promoting efficiency and productivity. Your law firm software should be capable of three-way reconciliation and tracking operating and trust accounts separately. The legal accounting software should feature automation to reduce manual processes prone to error, while also having the capability to produce easy-to-understand financial dashboards and reports.

There are several methods for integrating a time-tracking system with your accounting software, ensuring revenue recognition and accurate recording of billable hours. One of the easiest methods is to identify time tracking systems and accounting software that have built-in integration or an API. This way, these systems and software easily communicate, producing error-free results while remaining compatible after system and software updates.

Best practices for handling client retainers and advance payments to avoid accounting discrepancies include implementing robust accounting software and systems, maintaining detailed records, regularly reconciling retainer accounts, creating separate accounts (trust and escrow) when possible, and clearly defining terms in your client agreement from the outset.

When you utilize our comprehensive, tax-deductible bookkeeping and accounting solutions, you can rest assured that your client data is safe and secure. We use the industry-standard 128-bit SSL encryption to safeguard your information. As an added safeguard, our team remains vigilant to emerging threats to help ensure your data is secure.

1-800Accountant can help your law firm budget for expenses like malpractice insurance and bar dues, analyzing historic data and forecasting costs, budgeting, cash flow management, and tax planning, among other methods. When these methods are used in conjunction by your designated accounting team, it provides clarity to your financial roadmap for the coming tax year.

We offer financial services to small businesses nationwide, serving a diverse range of industries across all 50 states. Our services are designed to scale with your requirements, whether your firm serves a specific region or you face multi-jurisdictional tax obligations with clients in multiple states. Because 1-800Accountant exclusively serves businesses headquartered in the United States, we do not currently offer services in other countries.

While our full-service bookkeeping solution doesn't include basic financial literacy support by default, we offer tailored solutions to support your law firm's initiatives fully. If basic financial literacy and other features are required to address your firm's unique needs, your designated 1-800Accountant can provide that training and support to your legal professionals.

Speak to our experts about bookkeeping solutions for your law firm today!

*Based on a $12.2k average 2022 tax refund per client, which is 4x the cost of a full-service package. Source: first-party data.

**Includes average business tax preparation, form completion and submission, record keeping, and other misc admin time. Source.

***Historical first-party data.