Simplify Your Finances & Grow Your Business with Bookkeeping for Electricians

Simplify your finances with expert bookkeeping for electricians. Track expenses, manage invoices, and stay tax-compliant easily.

Professional Bookkeeping for Electricians

Bookkeepers are responsible for maintaining the records for small businesses, handling payroll, and creating invoices. Bookkeepers for electricians also handle the important task of financial reconciliation, ensuring that business bank statements align with the records in your general ledger. Creating and maintaining the general ledger is another critical, time-consuming task for which bookkeepers are responsible.

1-800Accountant, America's leading virtual accounting firm, addresses your electrician business's bookkeeping needs with an affordable, tax-deductible full-service solution powered by a real bookkeeper. Your designated bookkeeper works closely with you, providing personalized support while accurately and efficiently managing your books. This provides you with the insights you need to make informed decisions about the future of your business, based on accurate, real-time data, from expansion to electrical apprenticeships.

Electrician Industry Bookkeeping

We track your electrician business's revenue and operating expenses and share findings with easy-to-understand reporting.

Talk to Your Accountant

You can schedule a call whenever you have a question or need advice about the financial health of your electrician business, or you can send a message.

All Electricians Welcome

We offer professional accounting solutions to electricians in all 50 states.

Getting started is easy and free.

Connecting with 1-800Accountant, leaders in bookkeeping for electricians, is easy and free. Here's what to do:

- Select a convenient date and time within your schedule to speak to one of our professionals.

- Tell us about your long-term plans for your electrical contracting business during this 30-minute call, a $199 value.

- Once onboarded, we’ll implement a year-round income tax strategy that empowers you to reach your business goals. Your tax advisor will guide you through each step, ready to offer solutions to even the most complex tax challenges faced by electricians throughout the year.

Bookkeeping for Electricians

- Tax Advisory

- Tax Preparation and Filing

- Sales Tax Compliance

- Quarterly Estimated Taxes

- Business Bookkeeping Services

- Entity Formation

- Payroll Services

Electrician Bookkeeping FAQs

Electricians need bookkeeping services to ensure that all their business metrics and financial data, including debits and credits, are properly recorded by creating a general ledger. Maintaining the ledger is a crucial part of the bookkeeping process, requiring detail-oriented work. The thorough information it provides is essential for accurate financial data interpretation, informed decision-making, and effective forecasting, ultimately helping to streamline business operations.

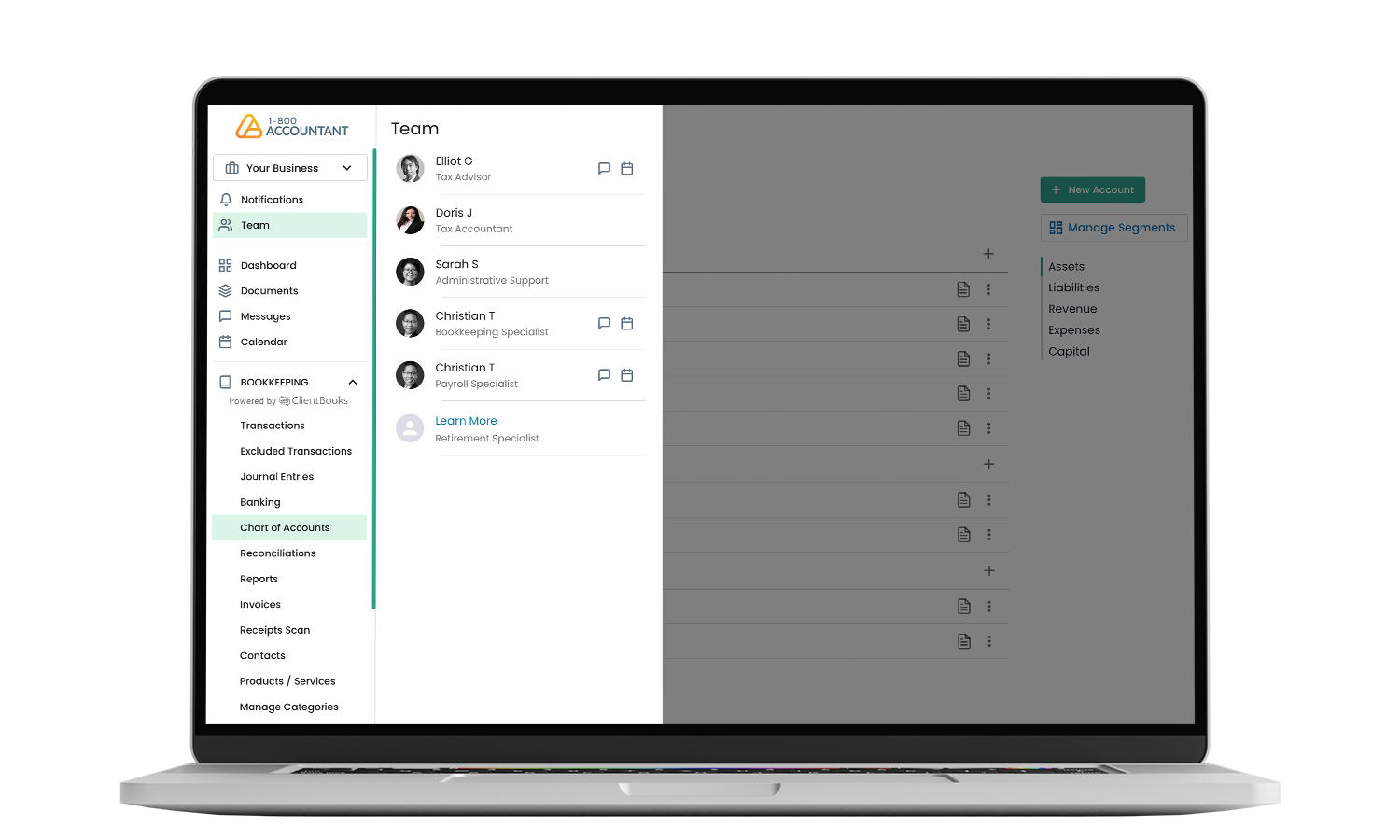

1-800Accountant favors our proprietary bookkeeping platform, ClientBooks. We feel it’s the best accounting software to address your electrical business needs. Our platform is compatible with leading bookkeeping software, including QuickBooks Online (QBO), FreshBooks, and Wave. Our bookkeepers are fluent in these platforms, ensuring seamless integration and financial data management for your auto repair shop.

Electricians should be keeping track of numerous expenses, particularly those deemed ordinary and necessary for conducting business. Expenses of this type are typically tax-deductible. Claiming every tax deduction your electrical business is eligible for is a way of lowering your total taxable income. You need to retain supporting documents and accounting records to provide evidence for the expense itself and its purpose, helping to underscore the importance of accurate and timely recordkeeping.

Unlike do-it-yourself bookkeeping software that still requires a lot of time and attention, 1-800Accountant offers electricians a full-service bookkeeping solution for an affordable, tax-deductible fee. Your professional bookkeeper will handle your tedious, time-consuming bookkeeping tasks and generate the digestible, easy-to-understand reporting you need to make critical business decisions in real time.

Your accountant uses the financial information compiled by your bookkeeper to produce financial reports for your electrician business. These reports help you better understand your business's profitability, cash flow, and financial path. You should rely on your accountant for help understanding your finances at a high level for tax planning, forecasting, and advice.

1-800Accountant offers a suite of professional accounting services designed to support the financial health of your electrician business during tax season and throughout the year. Business tax filing and preparation of your tax return, tax advisory, and other affordable tax-deductible services ensure maximum tax savings and that your business fully complies with applicable IRS rules and regulations.

You can depend on your dedicated bookkeeper for accurate bookkeeping, categorizing transactions, and bank reconciliations. We also provide numerous tools to help keep things current and running smoothly, allowing you to automatically connect bank accounts, send invoices, upload receipts, and track mileage.

Our full-service, tax-deductible payroll solution, powered by experts, runs payroll for you each period and handles payroll tax submissions. Spend minutes on payroll each month instead of hours with this service, enabling your employees to be paid in just a few clicks. If you need help, get guidance on creating efficient procedures for payroll processing, tax payments, and reporting. As with all 1-800Accountant services, our payroll pricing is affordable and tax-deductible.

1-800Accountant's mission is to provide financial expertise to small business owners in every industry, including electricians. Our financial services are tailored to the needs of small businesses, with additional customization options and enhancements available to streamline business tasks while maximizing tax savings. When your small electrical business transitions into a larger contracting firm, our services scale with you, providing the support and expertise you need at every stage of your business.

Your dedicated bookkeeper will create and track your invoices, customer payments, and electrical orders, among other essential tasks. Your bookkeeper also provides easy-to-understand reporting that allows you to review up-to-the-minute customer data, aiding in business management and profit margins. Learn more about 1-800Accountant's full-service bookkeeping solution.

Whether you share accounts for personal or business use or are looking for tactics to ensure an efficient separation of the two, 1-800Accountant has you covered. Request time with your bookkeeper or accounting team in the 1-800Accountant Client Portal for questions or guidance to separate your personal and business finances and accounts.

While our proprietary bookkeeping platform, ClientBooks, is compatible with leading bookkeeping software, including QBO, FreshBooks, and Wave, we would need to evaluate your software environment for integration opportunities. Our bookkeepers are fluent in numerous do-it-yourself bookkeeping software.

Speak to our experts about bookkeeping for your electrician business today!

*Based on a $12.2k average 2022 tax refund per client, which is 4x the cost of a full-service package. Source: first-party data.

**Includes average business tax preparation, form completion and submission, record keeping, and other misc admin time. Source.

***Historical first-party data.