How ClientBooks Helps Small Businesses Stay Tax-Ready

Tax deadlines can sneak up on small business owners, causing stress at the worst possible moments. Between quarterly estimated tax calculations and payments, payroll filings, and year-end returns, it’s easy for even the most diligent entrepreneurs to feel overwhelmed. The reality for small businesses is that tax readiness isn’t just something to think about in April, like a traditional employee. Staying tax-ready requires year-round organization and accurate, up-to-date bookkeeping.

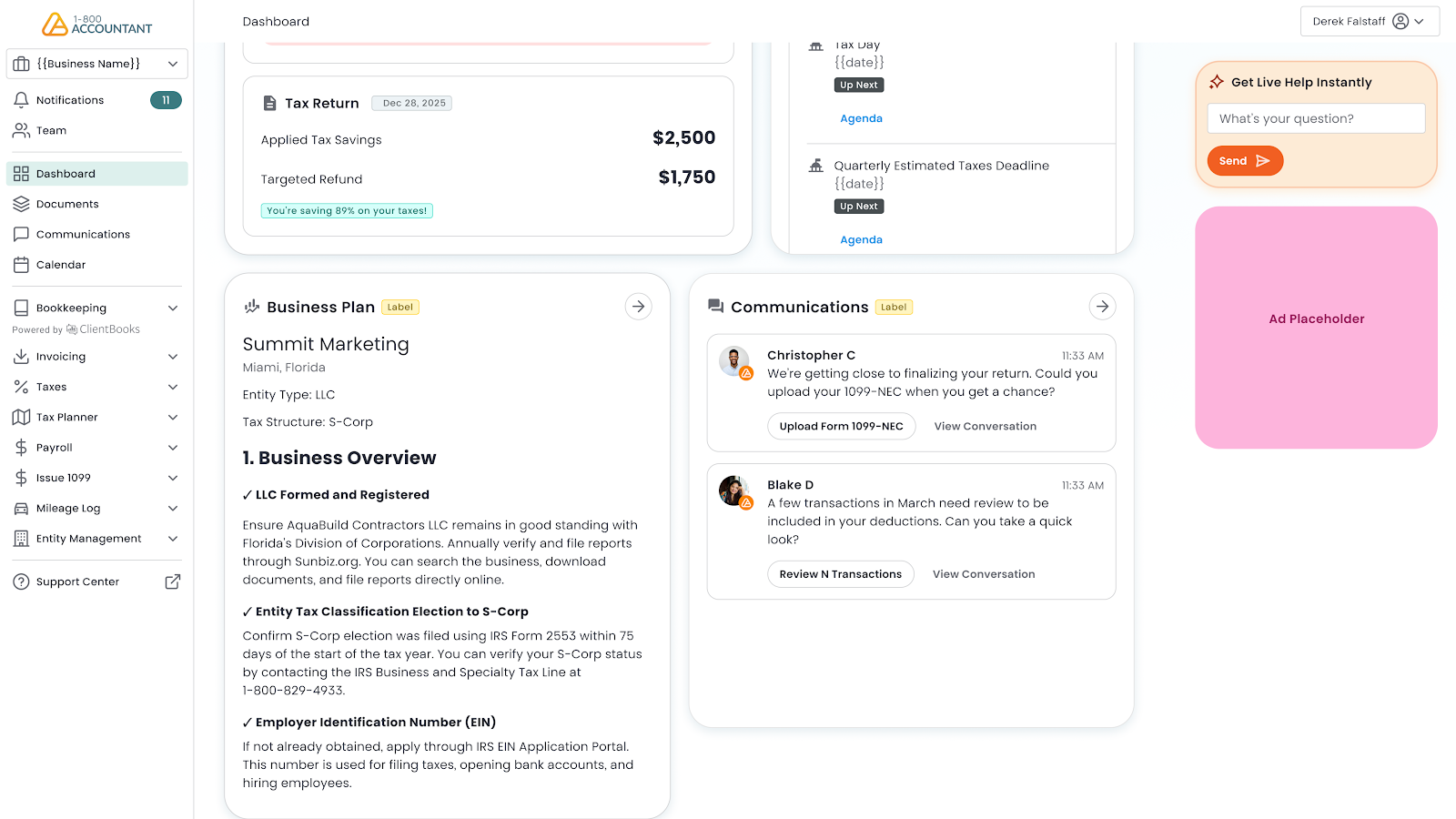

That's why 1-800Accountant, America's leading virtual accounting firm, created ClientBooks, our proprietary bookkeeping software platform. ClientBooks is specifically designed to support small businesses, making it easier than ever to stay compliant, organized, and stress-free throughout the year.

Key Highlights

ClientBooks, whether used alone or with bookkeeping services backed by a real bookkeeper, keeps businesses tax-ready all year.

Organized financial records reduce errors, maximize deductions, and simplify filing.

Built-in compliance tools help businesses stay ahead of quarterly and payroll tax deadlines.

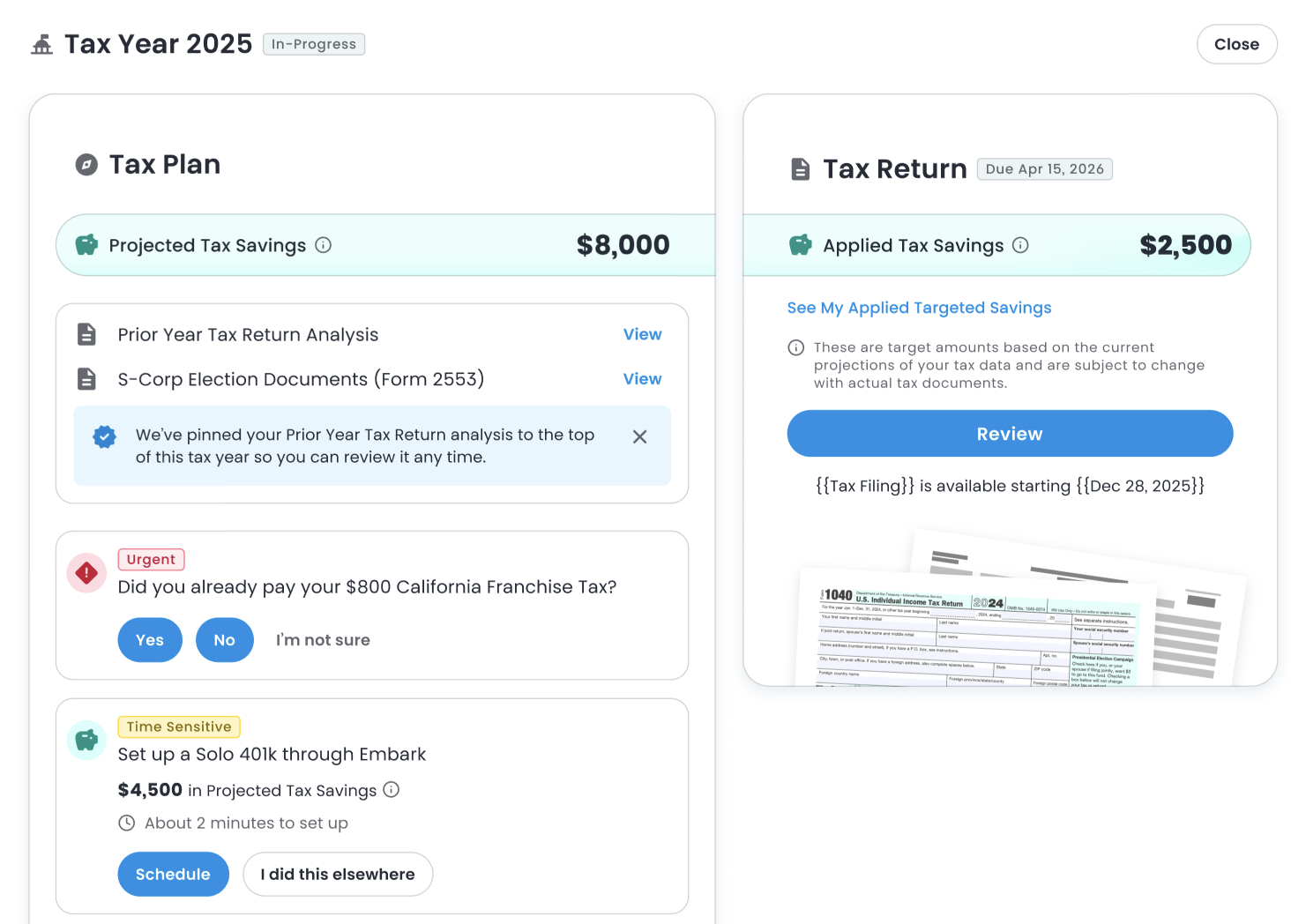

Unlike spreadsheets or generic do-it-yourself accounting software, ClientBooks integrates bookkeeping with proactive tax planning.

On average, 1-800Accountant clients save more than $12,000 annually in taxes, guided by ClientBooks data.

What Is ClientBooks?

ClientBooks is 1-800Accountant’s proprietary bookkeeping software platform, created exclusively for small business owners who want professional-grade accuracy without spending hours on spreadsheets.

While ClientBooks can be used like other do-it-yourself tools, such as QuickBooks, ClientBooks can also be paired with 1-800Accountant's full-service bookkeeping solution backed by an expert bookkeeper. That means your bookkeeping isn’t just automated — it’s aligned with proactive tax strategies and compliance requirements that you need to move your business forward.

With features like secure document storage and automatic transaction categorization, Clientbooks is the all-in-one solution that helps busy entrepreneurs focus on what they do best: running their businesses.

👉 Get Started With ClientBooks

Common Tax Challenges for Small Businesses

Every day, every month, and every year, it's easy to find thousands of small business owners scrambling to catch up on their tax obligations. The most common issues include:

Missed quarterly deadlines. Estimated tax payments are due four times a year (September 15, January 15, April 15, and June 15). Missing these payments can result in IRS penalties and interest.

Disorganized records. Without consistent and accurate bookkeeping, many entrepreneurs overlook deductions for mileage, home office expenses, or equipment depreciation.

Payroll compliance headaches. Employers must file IRS Form 941, Employer's Quarterly Federal Tax Return, each quarter (January 31, April 30, July 31, October 31) and make timely deposits or risk penalties of between 2% and 15%.

New tax law complexity. Recent legislation, such as the One Big Beautiful Bill Act (OBBB), permanently restored 100% bonus depreciation and modified 1099 reporting thresholds.

For busy small business owners, staying on top of these obligations without professional support can seem nearly impossible.

How ClientBooks Keeps You Tax-Ready

Organized Books = Smooth Tax Filing

With ClientBooks, tax-ready bookkeeping software, transactions are automatically tracked and categorized, so your company's books are always accurate and up-to-date. Easy-to-read business financial reports are available at the click of a button, so you’ll never have to scramble to find receipts or recreate records at year-end.

This level of organization simplifies tax prep, reduces the chance of mistakes, and ensures your dedicated accountant has everything they need to file quickly and accurately.

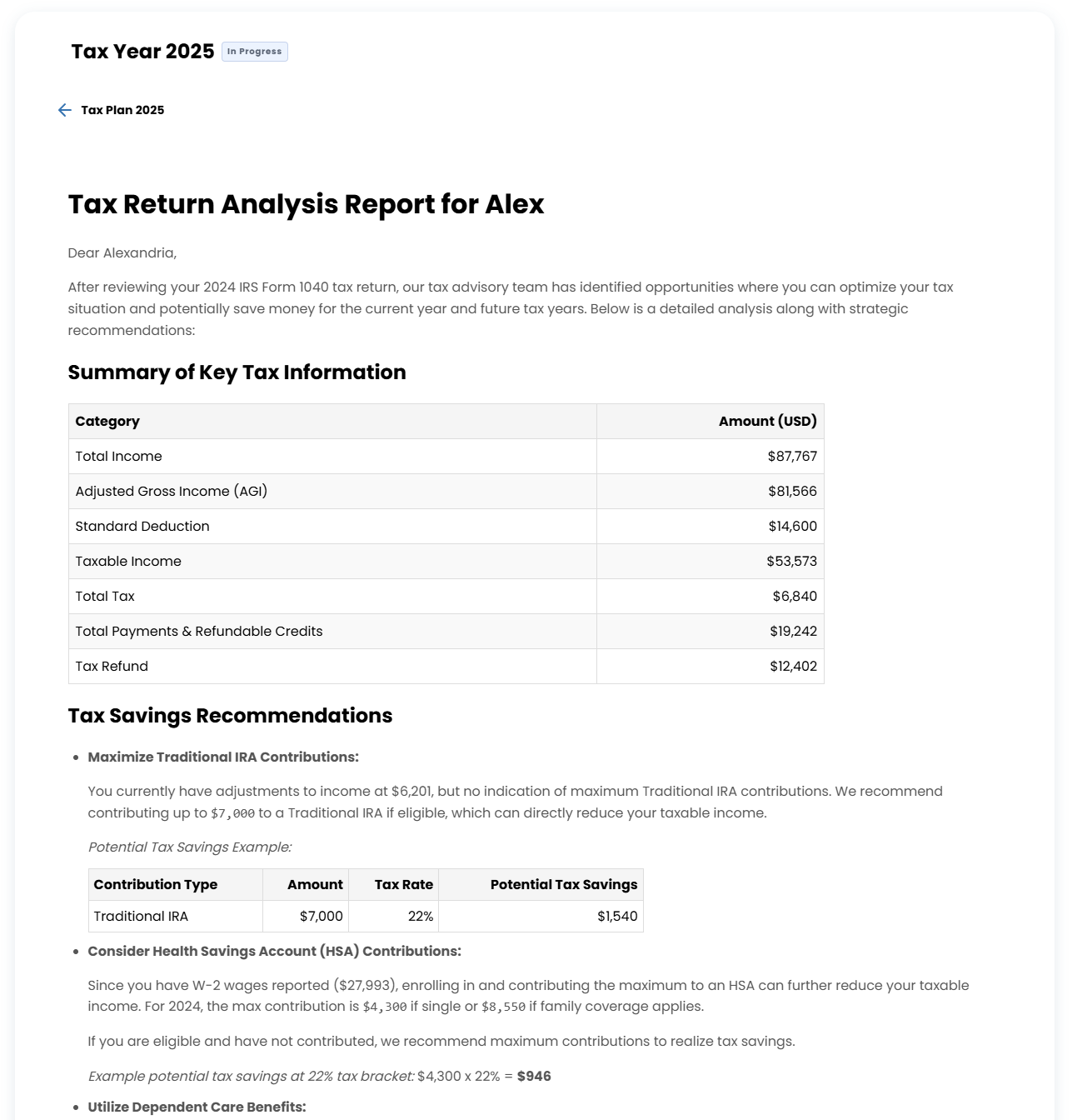

Maximizing Deductions with Accurate Records

When your books are clean, you can efficiently capture every deduction you’re entitled to before you file taxes. ClientBooks ensures that deductible expenses, such as mileage, home office use, and Section 179 equipment purchases, are recorded accurately.

With our full-service bookkeeping solution backed by a real bookkeeper, your records go beyond bookkeeping — they’re leveraged to find strategic savings. For example, under the OBBB, small businesses can now fully expense qualifying assets immediately. Your CPA can spot opportunities like these to help lower your tax bill based on the accurate, real-time records provided by your designated bookkeeper.

Staying Ahead of Tax Deadlines

One of the most stressful parts of running a business is preparing for and remembering tax deadlines. ClientBooks, small business bookkeeping software, paired with 1-800Accountant’s full-service bookkeeping solution, helps you stay compliant by:

Sending reminders for quarterly estimated tax payments.

Ensuring payroll deposits and filings, such as W-2s and 1099s, are submitted on time.

Helping avoid costly penalties from late deposits or missed forms by integrating IRS rules directly into the platform.

For additional guidance, the IRS small business resources page outlines federal requirements — but with ClientBooks and expert support, you won’t have to navigate them alone at tax time.

Why ClientBooks Beats DIY Solutions

While spreadsheets and generic apps may track expenses, they can’t ensure the tax readiness of your business accounts. ClientBooks offers something different:

Integration of bookkeeping and year-round tax planning. Your records aren’t just accurate — they can be optimized for tax strategy.

Bookkeeper oversight. Full-service bookkeeping and ClientBooks ensure you always know your books are meeting IRS standards.

Peace of mind. No more guessing which expenses are deductible or whether you’ve met filing requirements.

Our full-service bookkeeping solution and ClientBooks eliminates uncertainty while instilling confidence in your records.

Real Benefits for Small Business Owners

When you use ClientBooks as your bookkeeping platform of choice, it delivers tangible results:

Save time. No more late nights figuring out how to reconcile your books.

Stay compliant. Avoid IRS penalties by staying on top of payroll and estimated tax deadlines.

Be confident and audit-ready. Clean, accurate records mean you’re prepared if the IRS comes calling.

These benefits are why so many small business owners trust 1-800Accountant for professional bookkeeping support.

How to Get Started with ClientBooks

Whether you're new to bookkeeping or already using a DIY solution, we have you covered. ClientBooks is compatible with leading accounting software, ensuring seamless integration and financial data management.

Getting started is simple:

Schedule a free consultation. You’ll speak with a 1-800Accountant small business expert about your situation and business needs.

Quick onboarding. ClientBooks setup is quick and straightforward, with support every step of the way.

Transparent pricing. Flat-rate plans mean no hidden fees to worry about, just predictable costs.

If you’re unsure about whether ClientBooks is your optimal solution for tax season, start with a consultation — it’s free, and it will give you a glimpse into a better kind of bookkeeping.

Stay Tax-Ready, Year-Round

Never wonder how to prepare for tax season again.

Being tax-ready and staying that way is non-negotiable. For small businesses, it’s the foundation of financial health, peace of mind, and future success.

With ClientBooks, accounting software for small businesses, and 1-800Accountant's full-service bookkeeping solution, you get more than bookkeeping software — you get a complete financial solution backed by your designated bookkeeper. From staying organized and maximizing deductions to keeping ahead of deadlines, ClientBooks helps small businesses strengthen their financial foundations.

Ready to take control of your books and your taxes? Schedule your free 30-minute consultation today to learn more about ClientBooks: tax-ready bookkeeping for small businesses.