Property Management Accounting Services

Get expert accounting services for property managers and real estate investors. 1-800Accountant handles bookkeeping, taxes, rent tracking, 1099s, and more.

Accounting Services for Property Managers

Property managers, landlords, and short-term hosts – however you operate, it's essential to have a firm understanding of your business's financial status. Minimizing your business tax liability while maintaining compliance can be challenging, especially as you address maintenance and repairs, as well as requests from tenants or guests, among other responsibilities. If you're struggling to balance taxes with property management as your business grows and matures, you're not alone. Still, you need to take action with affordable, tax-deductible financial solutions that support your properties throughout the fiscal year.

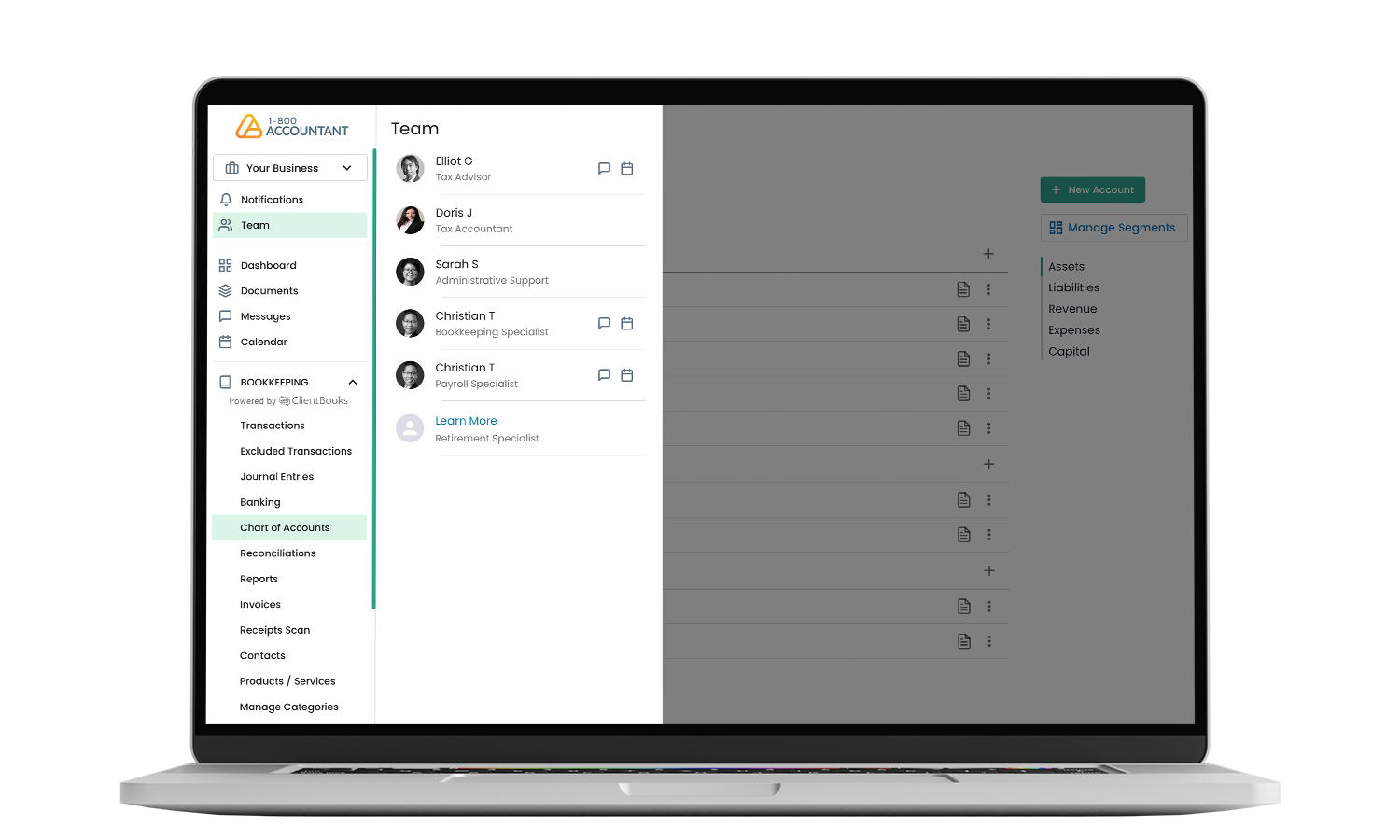

1-800Accountant, America's leading virtual accounting firm, addresses your property management business's complex accounting work with a suite of financial solutions powered by real accounting professionals. Your dedicated team, experienced in addressing the distinct needs of property managers, works closely with you, providing personalized support while accurately and efficiently managing your finances. This gives you the confidence and insights you need to make informed decisions about rental acquisitions, budgetary allocations, and other critical decisions impacting your business’s long-term financial health.

.png?w=1080)

Property Management Bookkeeping

We track your property's revenue and operating expenses and share findings with easy-to-understand reporting.

Talk to Your Accountant

You can schedule a call whenever you have a question or need advice about the financial health of your property management business, or you can send a message.

All Property Managers Welcome

We offer professional accounting solutions to property managers in all 50 states.

Getting started is easy and free.

Connecting with 1-800Accountant, the property accounting experts, is easy and free. Here's what to do:

1. Select a convenient date and time within your schedule to speak to one of our experts.

2. During this 30-minute call, we'll discuss your property management business's plans, a $199 value.

3. Once fully onboarded, we’ll implement a year-round income tax strategy that empowers you to reach your business goals. Your tax advisor will guide you through each step, ready to offer solutions to even the most complex property management tax challenges throughout the year.

Property Management Accounting

- Tax Advisory

- Tax Preparation and Filing

- Sales Tax Compliance

- Quarterly Estimated Taxes

- Business Bookkeeping Services

- Entity Formation

- Payroll Services

Property Management Accounting FAQs

Property management accounting involves accurately tracking and managing the finances of property management and real estate businesses. Operating expenses, rental income, owner distributions, and maintenance costs are among the metrics that should be tracked. When property management accounting is implemented, it generates important insights for budgeting, forecasting, and financial reporting, while ensuring tax compliance.

Property managers, landlords, real estate investors, and condo boards should all consider using 1-800Accountant's suite of professional accounting services. When you trust 1-800Accountant with your complex accounting work, you're matching with an accountant or team experienced in property management accounting in your state.

It's essential to have a firm grasp of your business's financial performance while maintaining tax compliance, which is achieved via property management accounting. When property management accounting is implemented and your data is accurately tracked, including rental income and operating expenses, it generates important insights that empower you to make critical business decisions based on up-to-the-minute financial data.

Unlike do-it-yourself tax and bookkeeping providers, 1-800Accountant's business tax preparation and bookkeeping solutions are full-service, powered by tax professionals and technology to ensure accuracy and a minimal tax burden, while ensuring compliance with state and federal authorities. This empowers property managers to focus on managing their businesses while 1-800Accountant handles their accounting needs.

1-800Accountant's suite of professional accounting services is compatible with many of the leading property management software platforms. Whether you prefer AppFolio, Buildium, Rent Manager, or have embraced a different platform, our accounting software and services integrate with your preferred property management software.

Unlike accounting generalists who may miss deductions and are typically inexperienced in catering to the precise needs of property managers, 1-800Accountant can handle managing funds held in a trust and regular escrow bank reconciliations to ensure your escrow account matches bank statements. Our services are flexible and can be tailored to the needs of real estate owners and entrepreneurs.

Yes, 1-800Accountant can provide owner financial statements on a monthly basis with easy-to-read financial reporting, so you always know the health of your rentals. If you have questions, you can schedule time to meet with your team for answers and potentially update or adjust your strategy based on these insights and changing market forces.

Your designated accountant or accounting team will deliver reports that provide financial insight and aid in critical decision-making. While we tailor the reporting package to the individual needs of each rental property client, you may receive a profit & loss statement, balance sheet, cash flow statement, accounts receivable and payable reports, and more based on your business requirements.

1-800Accountant offers a tax-deductible, full-service bookkeeping solution to busy rental property owners, ensuring rent collection and payments, delinquencies, and late fees, among other important metrics, are accurately tracked. Your dedicated bookkeeper will work closely with you, providing personalized support while ensuring your books are managed accurately and efficiently, giving you the insights you need to make critical, data-backed business decisions for your properties.

When you trust 1-800Accountant with your rental business's sensitive financial work, your team works to streamline processes and maximize your tax savings while ensuring compliance. If you use workers who are not classified as W-2 employees, such as property contractors or vendors, it is your responsibility to submit Form 1099-NEC, Nonemployee Compensation, to your workers and the IRS by the end of January following the tax year. 1-800Accountant can handle this process on your behalf.

Our bookkeeping solution can categorize maintenance and repair expenses by property or unit, providing a more granular view of your rental property portfolio. Your designated bookkeeper may evaluate your previous categorization methods during initial setup and integration, ensuring efficient categorization and professional support.

1-800Accountant helps your property management business enhance processes by taking a strategic approach to its finances. Your designated accountant or team handles financial forecasting, budgeting, and cash flow management, among other complex financial responsibilities, to ensure the long-term profitability of your multi-property portfolio.

Year-end financial documents, such as profit & loss statements and rent roll, are provided to property management owners in preparation for each tax season. These documents enable property managers to evaluate yearly financial performance and ensure compliance, while promoting transparency to all stakeholders your business may have.

Whether you manage residential or commercial properties, 1-800Accountant's suite of affordable, tax-deductible real estate accounting services is an excellent fit for your operations. When you become a 1-800Accountant, we match you with tax professionals experienced in your state and industry, including property managers who cater to residential and commercial properties.

Your designated accountant or accounting team ensures compliance with applicable real estate industry regulations in several ways. This is achieved through adherence to all tax laws that impact your business, conformity to real estate industry best practices and standards, while keeping up with ever-changing rules and regulations. This involves adjusting strategy as necessary to maintain overall tax compliance for your business.

Your designated full-service bookkeeper, who handles your business's sensitive bookkeeping responsibilities, can track tenant security deposits separately from operating funds. Tracking these deposits and funds separately for your business ensures compliance and transparency while promoting accurate financial information for your property management operations.

Serving traditional property managers differs from the needs of short-term rental property owners on platforms such as Airbnb and Vrbo. Whether you have a single property or are in the middle of building a multi-property empire, 1-800Accountant works with and provides expert financial services to short-term rental property owners nationwide.

1-800Accountant supports your property management operations with a suite of affordable, tax-deductible real estate accounting solutions, including full-service real estate bookkeeping and business tax preparation and filing for property managers. Our services are customizable and designed to scale, whether you expand your portfolio of rental properties in your current state or have multistate real estate ambitions.

Connecting with 1-800Accountant to get started with our property accounting services is easy! Select a convenient date and time to speak to one of our experts. During the free 30-minute call, you'll tell us about your property management goals and challenges, which we'll use to tailor an affordable, tax-deductible accounting package for your business, ensuring compliance and a minimal business tax burden.

Speak to our experts about accounting for your property management business today!

*Based on a $12.2k average 2022 tax refund per client, which is 4x the cost of a full-service package. Source: first-party data.

**Includes average business tax preparation, form completion and submission, record keeping, and other misc admin time. Source.

***Historical first-party data.

.png?w=1080)