America’s largest virtual accounting firm for small businesses

Our mission is to provide financial expertise to small businesses in every industry. Our services are powered by a mix of expert CPAs and technology, enabling businesses to minimize tasks while maximizing tax savings. This allows owners to focus their time and energy on growing their businesses while we handle the rest.

Our CPAs have more than

17 years

of experience on average

We've served

100,000+

small businesses and counting

Operating in

All 50 states

with experts in all industries

Built by Accountants. Made for Small Business.

1-800Accountant was founded by veteran CPAs intent on bringing their experience gained at big international accounting firms to small American businesses. Our tech allows businesses to move faster, but it’s the relationships they forge with our accountants that make the difference. When you use us, you’ll feel that difference too.

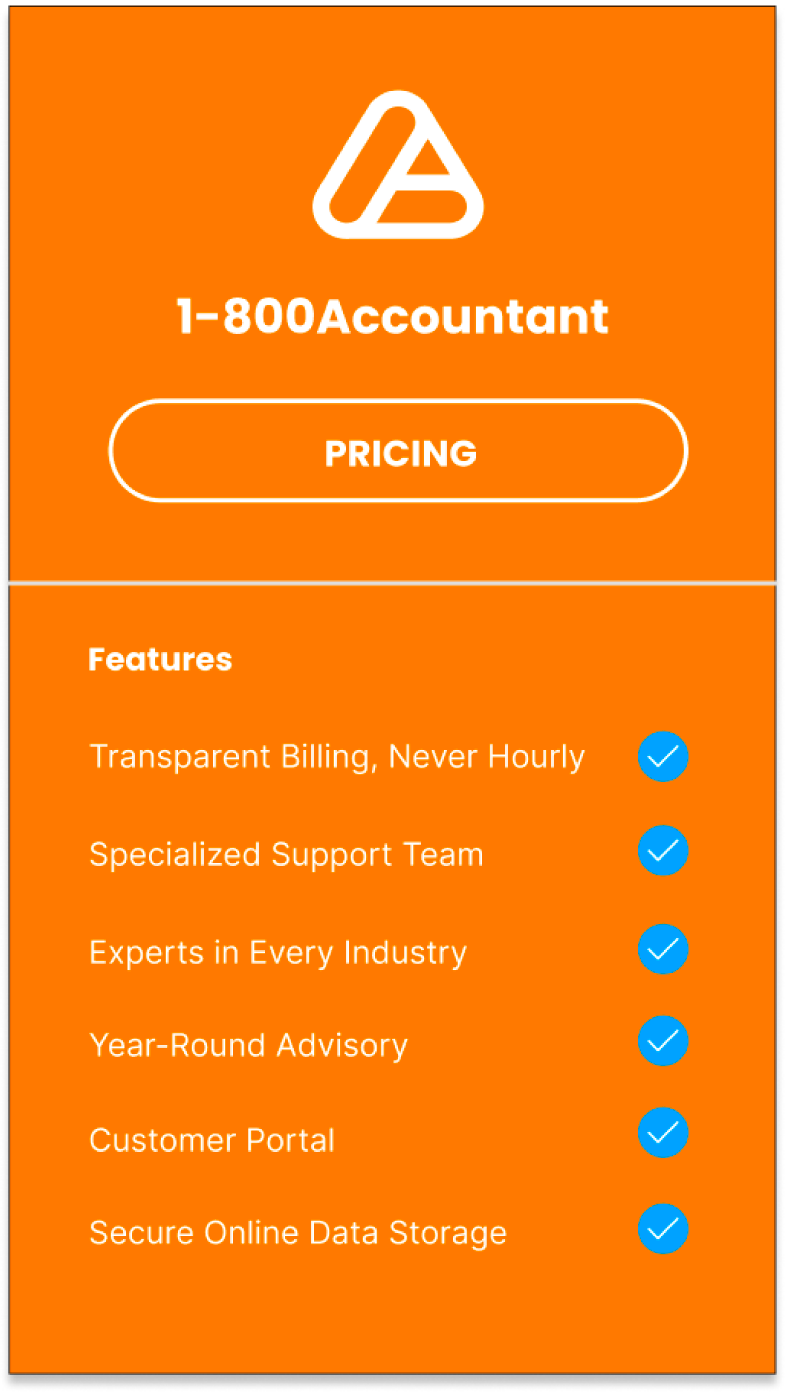

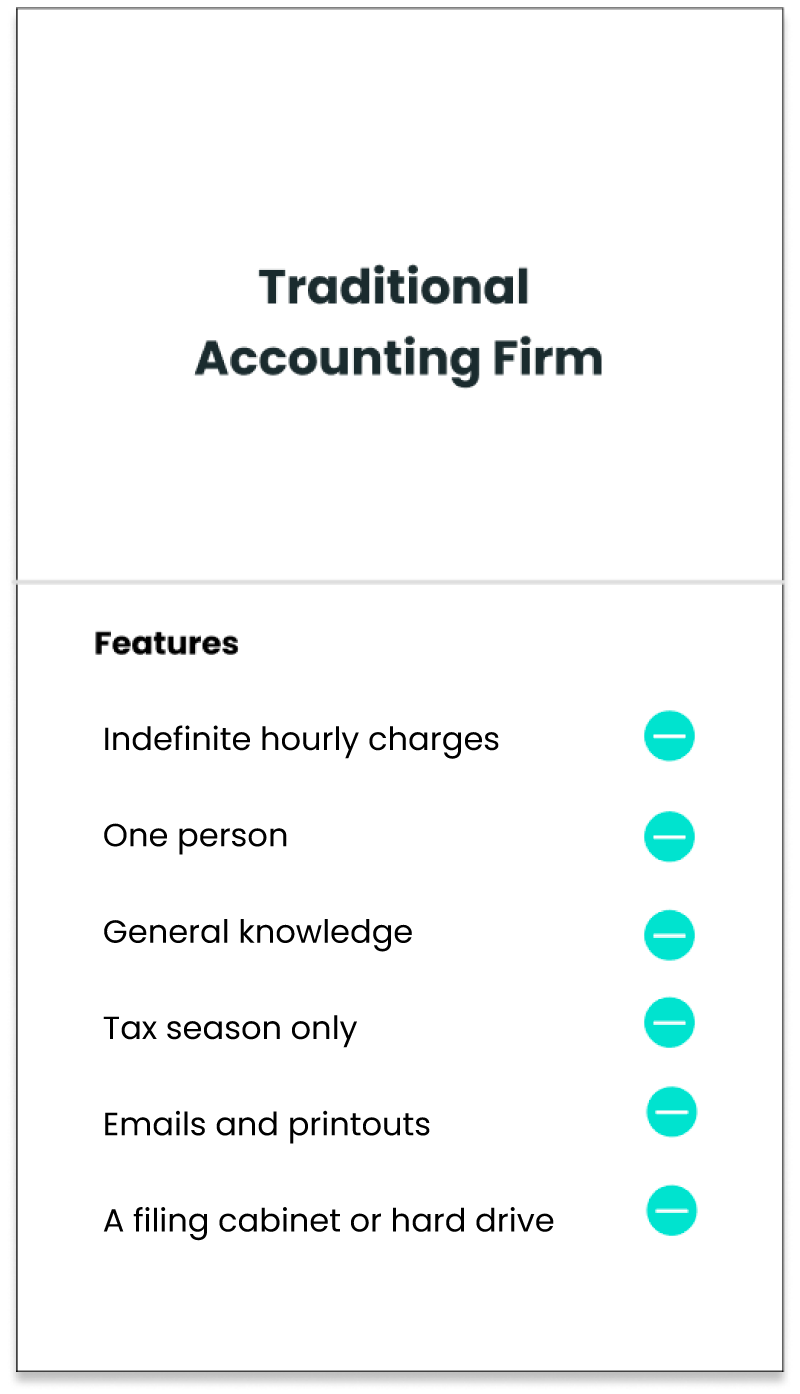

1-800Accountant vs Traditional Accounting Firms