Personal Income Tax Preparation & Filing Services

Get your maximum refund with personal income tax services from the leaders in virtual accounting. Schedule a free consultation to get started.

Personal Tax Preparation and Filing

1-800Accountant, America's leading virtual accounting firm, offers expert tax support for every filing situation — from simple W-2s to complex returns with multiple income sources. Our personal income tax services ensure accuracy and guaranteed refund maximization, along with the peace of mind knowing that professional income tax accountants back your complex financial work.

Maximize Your Tax Savings [[INFO:MaximizeSavings]]

Try our individual tax preparation services for 30 days. If you're not satisfied within that time, we'll refund the remaining balance of your purchase.

Year-Round Support

Get unlimited access to a dedicated accounting team and proactive, year-round tax planning and advice.

Get Peace of Mind

Let our tax professionals prepare your taxes for you. Affordable tax preparation, accuracy guaranteed.

Transparent Pricing

No hourly rates or hidden charges for federal and state personal income tax returns. Whether filing jointly or individually, what you see up front is what you get.

Bank-Level Security

Whether self-employed, freelance, or in a side-income tax situation, encryption and multiple layers of authentication keep your information safe and secure.

Peace of Mind

IRS audit support, year-round tax advisory, and integration with bookkeeping or small business tax services for mixed personal/business filers empowers you to focus on what you do best: running your business.

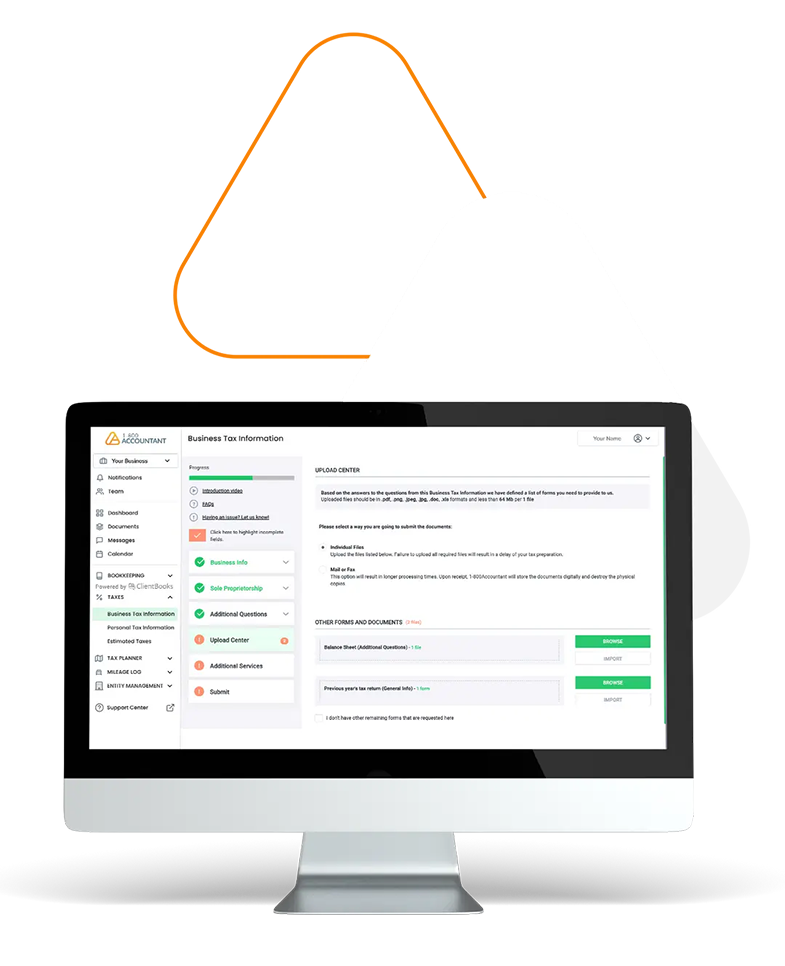

Discussing your personal tax situation with 1-800Accountant is easy:

- Schedule time and we'll give you a call.

- Tell us what’s going on with your personal tax situation.

- Get matched with an accountant who will minimize your personal tax liability, guaranteed.

Frequently Asked Questions about Income Tax

The time it takes to prepare personal taxes depends on many factors, including the complexity of the work. When you work with 1-800Accountant, we’ll prepare your individual income tax return with accuracy guaranteed – no matter how complex your situation may be.

LLCs taxed as a partnership or S corporation are pass-through entities but file separate tax returns. The difference is that the partnership and S corporation file a tax return to show income, expenses, and what percentage of the profits each partner owns, which then flows onto the partner’s personal tax return. Our accountants can handle both personal and business filings for sole proprietors, LLC owners, and freelancers for maximum efficiency.

C corporations pay taxes separately, but S corporations and partnerships also file separately – they just don’t pay taxes separately. For partnerships and S corporations, the partner’s share of the profit is added to their personal return after the business return is prepared.

Generally, you’re able to reduce your taxable income by writing off business losses. But not all business losses reduce taxable income. For instance, if your business has yet to launch but incurs a loss, the deduction is typically disallowed until the business becomes operational.

The 2025 filing deadline is April 15, 2026, with an extension deadline of October 15, 2026. If the April 15 tax deadline falls on a weekend or holiday, taxes are due the next business day. Ensure you never miss a deadline with expert support from 1-800Accountant.

While every personal tax situation can be unique, gather common forms, including W-2s, 1099s, deduction receipts, and state tax forms, to aid in preparation and filing. We’ll guide you step-by-step through this process, from identifying the proper forms to uploading them securely.

1-800Accountant can help your tax situation in many ways, including year-round planning and filing. Our tax advisors help you minimize future tax liability and plan proactively for next year’s return while navigating quarterly estimated taxes and ever-changing tax laws and rules.

We can help you file past-due returns and create a plan to manage or resolve IRS debt while minimizing penalties. Early personal tax filing online will also help you avoid missed deadlines.

Speak to our experts today

Everything Accounting, All in One Place

Entity Formation

Payroll

Bookkeeping

*Based on a $12.2k average 2022 tax refund per client, which is 4x the cost of a full-service package. Source: first-party data.

**Includes average business tax preparation, form completion and submission, record keeping, and other misc admin time. Source.

***Historical first-party data.