Professional Financial and Accounting Solutions for Businesses

See what America’s largest virtual accounting firm can do for your growing operations.

.png?w=1080)

Accounting Services for Established Businesses

Have you outgrown the processes and protocols that built your business into what it is today? Are you stretched thin as you manage employees, your business, and your time-consuming financial work? Are you searching for a customized, hands-on, end-to-end accounting service to entrust with that work so you can focus on growing aspects of your business? Your search is over.

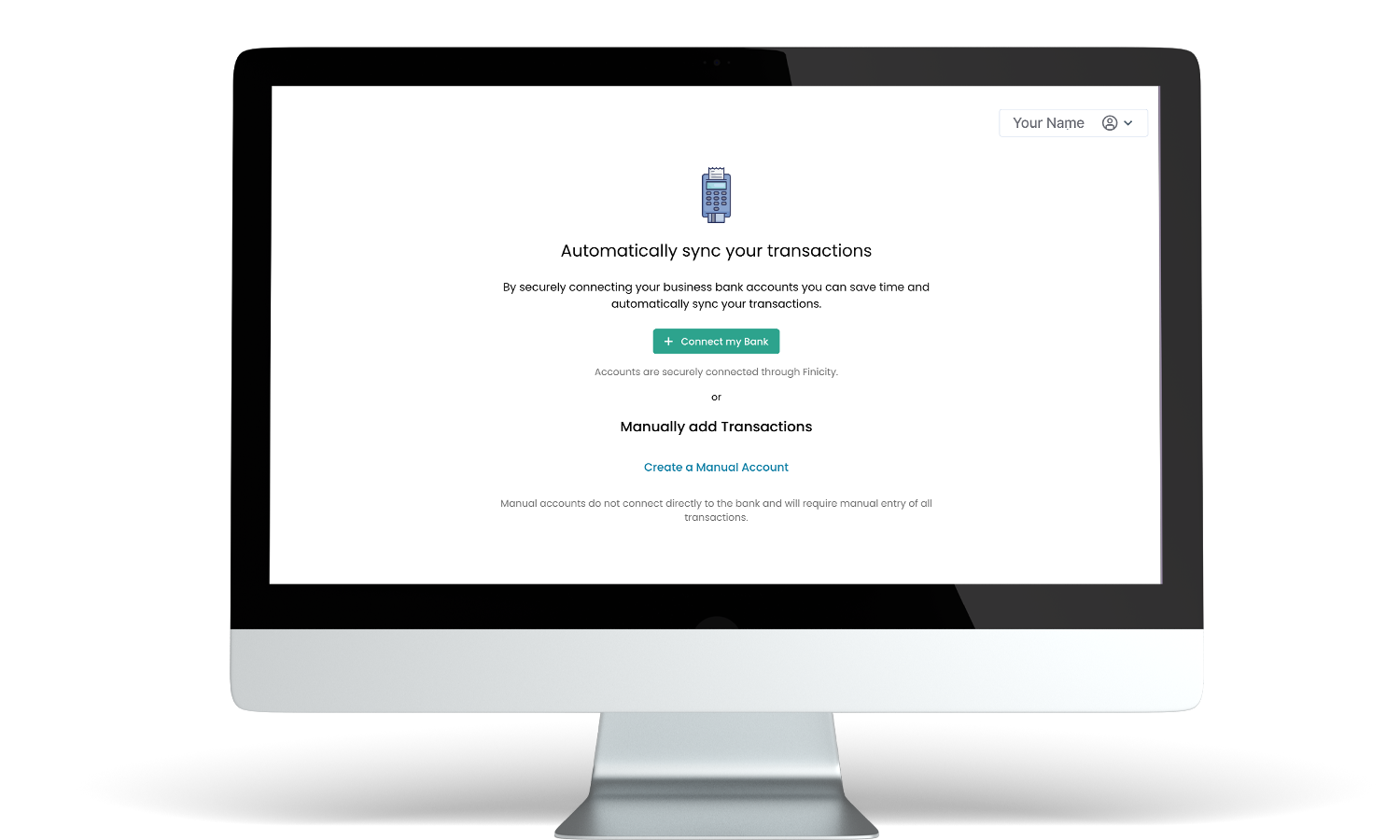

Our scalable, tech-driven services are your solution to successfully navigating your business's most pressing financial challenges. When you entrust 1-800Accountant to address your complex needs, expect a white glove experience that is second to none. Our tailored, full-service onboarding process establishes a custom system for your business that aligns with your strategic growth initiatives.

This system is supported by advanced month-end close management, secure data and file organization and sharing, an innovative, easy-to-understand financial reporting package, and technology advisory services that drive efficiency and empower you to focus fully on your business goals.

Full-Stack Accounting

Get end-to-end accounting services from your designated accounting team, including essential AP/AR management.

Strategic Financial Advisory

Year-round tax advisory from your dedicated advisory team ensures compliance, minimizes tax liabilities, and avoids costly errors.

Tax Compliance

Flexible, scalable compliance that intelligently expands and contracts based on seasonal and budgetary cycles.

Affordable Full-Stack Services

Our end-to-end financial services ensure your business initiatives are always supported with scalable and flexible solutions.

Positive Cash Flow Impact

Through continuous cost-cutting reviews, we identify financial opportunities designed to drive positive cash flow impact.

Four essential pillars power our end-to-end accounting and custom accrual-basis bookkeeping process:

Tech-Driven Delivery

POD Approach

Scalability

Regular Profit & Loss Reviews

This approach ensures our solution is your total business resource, which includes

Frequently Asked Questions

We will define a detailed service scope and set up a flat monthly fee based on a business needs analysis. If a requested service or project is out of scope, a new engagement letter will be established for approval before that service is conducted.

Yes, if a historical cleanup or catch-up project is required, we will scope the project and include that in our proposal.

Our advisor fees are fully tax-deductible as a business expense. With this service, we offer tax advice to businesses in all 50 states, including ecommerce, professional services, non-profits, and more. Our CPA advisors' strategic tax advice helps reduce tax liability while maintaining compliance.

Underreported income is one of the most common reasons a business would get audited. While determining whether to audit you, the IRS cross references your industry and locality to know what the typical deductions for a similar-sized business would take and how much.

Individuals who receive tax forms other than a W-2 typically have to pay, but there are exemptions for specific professions, such as fishing and farming.

For detailed Growth Focus and Strategic Finance pricing, please contact us.

*Based on a $12.2k average 2022 tax refund per client, which is 4x the cost of a full-service package. Source: first-party data.

**Includes average business tax preparation, form completion and submission, record keeping, and other misc admin time. Source.

***Historical first-party data.