Airbnb Accounting: Expert Bookkeeping and Tax Services

Expert Airbnb accounting services track income, manage expenses, and simplify tax reporting—so you can focus on hosting, not bookkeeping.

Expert Bookkeeping and Tax Services for Airbnb Hosts

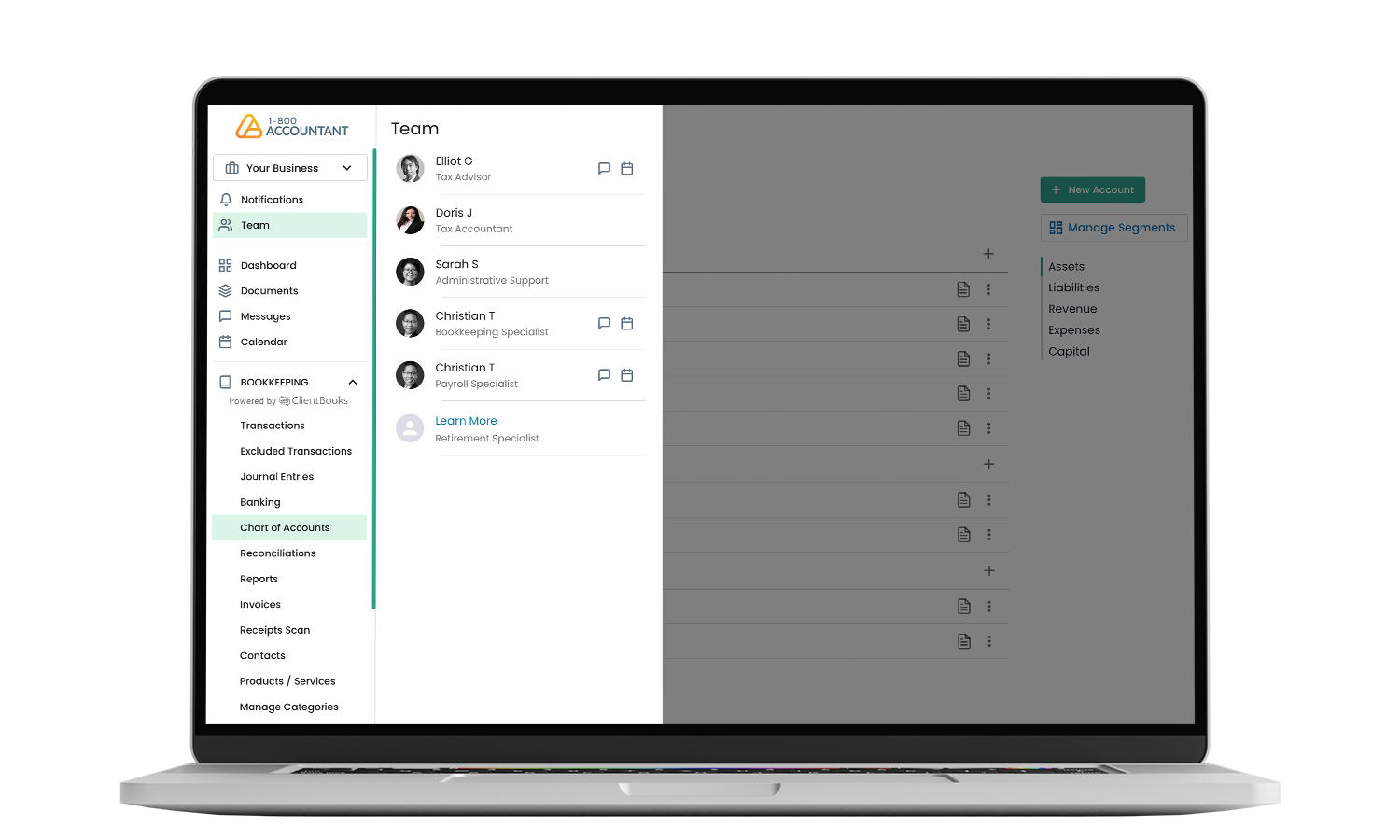

Short-term rental bookkeepers are responsible for maintaining records, creating invoices, and addressing the vital task of financial reconciliation, verifying that business bank financial statements match the records in the general ledger. Creating and maintaining the general ledger is another essential task for which bookkeepers are responsible. Short-term rental accountants use that information to produce financial reports, statements, and modeling, which provide critical, high-level insights to Airbnb rental property owners.

1-800Accountant, America's leading virtual accounting firm, addresses your Airbnb tax and bookkeeping needs with affordable, tax-deductible financial solutions powered by real accounting and bookkeeping professionals. Your dedicated team works closely with you, providing personalized support while accurately and efficiently managing your finances. This gives you the confidence and insights you need to make informed decisions about the future of your Airbnb operations.

Airbnb Bookkeeping

Talk to Your Accountant

All Airbnb Hosts Welcome

Connecting with 1-800Accountant, the Airbnb accounting experts, is easy and free. Here's what to do:

1. Select a convenient date and time within your schedule to speak to one of our professionals.

2. Tell us about your Airbnb rental plans during this 30-minute call, a $199 value.

3. Once fully onboarded, we’ll implement a year-round income tax strategy that empowers you to reach your Airbnb business goals. Your tax advisor will guide you through each step, ready to offer solutions to even the most complex short-term rental property tax challenges throughout the year.

Accounting and Financial Services for Airbnb Hosts

- Tax Advisory

- Tax Preparation and Filing

- Sales Tax Compliance

- Quarterly Estimated Taxes

- Business Bookkeeping Services

- Entity Formation

- Payroll Services

Airbnb Host Accounting FAQs

There are numerous expenses that Airbnb hosts can claim as tax deductions, which reduce their tax liability by reducing their taxable income. Repairs, cleaning fees, and mortgage interest are some of the top deductions you should consider claiming. When 1-800Accountant handles your short-term rental accounting work, your designated team ensures your business claims every eligible tax deduction.

If you've made improvements that you expect will depreciate faster than your residential property's determinable useful life of 27.5 years, you may benefit from a cost segregation study. A cost segregation study will identify rental property assets, such as furniture and appliances, that can be depreciated over a shorter time, such as 5, 7, or 15 years.

Our full-service accounting solution ensures your taxes are prepared and filed for maximum tax savings, provides access to your accountant for personalized advisory throughout the tax year, and submits simple income reports to help you make critical business decisions about the direction of your Airbnb operations. Eliminate short-term rental uncertainty when you work with America's leading virtual accounting firm for small businesses.

Whether you own a single short-term rental property or are expanding your real estate portfolio, 1-800Accountant supports your operations with income and expense tracking. Our proprietary bookkeeping platform, ClientBooks, is compatible with leading do-it-yourself accounting systems and accounting software (Xero, Quickbooks Online, etc.), ensuring seamless integration with your previous tracking activities.

1-800Accountant handles tax preparation and filing for Airbnb hosts on their behalf. We help you save through restructuring and reclassification and support your operations with year-round strategy and advice, so you're always confident about your business tax situation.

We can help calculate your occupancy tax obligation as mandated by state or sometimes local authorities. If you operate short-term rental properties in multiple states, we can support your operations by providing occupancy tax calculations for each state, taking any special rules or rate differences into account.

Yes, 1-800Accountant supports your Airbnb operations with financial reporting. Your accountant uses the financial information compiled by your bookkeeper to produce financial reports. These reports help you better understand your profitability, cash flow, and financial path. Often, Airbnb hosts turn to accountants for help understanding their finances at a high level for tax planning, forecasting, and advice.

1-800Accountant exclusively serves the financial needs of small business owners and self-employed Airbnb hosts with a suite of financial solutions in all 50 states. Our services do not currently extend to businesses operating outside the United States.

A separate business bank account isn't required for your Airbnb rental, but it can help streamline operations. Separating your personal and business bank accounts promotes efficiency and time savings while eliminating extra work you would need to do to isolate your business income and materials at tax time.

When you trust 1-800Accountant with your vacation rental accounting, your designated accounting team ensures your business is optimally structured and classified while identifying every opportunity to reduce your taxable income via tax deductions and credits for your Airbnb short-term rental business.

Speak to our experts about accounting and financial solutions for your Airbnb business today!

*Based on a $12.2k average 2022 tax refund per client, which is 4x the cost of a full-service package. Source: first-party data.

**Includes average business tax preparation, form completion and submission, record keeping, and other misc admin time. Source.

***Historical first-party data.