Construction Accounting Services for Contractors and Builders

Expert construction accounting services for contractors and builders. Job costing, WIP reports, payroll, and tax compliance, all in one place.

Accounting for Contractors and Builders

Builders and contractors take on various construction projects to build up and beautify communities across the country. It takes enormous skill and dedication to see each project through, which depends, in part, on the strength of your business's financial foundation. Successful construction business management includes tax and recordkeeping considerations, addressing ongoing compliance concerns, and employee and subcontractor retention and management. If the threat of costly delays distracts from your latest construction project, full-service, tax-deductible financial solutions can help.

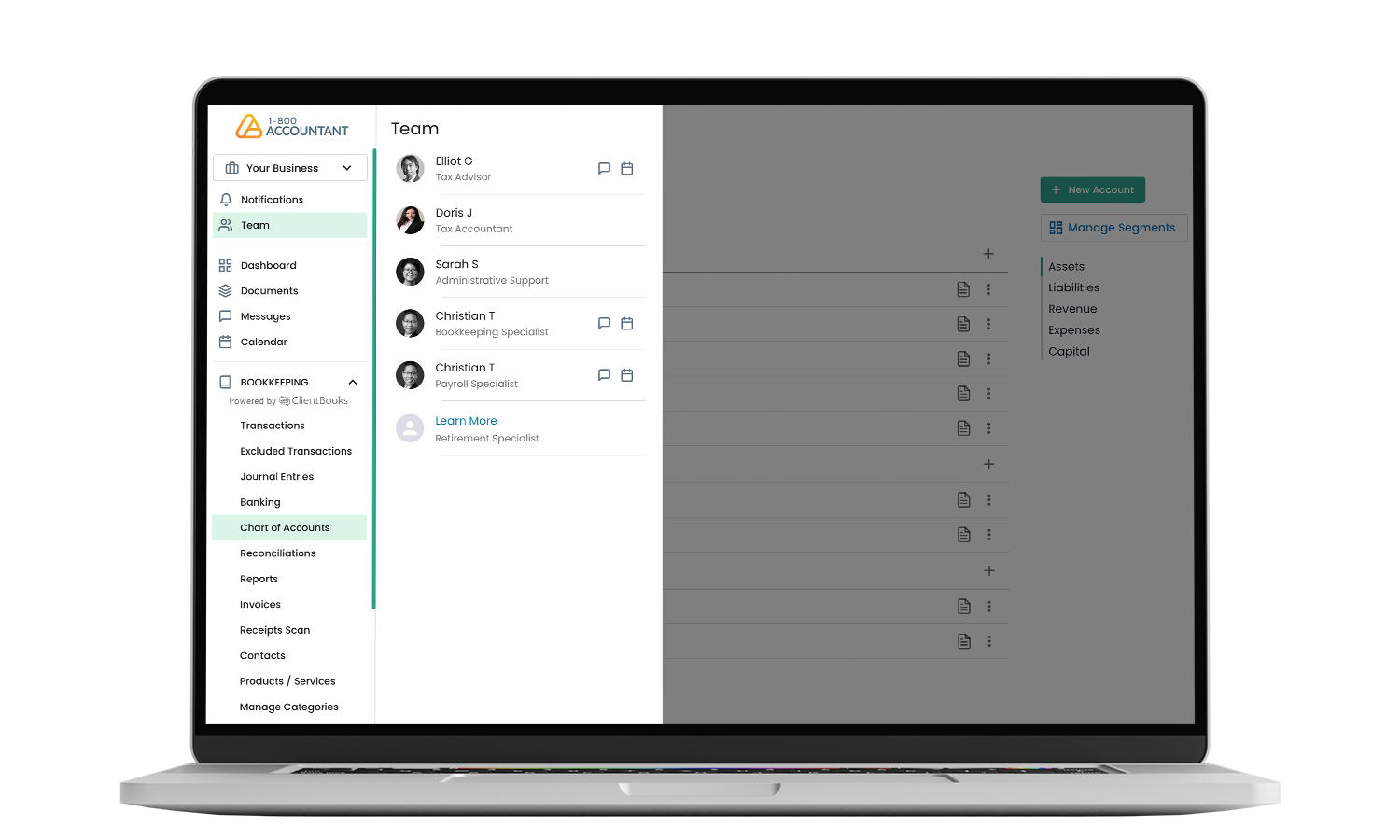

When you trust 1-800Accountant, America's leading virtual accounting firm, with your construction business's sensitive accounting work, you benefit from a suite of tax services and financial solutions powered by real accounting professionals. Your dedicated team will work closely with your business, providing construction bookkeeping, personalized advisory services, payroll, and efficient, year-round financial management, maximizing your tax savings while ensuring peace of mind and the freedom to focus.

Construction Bookkeeping

We track your construction company's revenue and operating expenses and share findings with easy-to-understand reporting.

Talk to Your Accountant

You can schedule a call whenever you have a question or need advice about the financial health of your construction business, or you can send a message.

All Builders Welcome

We offer expert accounting solutions to construction business owners in all 50 states.

Getting started is easy and free.

Connecting with 1-800Accountant, the construction accounting experts, is easy and free. Here's what to do:

1. Select a convenient date and time within your schedule to speak to one of our professionals.

2. Tell us about your long-term plans to build your business during this 30-minute call, a $199 value.

3. Once onboarded, we’ll implement a year-round income tax strategy that empowers you to reach your business goals. Your tax advisor will guide you through each step, ready to offer solutions to even the most complex business tax challenges facing contractors and builders throughout the year.

Tax and Accounting Support for Construction Businesses

- Tax Advisory

- Tax Preparation and Filing

- Sales Tax Compliance

- Quarterly Estimated Taxes

- Business Bookkeeping Services

- Entity Formation

- Payroll Services

Construction Accounting FAQs

Accurate job costing helps general contractors and builders understand each project’s (which must be tracked separately) financial health. Job costing schedules reflect estimated and actual revenues and expenses for each contract. Updates to the job costing schedules with actual costs and updated profit margins are applied throughout each project. Construction businesses use accounting ratios, including current, quick, and debt-to-equity ratios, to understand project profitability and the business’s financial health. Construction businesses often look to accountants for job costing and project profitability tracking.

Incremental invoicing over the course of a construction project, sometimes over years, is known as progress billing, and the American Institute of Architects (AIA) billing is a standard invoicing system commonly used in construction. When you trust 1-800Accountant with your complex construction accounting work, we match you with a qualified team experienced in serving the distinct accounting needs of your business, including supporting your progress and AIA billing needs.

Our affordable, full-service payroll solution, powered by experts, will run payroll for you each period and handle payroll tax submissions. Spend minutes on payroll each month instead of hours with this service, enabling your employees to be paid in just a few clicks. If you need help managing government-mandated certified payroll and union reporting, our payroll experts can provide appropriate support to comply with contractual requirements. As with all 1-800Accountant services, our payroll pricing is tax-deductible.

1-800Accountant favors our proprietary bookkeeping platform, ClientBooks. We feel it’s the best accounting software to address your construction business's needs. Our platform is compatible with leading bookkeeping software, including QuickBooks Online, FreshBooks, and Wave. Our bookkeepers are fluent in these platforms, ensuring seamless integration and financial data management for your construction business.

Creating a tax planning strategy to help achieve your short- and long-term business goals while maintaining compliance is essential. Your tax strategy should aim to efficiently reduce your construction business's annual federal and state tax liability. Tax planning should save time and resources, but it’s generally not just one activity—it can be a combination of different supporting tactics that the experts at 1-800Accountant can assist with.

Successfully managing your construction business's cash flow helps keep your business running smoothly. Improving cash flow, particularly between draws, delays, and material costs that impact construction businesses, is essential. 1-800Accountant can help improve your business's cash flow with strategic planning and regular monitoring of key metrics, including tracking material usage and days sales outstanding.

Cyclical construction work is typically broken up by external forces, including economic and seasonal factors, where work is performed during certain periods followed by periods of inactivity. These types of scenarios require careful tax planning strategies to support your business throughout the year, which 1-800Accountant can spearhead.

Work in progress reporting involves tracking costs, status, and overall progress of each construction project that has yet to be completed. This type of reporting is essential for long-term construction projects. 1-800Accountant can support your business by producing work in progress reporting for your current and upcoming projects.

1-800Accountant supports your construction business's multistate and out-of-state projects primarily through a tax and financial lens. These projects may require your business to adhere to sales, use, payroll, withholding tax considerations, nexus standards, and overall financial planning and budgeting, which your 1-800Accountant team can support.

Your designated bookkeeper can assist with spreadsheet integration into our proprietary bookkeeping platform, ClientBooks. Whether you've been using custom spreadsheets to track business performance or DIY software, ClientBooks is designed to have wide compatibility with various scenarios to ensure you hit the ground running.

1-800Accountant's outsourced payroll service supports subcontractor payments, contractor compliance, and preparing and distributing applicable 1099 forms. Depending on its specific requirements, 1099s are sent to the IRS and potentially to your state. We then file these forms electronically, concluding the process.

1-800Accountant supports your construction business during audits or project reviews by preparing all necessary accounting and financial documentation for the project or program being scrutinized. It's not uncommon for construction audits and reviews to occur to ensure year-long projects are staying on track while meeting objectives and milestones.

Speak to our experts about construction accounting solutions today!

*Based on a $12.2k average 2022 tax refund per client, which is 4x the cost of a full-service package. Source: first-party data.

**Includes average business tax preparation, form completion and submission, record keeping, and other misc admin time. Source.

***Historical first-party data.

![Construction Accounting 101 for Contractors [2025]](https://images.contentstack.io/v3/assets/blt5aaad8b5e90091d6/blta0793f60a0449b7f/67ddd62617f7b404090d0690/Blog_Thumbnail_Construction_Accounting_101_for_Contractors_1200x630_2.jpg?w=1080)