Daycare Bookkeeping & Accounting Services

Simplify daycare bookkeeping with 1-800Accountant’s expert accounting, payroll, and tax services to keep your childcare business organized and compliant.

Bookkeeping & Tax Help for Childcare Providers

Daycares provide a valuable service to working parents and guardians. Helping raise the next generation is a massive responsibility built on a trustworthy reputation that reflects your commitment to childcare. Balancing your services with other obligations, including taxes, is essential as a business owner. Daycare owners must often manage complex tax situations throughout the year, with mistakes or missed deadlines enough to disrupt operations. If you struggle to provide the best care while maintaining tax compliance, full-service, tax-deductible financial solutions can help.

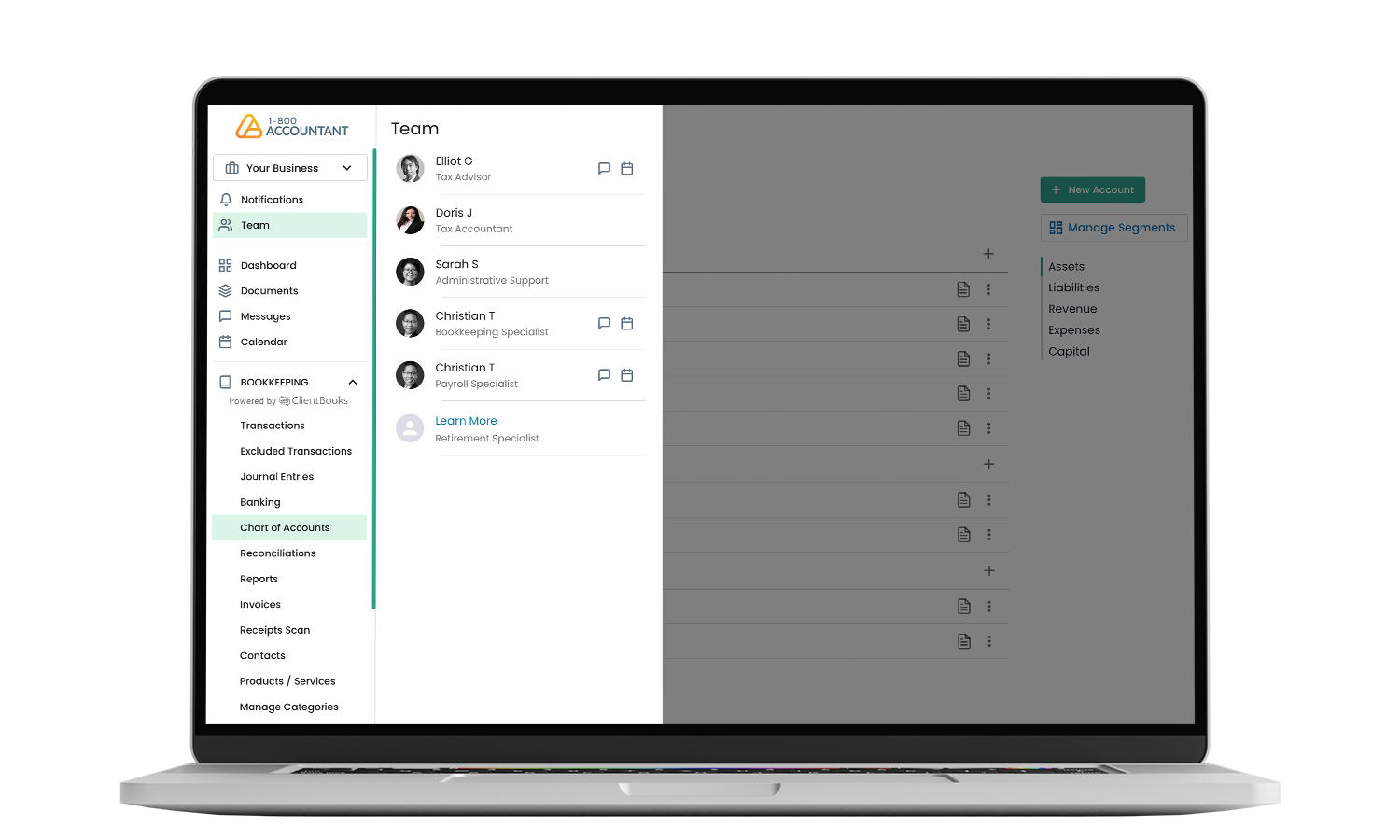

When you trust 1-800Accountant, America's leading virtual accounting firm, with your daycare's accounting work, you benefit from financial solutions powered by real accounting professionals. Your dedicated team will work closely with you, providing bookkeeping, personalized advisory support, budgeting, and efficient, year-round financial management. This gives peace of mind and empowers you to confidently care for children, knowing your bookkeeping and accounting work is up to date and error-free.

Daycare Bookkeeping

We track your daycare's revenue and operating expenses and share findings with easy-to-understand reporting.

Talk to Your Accountant

You can schedule a call whenever you have a question or need advice about the financial health of your daycare business, or you can send a message.

All Daycares Welcome

We offer expert accounting solutions to childcare professionals in all 50 states.

Getting started is easy and free.

Connecting with 1-800Accountant, the Daycare accounting experts, is easy and free. Here's what to do:

1. Select a convenient date and time within your schedule to speak to one of our professionals.

2. Tell us about your long-term plans for your daycare during this 30-minute call, a $199 value.

3. Once onboarded, we’ll implement a year-round income tax strategy that empowers you to reach your business goals. Your tax advisor will guide you through each step, ready to offer solutions to even the most complex daycare business tax challenges throughout the year.

Tax & Bookkeeping Support for Daycare Operators

- Tax Advisory

- Tax Preparation and Filing

- Sales Tax Compliance

- Quarterly Estimated Taxes

- Business Bookkeeping Services

- Entity Formation

- Payroll Services

Daycare Bookkeeping & Accounting FAQs

Deductions reduce your daycare's tax liability by lowering your total taxable income. Numerous deductions are available and typically qualify if they are ordinary and necessary costs, including the home office deduction, and deductions related to equipment, supplies, and meals. If you're having trouble determining every eligible deduction, consult a qualified tax professional specializing in daycare businesses.

Daycare bookkeeping ensures that all financial data, including debits and credits, is properly recorded by creating a general ledger. Maintaining the ledger is part of the bookkeeping process. It is detail-heavy work, with its thorough information providing the best financial data interpretation, decision-making, and forecasting tools to help streamline your daycare operations. Unlike do-it-yourself bookkeeping software that still demands your time and attention, 1-800Accountant offers daycare owners a full-service bookkeeping solution for an affordable, tax-deductible fee.

Our affordable, full-service bookkeeping solution is handled for you by a designated bookkeeper who generates easy-to-understand reporting that aids in critical business decisions. Let us handle your everyday bookkeeping tasks so you can focus on what you do best – running your daycare business. In addition to bookkeeping, we support your business with a suite of financial services, including payroll and quarterly estimated tax prep and filing.

If you are self-employed and devote a portion of your home used exclusively and regularly for your daycare business, you can take the home office deduction. There are two ways to calculate this deduction: the regular method or the simplified method. Business owners who handle their own financial work will likely embrace the simplified method that avoids the more complex calculations required by the regular method. The simplified home office deduction represents $5 per square foot of your home office/daycare, but is limited to 300 square feet, or $1,500.

To ensure compliance and to understand current cash flow, you should track all payments to your daycare in your bookkeeping system, regardless of payment type. Whether a parent submitted payment by check, credit card, third-party payment platform such as PayPal, or cash, it is your responsibility to track those payments and pay applicable taxes.

If your daycare center has hired W-2 employees, you will have to withhold taxes on their behalf. At the same time, your business must contribute to certain taxes, including Social Security, Medicare, and state and federal unemployment taxes.

Our affordable, full-service payroll solution, powered by experts, will run payroll for you each period and handle payroll tax submissions. Spend minutes on payroll each month instead of hours with this service, enabling your daycare employees to be paid in just a few clicks. If you need help, get guidance on creating efficient procedures for payroll processing, tax payments, and reporting. As with all 1-800Accountant services, our payroll pricing is tax-deductible.

1-800Accountant favors our proprietary bookkeeping platform, ClientBooks. We feel it’s the best daycare accounting software to address your business's needs. Our platform is compatible with leading bookkeeping software, including QuickBooks Online, FreshBooks, and Wave. Our bookkeepers are fluent in these platforms, ensuring seamless integration and financial data management.

You can ensure your daycare stays tax compliant by identifying and understanding all applicable tax laws, submitting accurate, complete materials and tax payments by each deadline, and retaining pertinent records and documentation. Tax laws and rules tend to change often, so staying on top of these shifts is important to ensure the accuracy of each tax submission.

Your daycare doesn't require a separate business bank account to operate, but it can help streamline operations. Separating your personal and business bank accounts promotes efficiency and time savings while eliminating extra work you would need to do to isolate your business income and materials at tax time.

Whether you need bookkeeping support, tax advisory, or any of our professional accounting services, we have the affordable, tax-deductible solutions you need to ensure your daycare business remains compliant. Getting started is easy and free. Schedule a quick consultation with one of our experts–usually 30 minutes or less—to learn more about how 1-800Accountant's bookkeeping service can help your business.

Speak to our experts about daycare accounting solutions today!

*Based on a $12.2k average 2022 tax refund per client, which is 4x the cost of a full-service package. Source: first-party data.

**Includes average business tax preparation, form completion and submission, record keeping, and other misc admin time. Source.

***Historical first-party data.