Outsourced Accounting Services: Streamline Your Finances

Unlock seamless financial management with expert outsourced accounting services. Customizable, secure, and scalable solutions for growing businesses.

Streamlined Accounting Services

It's not uncommon for entrepreneurs to take a hands-on approach to their business's early-phase accounting work, primarily as a cost-saving measure. As their businesses mature, so too will their financial and accounting needs, necessitating a shift from informal, do-it-yourself practices to professional outsourced solutions. If your business is ready to make the transition, 1-800Accountant, America's leading virtual outsourced accounting firm, is here to support those ambitions.

When you trust 1-800Accountant with business tax preparation, tax advisory, and bookkeeping, among other affordable, tax-deductible financial solutions, your business tax burden is minimized while compliance is maximized. This gives you the confidence and focus to pursue your next milestone, knowing your business is expertly supported with full-service financial management, insights, and advisory throughout the fiscal year.

Bookkeeping for Small Businesses

We track your business's revenue and operating expenses and share findings with easy-to-understand reporting.

Talk to Your Accountant

Schedule a call or send a quick message whenever you have a question about your business's financial health or if you need advice.

All Businesses Welcome

We offer tax-deductible accounting solutions to businesses in all 50 states.

Getting started is easy and free.

Connecting with 1-800Accountant, the outsourced accounting experts, is easy and free. Here's what to do:

1. Select a convenient date and time that suits your schedule to speak with one of our professionals.

2. During this 30-minute call, a $199 value, tell us about your goals and business needs.

3. Once fully onboarded, we’ll create and implement a year-round income tax strategy that empowers you to reach your accounting goals. Your tax advisor will guide you through each step, ready to offer solutions to even the most complex business tax challenges throughout the year.

Outsourced Accounting Services

- Tax Advisory

- Tax Preparation and Filing

- Sales Tax Compliance

- Quarterly Estimated Taxes

- Business Bookkeeping Services

- Entity Formation

- Payroll Services

Outsourced Accounting Services FAQs

When businesses launch, owners, CFOs, and other high-level figures will sometimes handle financial operations and accounting tasks themselves as a cost-cutting measure. As these tasks become more complex, outsourced accounting benefits these business owners the most. With outsourced accounting, which is tax-deductible, your business gets the results of an in-house accounting team without the costly overhead.

There are numerous accounting and financial functions that small business owners can outsource. For example, 1-800Accountant offers a suite of affordable, tax-deductible outsourced services, including entity formation, EIN filing, business tax preparation, tax advisory, audit defense, quarterly estimated tax preparation, bookkeeping, and payroll. These professional services ensure your business has a minimal tax liability while maintaining compliance. Review our packages and pricing page for more information.

1-800Accountant matches your business with a designated team familiar with the regulatory and financial requirements and challenges of your state and industry. While an accounting generalist may be able to adequately address certain low-level financial functions, the most favorable scenario involves tax professionals who understand the nuances of what your business is facing and the region in which you're facing them.

When you utilize our comprehensive, tax-deductible bookkeeping and accounting solutions, you can rest assured that your client data is safe and secure while complying with financial regulations. We use the industry-standard 128-bit SSL encryption to safeguard your information. As an added safety measure, our team remains vigilant to emerging threats to help ensure your data is secure.

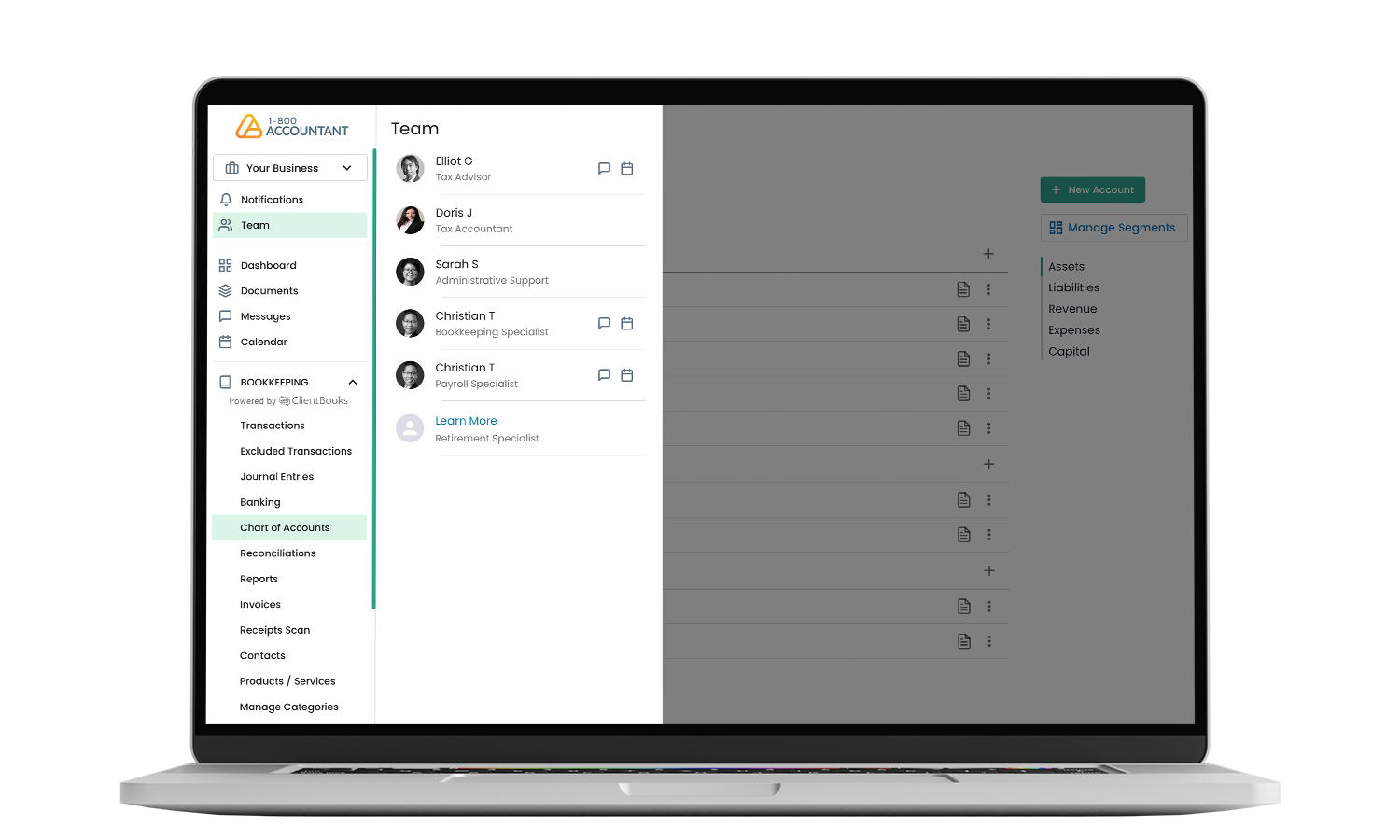

1-800Accountant's proprietary bookkeeping platform, ClientBooks, is compatible with leading accounting software, including QuickBooks Online (QBO), FreshBooks, and Wave. Our bookkeepers are fluent in these platforms, ensuring seamless integration and financial data management. ClientBooks features automation tools, including smart categorization. This enhancement saves time by quickly categorizing your business expenses when you select sync.

1-800Accountant's suite of affordable, tax-deductible financial services is designed to support your business throughout different stages of growth and seasonal fluctuations. Whether your business uses tax preparation, year-round advisory, or bookkeeping, our services scale with you as your operations grow from a startup to a middle market business to a corporation.

Onboarding times will vary depending on the complexity of your financial situation and typically take about a week on average. Your designated accounting team may handle the transition of historical financial data from your previous system. Our tax professionals are familiar with the leading accounting and bookkeeping systems you may have used, which typically makes for a smooth and efficient transition.

1-800Accountant's pricing structure is determined by affordability and the value we deliver for our clients. Unlike traditional accounting CPA firms, where hourly charges can quickly accumulate, we offer a flat-rate model that ensures maximum transparency. In addition to affordability and transparency, you may request a refund of the prorated balance of your annual plan if you're not satisfied within the first 30 days of your purchase.

1-800Accountant does not require a contract to utilize our full-service accounting solutions; however, many businesses choose to stay with us long-term due to the value, quality, and tax savings they often experience. Our affordable, tax-deductible services are billed on an annual basis.

1-800Accountant's tax preparation and filing solution is full-service and handled on your behalf, saving you countless hours while minimizing your tax liability. We support your defense with audit-ready work and through our audit defense service, in the event that the IRS requests additional information or sends a notice. We support you by developing an action plan, creating a communication strategy, and preparing all necessary financial accounting documents.

Our year-round tax advisory service ensures compliance and minimizes tax liabilities, while providing high-level financial analysis and strategic advice to ensure you have the data and insights necessary for informed decision making that impacts the future of your business. Your dedicated advisor provides strategic advice and additional financial planning services, including entity structuring and loan agreements.

Your designated accountant or team can assist with financial forecasting and budgeting, which are seamlessly integrated into various aspects of our solutions. Your accountant uses the financial information compiled by bookkeepers to produce financial reports, which are designed to help business owners better understand their profitability, cash flow, and financial path. Often, business owners turn to accountants for help understanding their finances at a high level for strategic planning, forecasting, tax advice, and strategic business decision making

1-800Accountant's Client Portal is your centralized hub to upload and store essential financial documentation and income tax returns, transmit messages to your designated accounting team, and access financial dashboards and reports impacting your operations in real-time. You can access the financial data in your Client Portal anytime you need it.

Speak to our experts about small business accounting solutions today!

*Based on a $12.2k average 2022 tax refund per client, which is 4x the cost of a full-service package. Source: first-party data.

**Includes average business tax preparation, form completion and submission, record keeping, and other misc admin time. Source.

***Historical first-party data.