Expert Accounting for Plumbers

Get expert accounting, tax prep, payroll, and financial planning for your plumbing business to stay organized and maximize profits.

Tax Preparation and Accounting Services for Plumbers

Plumbers seem to always be in demand. One moment, they're repairing a broken pipe at a factory, and the next, they're off to a residential home to install a new water heater. A plumber's schedule can be varied, with their difficult work and extensive travel to and from worksites limiting time to address other important aspects of their businesses, including their complex tax situation. If you're struggling to balance taxes with other responsibilities, it's time to demand affordable, tax-deductible financial solutions that support your plumbing business throughout the year.

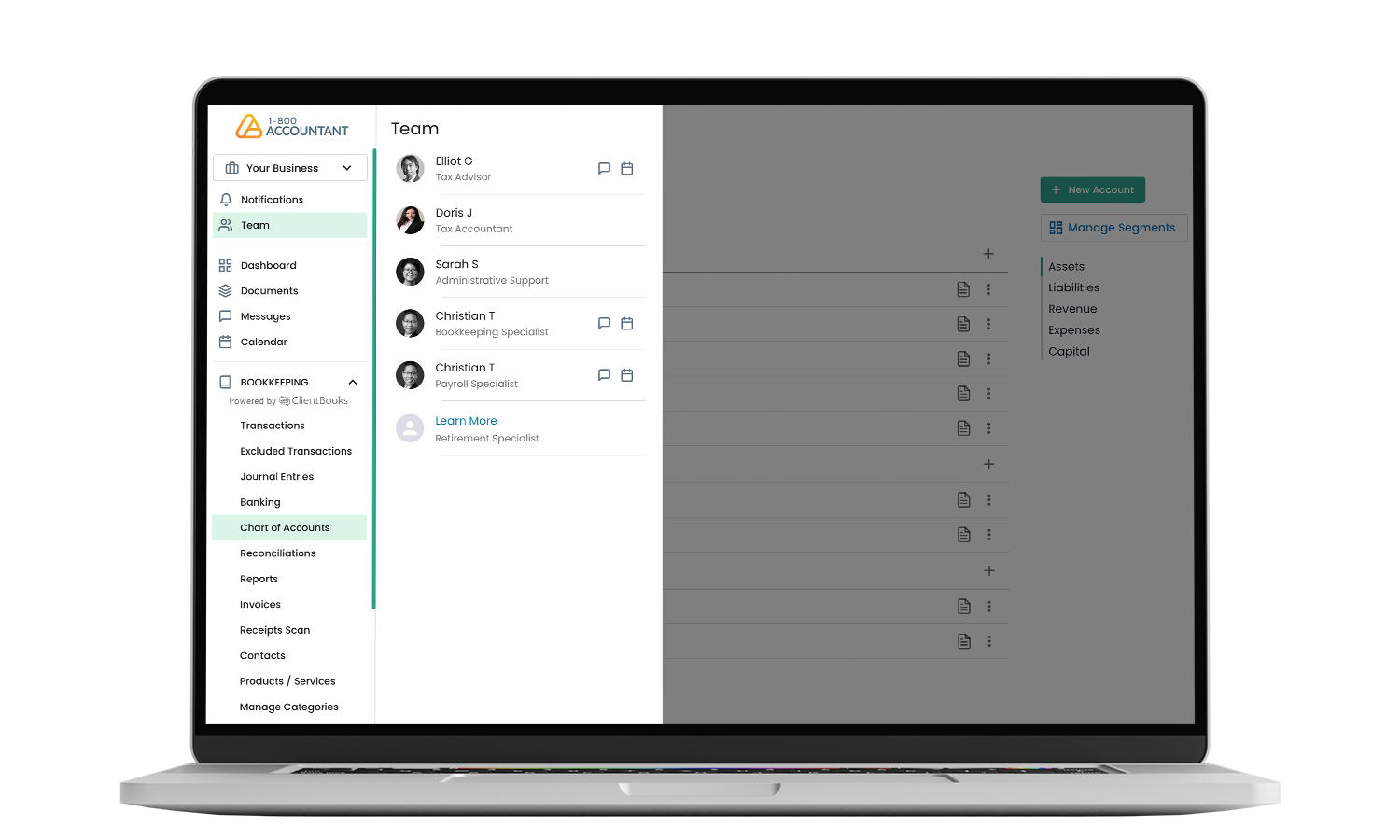

1-800Accountant, America's leading virtual accounting firm, addresses your plumbing business's accounting work with a suite of financial solutions powered by real accounting professionals. Your dedicated team works closely with you, providing personalized support while accurately and efficiently managing your finances. This gives you the confidence and insights you need to make informed decisions about which parts to stock and when, budgetary allocations, and other critical decisions impacting your business’s financial health.

.png?w=1080)

Plumber Bookkeeping

Talk to Your Accountant

All Plumbers Welcome

Getting started is easy and free.

Connecting with 1-800Accountant, the plumbing industry business accounting experts, is easy and free. Here's what to do:

1. Select a convenient date and time within your schedule to speak to one of our professionals.

2. Tell us about your plumbing business's plans during this 30-minute call, a $199 value.

3. Once fully onboarded, we’ll implement a year-round income tax strategy that empowers you to reach your business goals. Your tax advisor will guide you through each step, ready to offer solutions to even the most complex plumbing tax challenges throughout the year.

Accounting and Financial Services for the Plumbing Industry

- Tax Advisory

- Tax Preparation and Filing

- Sales Tax Compliance

- Quarterly Estimated Taxes

- Business Bookkeeping Services

- Entity Formation

- Payroll Services

Plumbing Industry Accounting FAQs

There are numerous expenses that plumbers can claim as tax deductions, which reduce their tax liability by reducing their taxable income. Tools, equipment, and plumbing protective gear are some of the top deductions you should consider claiming. When 1-800Accountant handles your accounting work, your designated team ensures your plumbing business claims every eligible tax deduction.

Plumbers can write off vehicle expenses related to their work. Your business expenses must be ordinary (common and acceptable) and necessary (appropriate and helpful expenses for your work) to qualify. Work vehicle maintenance, gas, and tolls are just a few of the costs you should consider writing off.

Accountants specializing in your field can better serve the distinct accounting needs of your plumbing business, which accounting generalists might miss. These specialists are typically experienced in addressing state and regional tax challenges plumbers may encounter, which is another invaluable advantage over generalists.

The optimal business structure to file taxes will depend on many factors, which your accounting team will advise you on. However, our CPAs typically recommend forming an LLC or limited liability company due to its numerous advantages for small business entrepreneurs. LLC owners enjoy simplicity and flexibility in their tax filing and the protection of their personal assets, shielding them from business liabilities.

Your plumbing company doesn't require a separate business bank account to operate, but it can help streamline operations. Separating your personal and business bank accounts promotes efficiency and time savings while eliminating extra work you would need to do to isolate your business income and materials at tax time.

Our full-service accounting solution ensures your taxes are prepared and filed for maximum tax savings, provides access to your accountant for personalized advisory throughout the tax year, and submits simple income reports to help you make critical business decisions about the direction of your plumbing operations. In addition to tax preparation, we support your business with a suite of financial services, including payroll, bookkeeping, and quarterly estimated tax prep and filing.

When you trust 1-800Accountant with your complex accounting work, your designated accounting team ensures your plumbing business is optimally structured and classified while identifying every opportunity to reduce your taxable income via tax deductions and credits. Entity structure optimization typically reduces first-year clients' tax burden by 50%.

1-800Accountant can provide insights and help you manage cash flow for your plumbing business. Your accountant uses the financial information compiled by your bookkeeper to produce financial reports. These reports help you better understand your business's profitability, cash flow, and financial path. You should rely on your accountant for help understanding your finances at a high level for tax planning, forecasting, and advice.

Our affordable, full-service payroll solution powered by experts will run payroll for your plumbing business each period and handle payroll tax submissions. Spend minutes on payroll each month instead of hours with this service, enabling your employees to be paid in just a few clicks. If you need help, get guidance on creating efficient procedures for payroll processing, tax payments, and reporting. As with all 1-800Accountant services, our payroll pricing is tax-deductible.

When you trust 1-800Accountant with your bookkeeping work, your bookkeeper will create and track your invoices, customer payments, and plumbing orders, among other essential tasks. Your bookkeeper also provides easy-to-understand reporting that allows you to review up-to-the-minute customer data, aiding in business management and profit margins.

1-800Accountant favors our proprietary bookkeeping platform, ClientBooks. We feel it’s the best accounting software to address your plumbing business's needs. Our platform is compatible with leading bookkeeping software, including QuickBooks Online (QBO), FreshBooks, and Wave. Our bookkeepers are fluent in these platforms, ensuring seamless integration and financial data management.

1-800Accountant's professional accounting services are powered by a combination of expert CPAs and technology. It enables your plumbing business to minimize tasks while maximizing tax savings. This lets you focus your time and energy on growing your plumbing business and expanding plumbing services while we handle the rest. Our experts can assist you with the creation and implementation of a growth plan along with supporting services as your business scales.

Speak to our experts about accounting and financial solutions for your plumbing business today!

*Based on a $12.2k average 2022 tax refund per client, which is 4x the cost of a full-service package. Source: first-party data.

**Includes average business tax preparation, form completion and submission, record keeping, and other misc admin time. Source.

***Historical first-party data.