Travel Agency Accounting: Streamline Your Finances Today

Optimize your travel agency's finances with expert accounting insights. Discover solutions for tax, currency, and revenue challenges.

Professional Travel Agency Accounting

Whether you own a travel agency or operate as a sole travel agent, it's essential to have a firm understanding of your financial status. Minimizing your business tax liability while maintaining compliance can be challenging, especially when booking flights and managing currency fluctuations while pursuing timely payments from corporate clients. If the complexities of balancing tax and business obligations make you feel like booking a permanent vacation, you're not alone. However, you still need to take action with affordable, tax-deductible financial solutions that support your travel operations throughout the year.

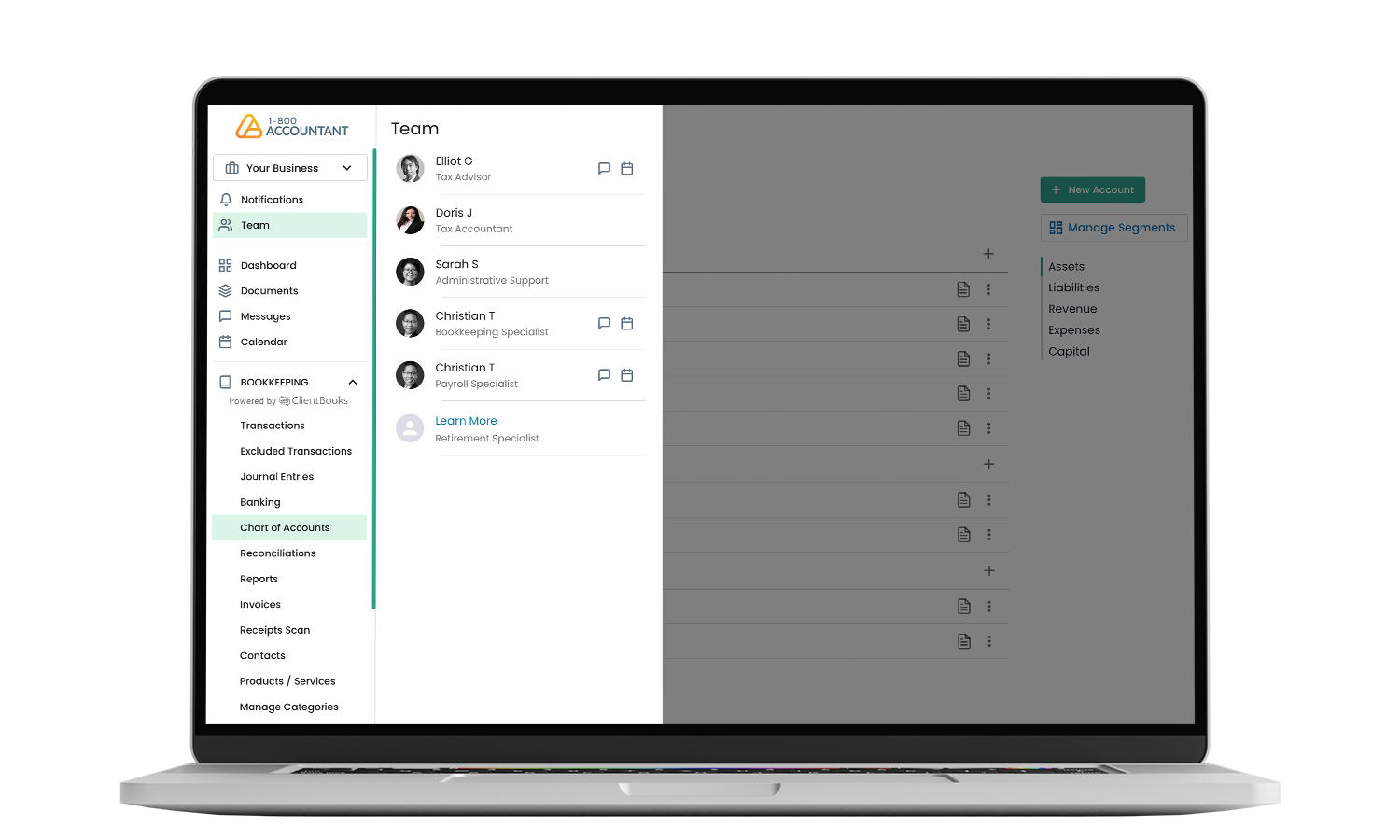

1-800Accountant, America's leading virtual accounting firm, addresses your agency's complex accounting work with a suite of financial solutions powered by real accounting professionals. Your dedicated team, experienced in addressing the distinct needs of travel agents, works closely with you to provide personalized support during both lean and active periods, while accurately and efficiently managing your finances. This provides you with the confidence and insights necessary to make informed decisions about the direction of your travel operations, which ensures its long-term financial health.

Bookkeeping for Travel Agencies

We track your travel agency's revenue and operating expenses and share findings with easy-to-understand reporting.

Talk to Your Accountant

Schedule a call or send a quick message whenever you have a question about your agency's financial health or if you need advice.

All Travel Agents Welcome

We offer tax-deductible accounting solutions to travel agencies in all 50 states.

Getting started is easy and free.

Connecting with 1-800Accountant, the travel agency accounting experts, is easy and free. Here's what to do:

- Select a convenient date and time that suits your schedule to speak with one of our professionals.

- During this 30-minute call, a $199 value, tell us about your travel agency goals and business needs.

- Once fully onboarded, we’ll create and implement a year-round income tax strategy that empowers you to reach your agency accounting goals. Your tax advisor will guide you through each step, ready to offer solutions to even the most complex business travel agency tax challenges throughout the year.

Travel Agency Accounting Services

- Tax Advisory

- Tax Preparation and Filing

- Sales Tax Compliance

- Quarterly Estimated Taxes

- Business Bookkeeping Services

- Entity Formation

- Payroll Services

Travel Agency Accounting FAQs

1-800Accountant offers a suite of affordable, tax-deductible solutions designed to support individual travel agents and broader agencies, including entity formation, EIN filing, business tax preparation, tax advisory services, audit defense, quarterly estimated tax preparation, bookkeeping, and payroll services. These professional services ensure your business has a minimal tax liability while maintaining compliance. Review our packages and pricing page for more information.

1-800Accountant's proprietary bookkeeping platform, ClientBooks, is compatible with leading accounting software, including QuickBooks Online (QBO), FreshBooks, and Wave. Our bookkeepers are fluent in these platforms, ensuring seamless integration and financial data management. ClientBooks features automation tools, including smart categorization that saves time by quickly categorizing your business expenses when you select sync. We also integrate with leading Global Distribution System providers, including Travelport and Amadeus.

1-800Accountant's professional accounting services are a good fit for both independent travel advisors and larger agencies. Your services and team scale with your operations as they expand, ensuring consistent support and expertise throughout your career in the travel industry. Our flat rate pricing, billed annually, provides maximum transparency.

Travel agencies operating across multiple jurisdictions must adhere to a variety of laws, regulations, and reporting requirements to remain compliant and operational in these territories. Managing VAT and sales tax variations, determining each taxable jurisdiction, while balancing cross-border withholding considerations, are just some of the challenges multijurisdictional travel agencies face. If your agency is grappling with these issues or is considering territorial expansion, 1-800Accountant can support your ambitions.

International payments from a variety of clients, combined with fluctuating exchange rates, present challenges to travel agencies, particularly those that handle their own record-keeping tasks. While using cloud-based accounting software that supports multiple currencies and automated exchange rate updates in real-time will help your agency manage these complexities, full-service bookkeeping solutions powered by real bookkeepers are optimal to address ongoing business accounting issues.

Outsourced accounting is a smart strategy for travel agencies facing unpredictable cash flow challenges, thanks to the affordability of services and specialized cash flow management solutions. If your agency faces this challenge, 1-800Accountant supports your business throughout the year with cash flow forecasting, budgeting, and monitoring, helping to stabilize your operations during difficult lean periods.

1-800Accountant can help reduce late payments from corporate clients by improving efficiency and streamlining your agency's financial processes. By focusing on upgrading invoicing processes and follow-ups, enhancing credit and cash flow management, generating financial statements, and providing accounts receivable and collection support, we help ensure more timely payments from corporate clients while preserving valuable business relationships.

Tax deductions reduce your agency's taxable income. When you trust 1-800Accountant with your travel agency's complex financial work, your dedicated team will evaluate your unique tax situation and select every eligible tax deduction on your behalf. Your team will also evaluate other aspects of your agency, including an entity structure analysis, to ensure a minimal tax liability throughout the year.

Outsourced accounting solutions and in-house accounting teams can produce great results for your travel agency. While 1-800Accountant's services are transparent, affordable, and tax-deductible, which is a significant advantage over in-house employees, your designated accounting team won't be in your office, which can be a disadvantage to agency leads who prefer the unfettered access of an in-house team. In-house teams, however, cost significantly more than outsourced accounting services, which is viewed as a disadvantage that has aided the popularity of virtual accounting solutions.

Revenue impact analysis, profit margin evaluation, cash flow analysis, and financial reporting are some of the actions your designated 1-800Accountant team will conduct to assess the financial impact of fluctuating exchange rates on your travel agency's profitability. Once completed, your team provides results with easy-to-understand reporting and analysis, ensuring smooth implementation.

Our team of accounting professionals stays up-to-date with financial regulations that impact travel agencies. This is achieved by proactively leveraging industry-specific resources, engaging with professional travel agent networks, and monitoring local and global tax developments, among other tactics, to ensure our accounting professionals stay current with the complex and ever-changing regulatory landscape impacting your operations.

Speak to our experts about affordable, tax-deductible travel agency accounting solutions today!

*Based on a $12.2k average 2022 tax refund per client, which is 4x the cost of a full-service package. Source: first-party data.

**Includes average business tax preparation, form completion and submission, record keeping, and other misc admin time. Source.

***Historical first-party data.