Uber Rideshare Driver Accounting & Tax Services

Uber drivers can maximize their earnings and stay tax compliant with expert accounting, tax prep, and deductions from 1-800Accountant.

Uber Rideshare Tax Preparation and Accounting

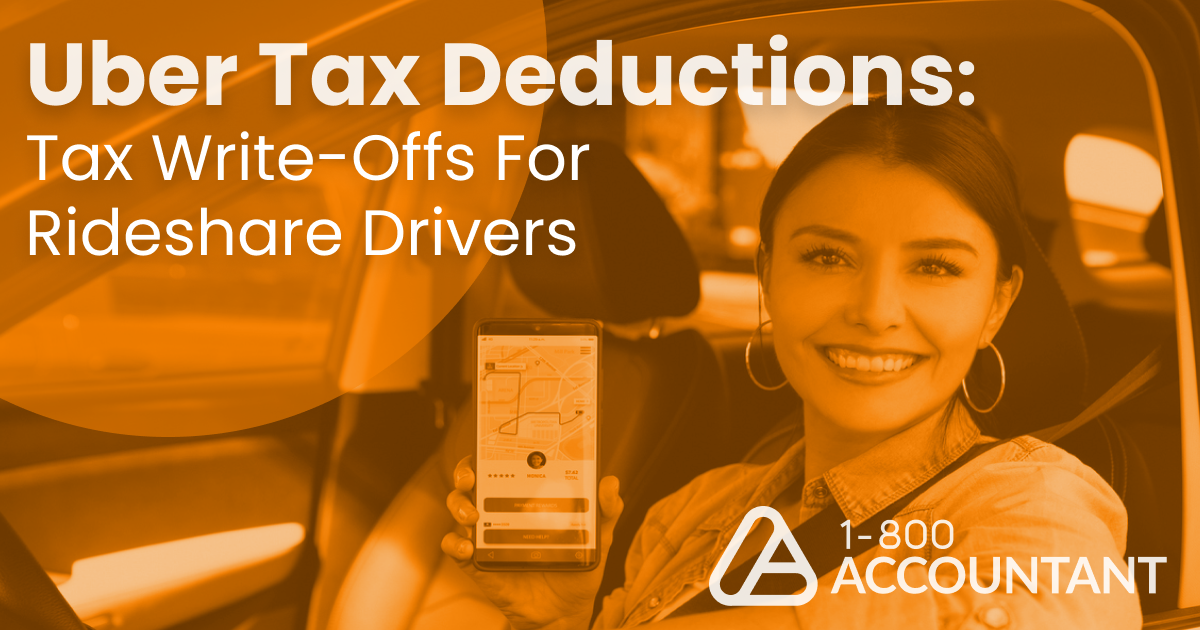

For many, Uber rideshare drivers are a common, essential part of our daily lives. It's difficult to envision a time when transportation services were so easy and cost-effective. Because of this popularity, Uber and other rideshare drivers now have a consistent, dependable income source and complex tax obligations that they never had to attend to when they were traditional W-2 employees. If you're struggling to balance taxes and compliance with your rideshare work, full-service, tax-deductible financial solutions will help you keep your eyes on the road.

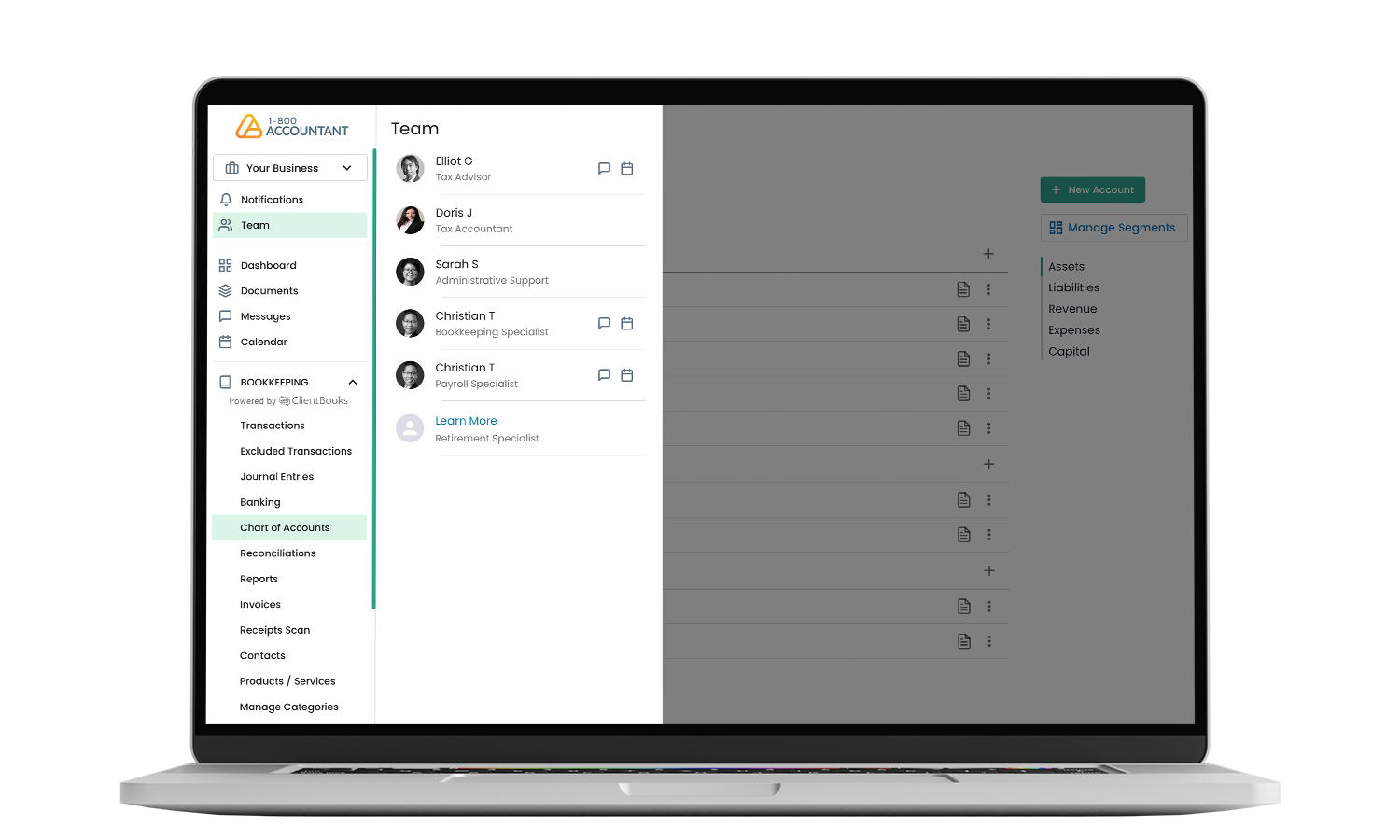

1-800Accountant, America's leading virtual accounting firm, addresses your rideshare accounting work with a suite of financial solutions powered by real accounting professionals. Your dedicated accountant will work closely with you, providing personalized support while accurately and efficiently managing your independent contractor finances. This gives you the confidence and insights to make informed decisions about where and how you'll drive your business into the future.

Rideshare Bookkeeping

We track your rideshare business's revenue and operating expenses and share findings with easy-to-understand reporting.

Talk to Your Accountant

You can schedule a call whenever you have a question or need advice about your rideshare business's financial health, or you can send a message.

All Rideshare Drivers Welcome

Getting started is easy and free.

Connecting with 1-800Accountant, the rideshare business accounting experts, is easy and free. Here's what to do:

1. Select a convenient date and time within your schedule to speak to one of our professionals.

2. Tell us about your long-term plans for your Uber rideshare business during this 30-minute call, a $199 value.

3. Once onboarded, we’ll implement a year-round income tax strategy that empowers you to reach your business goals. Your tax advisor will guide you through each step, ready to offer solutions to even the most complex rideshare tax challenges throughout the year.

Accounting and Financial Services for the Rideshare Industry

- Tax Advisory

- Tax Preparation and Filing

- Sales Tax Compliance

- Quarterly Estimated Taxes

- Business Bookkeeping Services

- Entity Formation

- Payroll Services

Speak to our experts about accounting and financial solutions for your Uber rideshare business today!

*Based on a $12.2k average 2022 tax refund per client, which is 4x the cost of a full-service package. Source: first-party data.

**Includes average business tax preparation, form completion and submission, record keeping, and other misc admin time. Source.

***Historical first-party data.

![The Uber Rideshare Driver's Guide to Filing Taxes [2025]](https://images.contentstack.io/v3/assets/blt5aaad8b5e90091d6/blt23b1a17e0ebb31f0/67a3b835c0dceb11ddd7c453/Uber3-landscape.png?w=1080)

.png?w=1080)