Accounting is a massive and diverse field. Accounting services can include everything from bookkeeping and tax preparation to auditing and business plan development. There is no single path or training required to become an accountant, either.

However, there are some grounding rules and principles that all accountants rely on in all that chaos. And there has to be! If there weren’t, accountants would be outlaws, each doing things their way. There’d be no consistency and no even playing field for businesses.

The essential standard foundations for accountants in the United States are the Generally Accepted Accounting Principles.

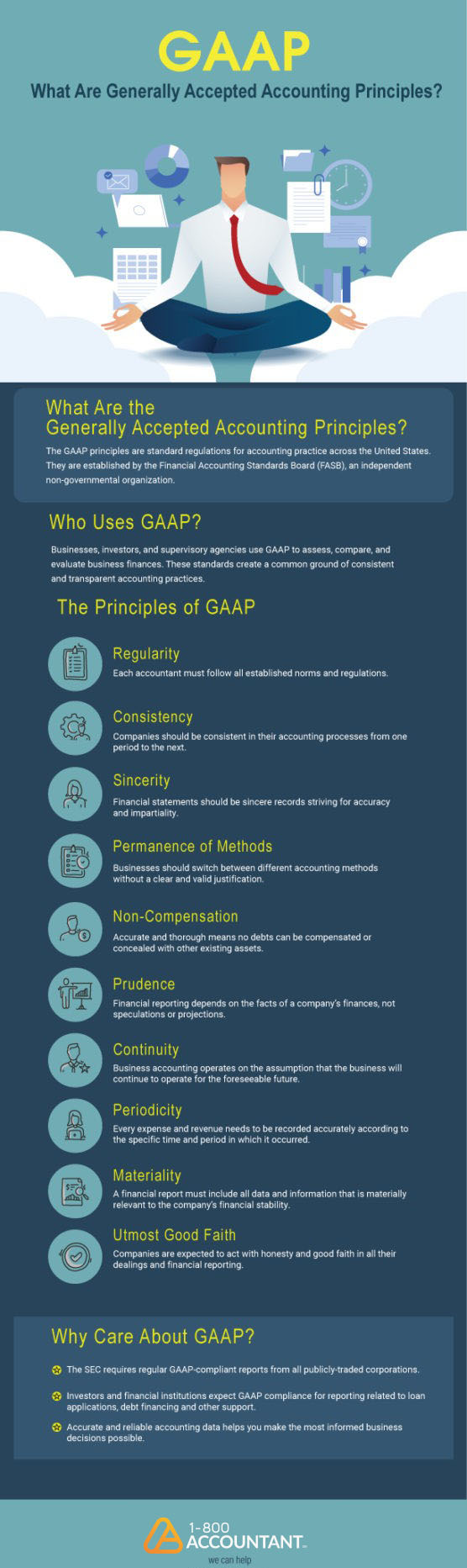

What is GAAP or Generally Accepted Accounting Principles?

Generally Accepted Accounting Principles, or GAAP, are a set of ten standards for all accounting and financial accounting reports in the United States.

These standards are described and set by the Financial Accounting Standards Board (FASB), an independent nonprofit organization. While FASB is a private organization, federal, state, and industry leaders give it the authority to shape accounting’s common language.

Corporations have to comply with all GAAP principles to be able to trade their shares publicly. Any private business will also struggle to find investors or apply for loans without full GAAP compliance.

Whatever accountant you hire, you should be able to expect them to follow these standards.

What Are GAAP Principles?

The principles of GAAP are all intended to encourage uniformity in accounting practice. An accountant should glance over two different companies’ business data and easily compare their relative financial situations. GAAP principles make that possible.

1. Principle of Regularity

The first GAAP accounting principle is the principle of regularity. This means that every accountant follows all regulations, allowing businesses to expect a similar service from every accounting professional.

2. Principle of Consistency

Next is the GAAP accounting principle of consistency, which refers to consistency in a company’s accounting over time. An accountant or business should strive to apply the consistency principle in their accounting process from period to period. This lets owners and investors compare and contrast financial periods with ease.

3. Principle of Sincerity

The accounting principle of sincerity says that financial records must be sincere reflections of the company’s finances. An accountant should strive for accuracy and impartiality in their work. It is unacceptable to manipulate data to make a business look better or worse than reality.

4. Principle of Permanence of Methods

This GAAP principle requires businesses to be consistent in the accounting methods and processes they use. The methods chosen should be chosen more or less permanently. If a company uses the accrual accounting method for part of its report, it can’t suddenly switch to the cash method when it makes its finances look better. Any variation or inconsistency within a report or across periods must be explained and justified.

5. Principle of Non-Compensation

The principle of non-compensation is another requirement that helps to enforce accurate and impartial financial statements. No entity should be compensated simply for delivering a full, accurate report. Businesses are also not allowed to embellish a company’s financial statement by compensating for debts with revenues or other accounts.

6. Principle of Prudence

According to the principle of prudence, companies should be prudent and careful in reporting their business facts. Financial reports are not a place for speculation or wild predictions but for precise and reliable data.

7. Principle of Continuity

Accounting that follows the principle of continuity operates on the assumption that the business in question will continue to operate into the future. Accountants are to assess and report data assuming business continuity.

8. Principle of Periodicity

The principle of periodicity, or time specificity, is concerned with respect for clearly delineated financial reporting periods. All credits and debits must be recorded accurately according to the time and quarter they occurred.

9. Principle of Materiality (or Good Faith)

The principle of materiality demands that accountants include in their accounting records and report all financial data that is materially relevant to the company’s overall finances. Accountants cannot conceal significant expenses. This principle is also sometimes known as the principle of good faith or full disclosure.

10. Principle of Utmost Good Faith

Also known as the principle of honesty, the principle of utmost good faith establishes that all businesses and accountants must be entirely honest and forthcoming in their financial recording and reporting. This encompasses many of the other GAAP principles concerned with preventing deceit or deception in accounting.

What Are the Principles of Accounting?

The FASB’s ten standards are the basic requirements for public and business accounting in the United States, but they’re incomplete in guiding everyday accounting work. The GAAP principles are the bare minimum rules for public-facing accounting work.

Beyond these rules, there are other norms and professional standards that should be common among all accountants. These principles are not legal requirements for businesses, except for where they overlap with GAAP, but they are essential foundations for effective and efficient accounting practice.

If your business hires an accountant to work with you, you should expect the accountant to work according to these guidelines.

1. Full Disclosure Principle

The first principle of effective accounting is the full disclosure principle. This means that accounting reporting on a company’s financial information should not only be accurate and impartial but complete. You should disclose everything relevant to a company’s finances, including all losses, pending lawsuits, potential audits, and anything else that helps provide context.

Financial statements and reports are intended to present your company’s financial information as effectively and transparently as possible. You or another owner can then use that information to guide business decisions, or an investor can use the decision to evaluate the company’s potential. Full disclosure ensures that the data is complete.

2. Economic Entity Principle

The economic entity principle suggests careful attention to the separation between the business’s economic entity and the owner's personal finances. Business finances should be recorded and reported entirely separately from any costs that aren’t business-related.

Ideally, personal and business accounts should never be intermingled, but recording them separately is essential no matter what.

3. Time Period Assumption

This assumption states that every expense, revenue, and accounting document must be dated according to its time period and a specific date. If you produce a statement recounting your accounts receivable, it needs to be clear that they are your accounts receivable as of the current date.

Periodic financial statements and reports are essential for good planning and growing your business, but dating is critical. Your business is constantly in motion, so a balance sheet printout will quickly go out of date.

4. Monetary Unit Assumption

According to the monetary unit assumption, accounting should be concerned only with things that can be expressed in monetary units. In the U.S., this means that there must be a dollar value for an object or expense to be included in the ledger.

5. Cost Principle

The cost principle reminds you that every sale or purchase needs to be recorded according to the exact cost at the time. Suppose the value of the product or service changes between the moment of purchase and recording the transaction. In that case, you need to be careful to accurately record the exact amount of money that was actually exchanged.

6. Materiality

Materiality refers to the relevance of an expense to the core of the business and the basic profit margins. Accountants using the principle of materiality can be flexible in how they report an expense according to its relevance.

7. Matching Principle

This principle is key to double-entry bookkeeping. Your accounts receivable and accounts payable should match. Revenue and expenses should both be recorded simultaneously at the time the exchange occurs.

8. Going Concern Principle

The going concern principle states the expectation that a business will continue to exist. If a business is stable and relatively healthy, it is a going concern. This means the company can take its time paying debt or holding on to inventory.

If financial warning signs suggest that a company is no longer a stable going concern, that requires immediate attention to debts and other obligations that could otherwise be deferred.

9. Revenue Recognition Principle

The revenue recognition principle requires consistency in the way that new revenue is recognized and then recorded. If a company records revenue when it is earned, as opposed to when the money itself is received, it becomes even more important that clear criteria are established.

Care and consistency in this process help to ensure that you track revenue accurately and efficiently and collect the money you’re owed.

10. Conservatism Principle

Accountants follow the conservatism principle by being cautious and conservative with their estimates and projections.

One of the problems of accounting is that there are always going to be ambiguities. If records are incomplete or lost, or if the situation's complexity leaves the accountant with multiple options, it is up to the accountant to make a judgment. The conservatism principle suggests that the safest thing is to underestimate income rather than overestimate it.

Difference Between GAAP vs IFRS

As noted above, the Generally Accepted Accounting Principles established by FASB are specific to the United States. Businesses operating internationally must comply with a separate set of regulations known as the International Financial Reporting Standards (IFRS). The IFRS is issued by the International Accounting Standards Board (IASB).

Like GAAP, the IFRS standards are meant to provide a common accounting language so that business finances can be reported, compared, and evaluated with ease. The U.S. is not the only country to have its own standards separate from the IFRS, but over 120 countries use the IFRS standards.

There are various, mostly small distinctions between these sets of standards. For example, the GAAP rules are more restrictive in defining what counts as revenue or an expense. At the same time, the IFRS standards are stricter in how they require businesses to account for the current inventory in their reporting.

However, more and more are transitioning from GAAP rules to IFRS recently. Both the IASB and FASB have been working on merging the two standards together since the early 2000s. Due to this, the SEC has removed the requirement for non-U.S. companies registered in the U.S. to be GAAP compliant if they are already IFRS compliant. Before the ruling in 2007, non-U.S. companies that traded on the U.S. exchange had to submit GAAP-compliant financial statements.

If you’re concerned about the differences in these standards or uncertain how they might apply to you, an accountant can help you figure out what you need to know.

Understanding the Hierarchy of GAAP

The GAAP principles are primarily defined by the Financial Accounting Standards Board, but they are enforced and regulated by a web of overlapping organizations and authorities. The Federal Securities and Exchange Commission (SEC) and the American Institute of Certified Public Accountants (AICPA) also play important roles.

So if you and your accountant are in an ambiguous accounting dilemma and you’re uncertain about how best to follow the GAAP guidelines, you need to know which authorities to pay attention to. This is where the hierarchy of Generally Accepted Accounting Principles comes in.

When you’re seeking clarification, you should start by looking at resources from the top of the hierarchy. If you can’t find what you’re looking for there, you can start going down the list.

- FASB statements, as well as rules interpretation publications from the SEC and AICPA board opinions or research bulletins

- FASB technical bulletins and FASB-approved accounting guides and statements from the AICPA.

- FASB-approved practice bulletins from the AICPA Accounting Standards Executive Committee and consensus opinions from the FASB’s Emerging Issues Task Force

- Informal FASB implementation guides and unapproved statements or practices from other organizations.

GAAP Requirements by State

For the most part, state and local governments using GAAP principles have no authority over whether small businesses comply with GAAP guidelines. However, many states use GAAP principles for their accounting, and many also require other governmental entities to use them.

City and county governments and even many school districts must comply with GAAP regulations if required by their state. In this case, it is not the SEC that will enforce the rules directly but the state government auditing and supervising other government entities.

Consult with your accountant and local supervisory authorities if you are unsure what accounting standards your company should be following.

Why Do Small Businesses Need to Care about GAAP?

GAAP principles established by FASB are most important for publicly traded corporations. Any business that wants to sell shares to the public must regularly submit GAAP-compliant reports approved by audit. This is supervised by the SEC at the federal level.

For most small businesses, however, there is no governmental authority that is going to punish you for failing to comply with GAAP. Instead, you will find that GAAP is more important for appealing to investors and banks.

Most businesses will find it very difficult to secure a loan or convince an investor of the health of their business if they fail to submit financial statements that follow GAAP compliance.

Complying with GAAP accounting principles in your own accounting will ensure you’re prepared when and if you need to go to a financial institution for support. Clear and reliable data will also help you stay informed and make better decisions about the future of your business.

Special GAAP Considerations

The GAAP principles are a set of aspirational standards. They establish what is and isn’t ordinary and ethical accounting practice, but that doesn’t mean they work to make all accounting honest and accurate all the time.

Many businesses regularly try to subvert these basic accounting principles and regulations by dishonestly omitting or adjusting data and then presenting it as a GAAP-compliant report. Sometimes businesses may make errors in their accounting and end up misrepresenting the facts by accident as well.

Pro Forma Statements

Even the most ethical and honest businesses may also need to deviate from GAAP at times for specific purposes. Outside of their regular GAAP-compliant financial reporting, businesses may also produce pro forma financial statements to help with planning or appeal to investors.

Pro forma financial reports are concerned with making predictions and projections about what a company’s finances will look like in the future. Because GAAP principles are concerned with reporting facts, not speculation, pro forma projections must necessarily go beyond GAAP to make predictions.

Work with an Accountant

Accounting is incredibly important for a business, and the Generally Accepted Accounting Principles are one of the things that make it more complicated. The good news is you don’t have to do it on your own. Start working with an accountant and let them take care of it for you.

Any accountant you hire should already know how to work according to these guidelines and help you understand them as well. An accountant can help small businesses succeed with effective and efficient financial planning and reporting.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. 1-800Accountant assumes no liability for actions taken in reliance upon the information contained herein.