1099 Accountant Services: Bookkeeping & Tax Help

Get expert 1099 accountant services with 1-800Accountant, including bookkeeping and tax prep for independent contractors and small businesses.

Bookkeeping and Tax Help for 1099 Professionals

Whether you represent yourself as a freelancer, independent contractor, or self-employed individual, balancing your 1099 tax and bookkeeping obligations with your non-employee work duties can sometimes feel insurmountable. You now have complex tax responsibilities that you never had when you were a traditional W-2, and they don't stop in April. Full-service, tax-deductible financial solutions for your freelance work are a game-changer, especially if you're struggling to maintain year-round tax compliance.

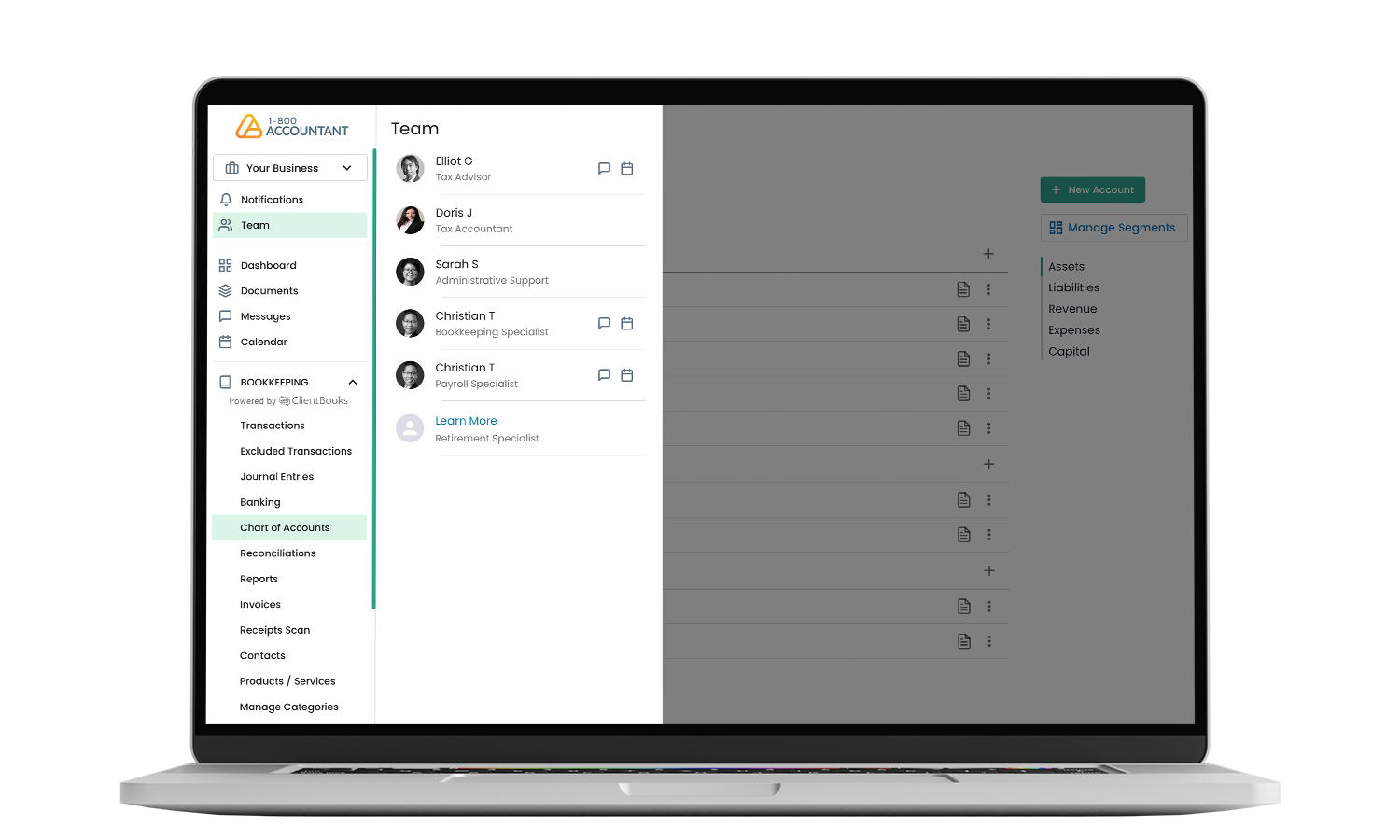

When you trust 1-800Accountant, America's leading virtual accounting firm, to address your self-employed accounting work, you benefit from a suite of financial solutions powered by real accounting professionals. Your dedicated accountant will work closely with you, providing personalized advisory support while accurately and efficiently managing your freelance finances throughout the year. This provides peace of mind and empowers you to confidently make critical business decisions based on up-to-the-minute data regarding the future of your operations.

1099 Bookkeeping

We track your independent contractor business's revenue and operating expenses and share findings with easy-to-understand reporting.

Talk to Your Accountant

You can schedule a call whenever you have a question or need advice about your business's financial health, or you can send a message.

All 1099 Professionals Welcome

We offer professional accounting solutions to independent contractors in all 50 states.

Getting started is easy and free.

Connecting with 1-800Accountant, the 1099 independent contractor experts, is easy and free. Here's what to do:

1. Select a convenient date and time within your schedule to speak to one of our professionals.

2. Tell us about your long-term plans for your business during this 30-minute call, a $199 value.

3. Once onboarded, we’ll implement a year-round income tax strategy that empowers you to reach your business goals. Your tax advisor will guide you through each step, ready to offer solutions to even the most complex 1099 independent contractor tax challenges throughout the year.

Bookkeeping & Tax Help for 1099 Independent Contractors

- Tax Advisory

- Tax Preparation and Filing

- Sales Tax Compliance

- Quarterly Estimated Taxes

- Business Bookkeeping Services

- Entity Formation

- Payroll Services

Self-Employed 1099 Accounting FAQs

Self-employed individuals, including freelancers and independent contractors, who receive 1099 income must typically pay the 15.3% self-employment tax, which funds Social Security and Medicare. Freelancers, independent contractors, and other self-employed individuals can claim 50% of their self-employment tax payment.

Deductions reduce your self-employed tax liability by lowering your total taxable income. There are numerous deductions available, some are well-known while others are a little more obscure. Deductions your business may be eligible for include advertising, tools and supplies, business travel, and other ordinary and necessary costs. If you're having trouble determining every deduction, consult a qualified tax professional.

Unlike accounting generalists who might miss important tax-saving opportunities, accountants who cater to freelance and independent contract professionals are best positioned to address your distinct accounting needs, ensuring compliance and minimal tax liability. These specialists are typically experienced in overcoming state and regional tax challenges that professionals with 1099 income may encounter, which is another invaluable advantage over accounting generalists.

As a payee, you must include information from Form 1099-NEC, Nonemployee Compensation, on your IRS Form 1040, U.S. Individual Income Tax Return. You may receive multiple 1099s. Locate box 1 on Form 1099-NEC; this is the amount you received from the payer. Since Form 1099-NEC documents money you received as a non-employee, you could either list it in line 3 (business income) or line 8z (other income) of Form 1040, Schedule 1. Add the amount from box 1 on Form 1099-NEC to your chosen line on Form 1040, Schedule 1. You may also receive other materials, including Form 1099-MISC and Form 1099-DIV for tax filing.

When you trust 1-800Accountant with your complex accounting work, your designated 1099 accounting team ensures your self-employed business is optimally structured and classified while identifying every opportunity to reduce your taxable income via tax deductions and credits. Entity structure optimization, such as converting from a sole proprietor to an S corp, typically reduces first-year clients' tax burden by up to 50%.

The most significant difference between a 1099 and a W-2 accountant is focus. To ensure compliance and a minimal tax liability, an accountant serving a self-employed business owner will approach this financial work differently than for a traditional employee who typically has a less complex financial situation. Accountants, CPAs, and other tax professionals likely have the capacity and experience to serve 1099 freelancers and traditional W-2 employees.

When you trust 1-800Accountant with your bookkeeping work, your designated bookkeeper will create and track your invoices and customer payments, among other essential tasks. Your bookkeeper also provides easy-to-understand reporting that allows you to review up-to-the-minute customer data, aiding in business management and profit margins for your freelance work.

1099 bookkeeping services ensure that all financial data, including debits and credits, is properly recorded by creating a general ledger. Maintaining the ledger is part of the bookkeeping process. It is detail-heavy work, with its thorough information providing the best financial data interpretation, decision-making, and forecasting tools to help streamline your operations. Unlike do-it-yourself bookkeeping software that still demands your time and attention, 1-800Accountant offers freelancers and independent contractors a full-service bookkeeping solution for an affordable, tax-deductible fee.

Our affordable, full-service payroll solution, powered by experts, will run payroll for you each period and handle payroll tax submissions. Spend minutes on payroll each month instead of hours with this service, enabling your employees to be paid in just a few clicks. If you need help, get guidance on creating efficient procedures for payroll processing, tax payments, and reporting. As with all 1-800Accountant services, our payroll pricing is tax-deductible.

Deductions reduce your self-employed tax liability by lowering your total taxable income. Numerous deductions are available and typically qualify if they are ordinary and necessary costs. If you're having trouble determining every deduction to take, consult a qualified tax professional for freelancers and independent contractors.

Our full-service accounting solution ensures your taxes are prepared and filed for maximum tax savings, provides access to your accountant for personalized advisory throughout the tax year, and submits simple income reports to help you make critical business decisions about the direction of your freelance independent contractor operations. In addition to tax preparation, we support your self-employed business initiatives with a suite of financial tax services, including bookkeeping, and quarterly estimated tax prep and filing.

Speak to our experts about accounting solutions for 1099 professionals today!

*Based on a $12.2k average 2022 tax refund per client, which is 4x the cost of a full-service package. Source: first-party data.

**Includes average business tax preparation, form completion and submission, record keeping, and other misc admin time. Source.

***Historical first-party data.