Balancing financial management with your other business tax obligations can feel overwhelming, particularly when you’re self-employed. Between tracking expenses, managing invoices, and preparing for tax season, bookkeeping often lands at the bottom of the to-do list — until it's undeniable. The good news? Understanding bookkeeping basics isn’t as complex as it seems, and getting organized early can save you time, money, and stress while enhancing your ability to compete in the market.

72% of self-employed contractors manage their own bookkeeping, while nearly 70% of small businesses operate without an accountant, typically as cost-saving measures. That means many entrepreneurs are figuring it out on their own — and you can too, with the right guidance and tools outlined in this self-employed bookkeeping guide.

Key Highlights

Learn step-by-step bookkeeping for self-employed individuals and the difference between bookkeeping, accounting, and taxes — and why each matters.

Discover step-by-step how to record income and expenses correctly.

Learn which bookkeeping mistakes to avoid that cost time and money.

Explore DIY and automated tools, including ClientBooks, built by 1-800Accountant.

Know when to outsource bookkeeping for accuracy and peace of mind.

Get a simple monthly checklist to keep your books in order.

Why Bookkeeping Matters for Self-Employed Individuals

Bookkeeping is the process of recording every financial transaction in your business — from client payments to office supply purchases. It provides the foundation for accurate financial records, accounting, and tax filing. Bookkeeping is also a key indicator of your business's financial health.

Bookkeeping vs. Accounting vs. Taxes:

Bookkeeping focuses on recording business transactions.

Accounting interprets and reports financial data.

Taxes apply those results to comply with IRS requirements and optimize deductions.

Keeping accurate books helps your business:

Stay organized for tax time.

Understand cash flow — what’s coming in and going out.

Detect errors or fraudulent activity early.

Claim every deduction you’re entitled to.

Poor bookkeeping habits can lead to missed write-offs, surprise tax bills, or even IRS audits. Bookkeeping for freelancers and gig workers — a large percentage of whom handle initial accounting duties — involves the anxiety of not knowing where their money went, and that anxiety peaks right around April 15. Getting ahead now helps ensure peace of mind throughout the fiscal year.

Basics of Bookkeeping for the Self-Employed

Review these self-employed bookkeeping basics that will help you set up your DIY bookkeeping software system.

Setting Up Your Bookkeeping System

Follow these four critical steps to set up your small business bookkeeping system the right way.

1. Choose an accounting method.

Most self-employed individuals start with the cash method for simplicity.

Cash method: Record income when received and expenses when paid.

Accrual method: Record income when earned and expenses when incurred.

2. Create a chart of accounts.

Your chart of accounts organizes transactions into categories such as:

Income (sales, consulting fees)

Expenses (rent, supplies, software)

Assets (equipment, vehicles)

Liabilities (loans, credit cards)

Owner’s equity (your capital contributions)

3. Separate business and personal finances.

Open a dedicated business bank account separate from your personal account to prevent confusion and simplify financial reports.

4. Choose your tools.

You can manage books manually in spreadsheets or use accounting software like QuickBooks, Wave, or ClientBooks, which integrates automation and offers expert support from 1-800Accountant's professional bookkeepers.

Recording Transactions Step-by-Step

Follow these steps to learn how to properly record your business's transactions.

Record income: Track payments from clients, deposits, and invoices. Always note the payment method and date.

Record expenses: Save and log receipts, vendor bills, and recurring expenses. Categorize each one correctly.

Reconcile bank statements: Match your records with your bank’s monthly statement to ensure accuracy. A dedicated business bank account streamlines this step.

Track owner’s draws and contributions: Keep separate entries for money you withdraw or invest.

Adjust entries as needed: If using accrual accounting, record unpaid invoices and expenses.

Best Practices to Avoid Bookkeeping Mistakes

It's essential to minimize errors and avoid bookkeeping mistakes. Review and implement these best practices into your bookkeeping system.

Automate bookkeeping transactions that recur when possible.

Keep digital copies of receipts using tools like Google Drive or built-in features in ClientBooks with document storage guarded by industry-standard bank-level security.

Review and reconcile monthly — don’t wait until year-end.

Avoid mixing personal and business expenses.

Schedule regular clean-up sessions to stay current.

Tools & Software Options (DIY vs. Semi-Automated)

There are three main options for tools and software you can use for your business bookkeeping. Review the pros and cons of each:

Approach | Pros | Cons |

Manual (spreadsheets) | Free, customizable | Time-consuming, prone to errors |

DIY Software (QuickBooks, Xero, Wave) | Automation, reporting tools | Requires setup and a learning curve |

Hybrid Tools (like ClientBooks) | Automation + the option of expert oversight | Subscription cost |

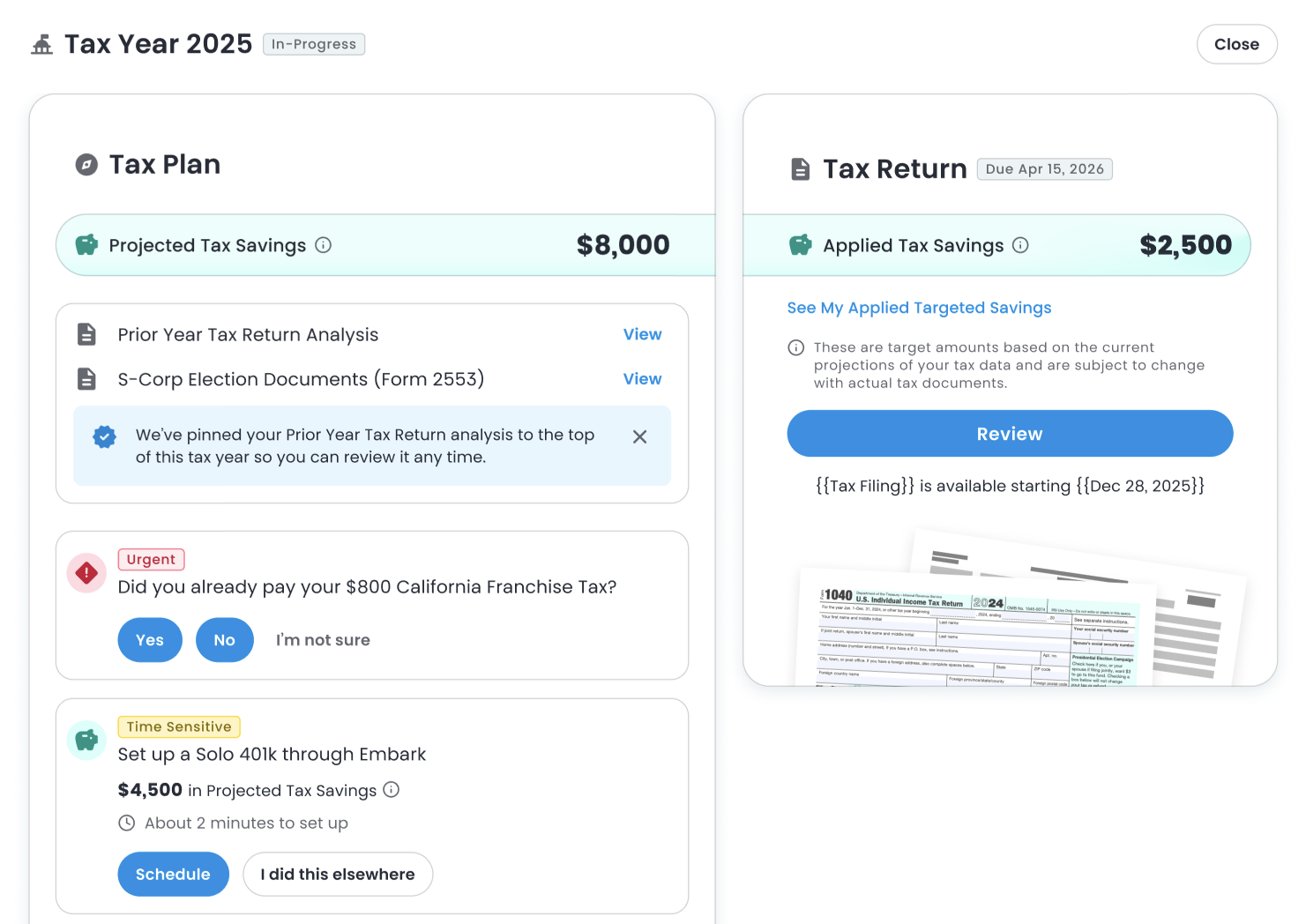

Why consider ClientBooks: ClientBooks' integrations & automation make bookkeeping simpler and easier for self-employed entrepreneurs. It syncs with QuickBooks, FreshBooks, and Wave, automatically categorizes transactions, and allows you to generate invoices. You can use ClientBooks yourself or opt for real 1-800Accountant professional support — so you get software convenience with expert accuracy.

When and Why to Outsource Bookkeeping

While handling bookkeeping tasks yourself early on is common, there may come a time when it starts eating into your productive hours. That, or you’re making recurring errors and other mistakes, indicating that it's time to outsource.

Common signs it’s time:

You’re behind on reconciling accounts.

You dread bookkeeping more than client work.

You’ve missed deductions or filed taxes late.

Bookkeeping is a tedious and time-consuming task. Hiring an in-house bookkeeper can cost around $22.81 per hour (according to QuickBooks), while outsourcing through a service like 1-800Accountant’s tax-deductible, full-service bookkeeping solution offers flexible, affordable support. Beyond cost savings, outsourcing means:

Peace of mind knowing your books are accurate and up to date.

More time to focus on running your business.

Ongoing compliance with tax regulations.

1-800Accountant’s bookkeeping service integrates directly with ClientBooks, offering real human support plus automated tools. Many clients say it’s like having the benefits of a whole accounting department at their disposal without the costly overhead.

Monthly Bookkeeping Workflow Checklist

When it comes to your bookkeeping, you should adopt an efficient monthly routine. Review this sample routine to help keep your business finances on track:

Import or download your bank and credit card statements.

Record income and categorize expenses.

Reconcile your accounts.

Review your profit & loss statement (see our free template).

Tag any unclear transactions for follow-up.

Save and back up receipts.

Review cash flow projections.

Tip: Block out one hour each week to review your books. Regular habits prevent year-end chaos.

Useful Tips, Tricks & Advanced Ideas

Once you've got your bookkeeping basics down, review and implement these tips, tricks, and other advanced ideas to enhance your output.

Set up automation rules for recurring vendors and income streams.

Integrate payment platforms like PayPal or Stripe for seamless tracking.

Use dashboards to visualize revenue trends and expenses.

Forecast cash flow and create a simple budget.

Schedule quarterly reviews to catch up and correct errors early.

When your business grows, consider hiring a professional to handle depreciation or accrual adjustments.

Common Bookkeeping Questions & FAQs

Can I switch from manual to software later?

Yes, you can switch from a manual approach to software later on. Most accounting tools let you import past data or spreadsheets with relative ease.

What if I miss months or fall behind?

Falling behind on your books is common. Prioritize catching up month by month. Bookkeeping services for sole proprietors and other business owners, like 1-800Accountant’s catch-up bookkeeping, can help you get back on track and stay ahead.

What records should I keep (and how long)?

Keep records, including receipts, invoices, bank statements, and tax filings for at least three years, and seven for major asset purchases. Maintaining accurate financial records is essential for small business owners.

How to handle refunds, returns, or refunds to clients.

Handle refunds, returns, or refunds to clients by recording a refund receipt and crediting the appropriate account, typically cash or accounts receivable.

What happens at tax time?

What happens at tax time depends on your practices throughout the fiscal year. Accurate books make filing easier and faster and ensure you don’t overpay or miss deductions.

Security & backups: How do I protect my data?

Use secure cloud software with encryption and regular backups — another benefit of platforms like ClientBooks.

Getting Started with ClientBooks + 1-800Accountant Bookkeeping

Getting started with 1-800Accountant, America's leading virtual accounting firm, and ClientBooks, our proprietary bookkeeping platform, is simple. Here's a glimpse of the step-by-step onboarding process:

Schedule your free 30-minute consultation with 1-800Accountant.

Set up your ClientBooks account and connect your bank feeds.

Connect with your dedicated bookkeeper. Bookkeeping and tax teams are fully integrated for maximum efficiency.

Review reports and dashboards regularly with your accountant for the best results.

Whether you prefer to stay hands-on or hand off the details, Bookkeeping with 1-800Accountant offers the flexibility to fit your business style.

Schedule a free 30-minute consultation with a small business expert to get started.

Summary & key takeaways

Whether you handle it yourself or outsource, bookkeeping is a critical task that your business cannot afford to ignore. This guide outlined the foundational steps you should take to establish your own bookkeeping system while disclosing the signs when it's time to outsource.

Whichever route you choose, remember that consistency matters. Don’t let messy books bog you down — the right tools or partner will help you focus on what you do best: running your business.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. 1-800Accountant assumes no liability for actions taken in reliance upon the information contained herein.