How to Fill Out Form 2553: A Step-by-Step Guide for Small Business Owners

Filing IRS Form 2553, Election by a Small Business Corporation, is one of the most important steps a small business can take to reduce its tax burden and create a more efficient structure for growth. This form enables eligible businesses to elect S corporation (S corp) tax status, which can provide significant savings and lay the foundation for improved payroll, compliance, and cash flow management. But mistakes, missed deadlines, or incomplete filings can cause the IRS to reject your election—costing you an entire year of potential tax savings.

This guide walks you through everything you need to know about completing and filing Form 2553, from eligibility requirements to step-by-step instructions. Along the way, we’ll highlight common mistakes to avoid, what to do if you miss the filing deadline, and how expert support can give you peace of mind while ensuring error-free results.

Key Highlights

-

Form 2553 is required to elect S corporation tax status with the IRS.

-

Eligible businesses must meet strict requirements, including shareholder limits and stock rules.

-

The filing deadline is March 15 for calendar-year businesses (or within 2 months and 15 days of starting your tax year).

-

Missing the deadline usually delays S corp status until the following year, but relief is available under Revenue Procedure 2013-30.

-

A step-by-step approach ensures accuracy, from filling in your business info to coordinating shareholder signatures.

-

Common mistakes include missing signatures, incorrect employer identification number (EIN), and filing late without a relief statement.

-

Working with a professional accountant reduces risk, saves time, and ensures your election is accepted.

Understanding the S Corp Election: More Than Just Paperwork

When you file Form 2553, you’re not just checking a box. You’re making a strategic choice that changes how your business is taxed and how profits are distributed.

Electing S corporation status means your business will be treated as a pass-through entity for federal tax purposes, helping you avoid double taxation. Instead of paying corporate income tax or being subject to double taxation, profits and losses flow directly to shareholders (owners), who report them on their personal income tax returns.

One of the primary advantages of this status is the potential to reduce the 15.3% self-employment tax by paying yourself a reasonable salary and designating the remainder of your income as shareholder distributions. However, beyond tax savings, the S corp election establishes long-term financial discipline, encompassing payroll, compliance, and even investor readiness.

Before You File: Confirm Your Business Is Eligible

Not every business can elect S corp status. Before filling out Form 2553, confirm your company meets these requirements:

-

Must be a domestic corporation (C corporation or LLC that has filed IRS Form 8832, Entity Classification Election to be taxed as a corporation).

-

No more than 100 shareholders.

-

Shareholders must be individuals (legal residents), certain trusts, or estates. Partnerships, corporations, and non-resident aliens are not allowed.

-

Only one class of stock is permitted, meaning all shares must have identical rights to distributions and liquidation.

If your business does not meet these rules, the IRS will reject your election.

Special cases to note:

-

LLCs must first file Form 8832 before filing Form 2553.

-

Trusts holding shares may need to complete Part III of the form.

Critical Filing Deadlines You Cannot Afford to Miss

Timing is everything with Form 2553.

-

March 15: Deadline for calendar-year businesses.

-

2 months and 15 days after the start of the tax year: Deadline for non-calendar-year filers.

Example: If your business operates on a standard calendar year, you must file by March 15, 2025, for your S corp status to apply to the 2025 tax year.

What happens if you miss the deadline?

If you file late, your S corp election won’t take effect until the following tax year. That means you’ll miss out on tax savings for the current year. However, there are a few rare scenarios where relief is possible.

How to get relief for a late election

The IRS offers relief under Revenue Procedure 2013-30 if you:

-

File within 3 years and 75 days of the intended effective date.

-

Provide a statement explaining your “reasonable cause” for late filing.

-

Write “FILED PURSUANT TO REV. PROC. 2013-30” at the top of the form.

This process can be tricky, and many businesses choose to work with a CPA or qualified tax professional to ensure compliance.

How long does IRS approval take?

S corp approval usually takes 45–90 days, assuming your materials are correct and complete. Incomplete forms or missing shareholder consent are common and can result in long delays or even outright rejection of your election.

Who Shouldn’t File Form 2553 (and Why)

While S corp status offers advantages, it’s not right for every business. You may want to avoid filing if:

-

Your business doesn’t meet IRS eligibility rules.

-

Profits are low or inconsistent, making S corp costs outweigh potential tax benefits.

-

You operate in states with high S corp fees or taxes (e.g., California or New York).

A Step-by-Step Guide to Filling Out Form 2553

Form 2553 may seem straightforward, but accuracy is crucial. Use these 2553 form instructions to learn how to complete each section:

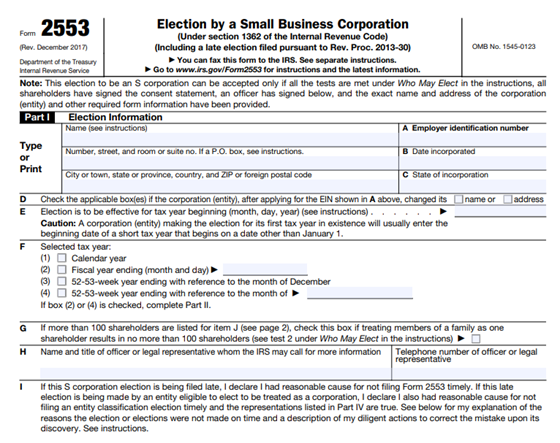

Part I: Election Information

The key information you’ll need for Part I includes:

-

Business legal name, address, and EIN.

-

Date and state of incorporation.

-

Shareholder details and signed consents.

| ⚠️ Note: The IRS requires wet signatures from all shareholders, as no electronic signatures are accepted. |

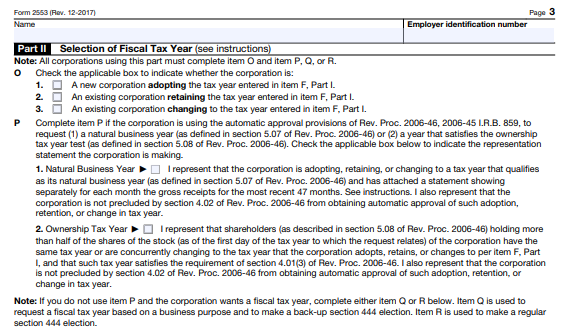

Part II: Selection of Fiscal Tax Year

Part II of Form 2553 is where you'll select your upcoming S corp's tax year.

-

Most small businesses use a calendar year that ends on December 31.

-

Select a fiscal year only if you have a valid business reason.

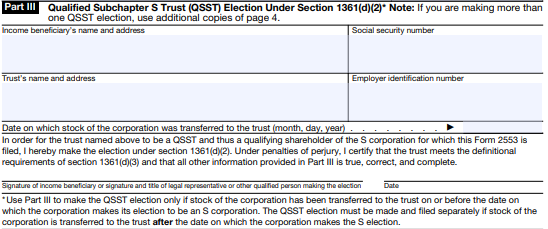

Part III: Qualified Subchapter S Trust Election

Part III only applies if a trust holds business shares. If this applies to your operation, completing this section requires specialized knowledge and meticulous attention to detail.

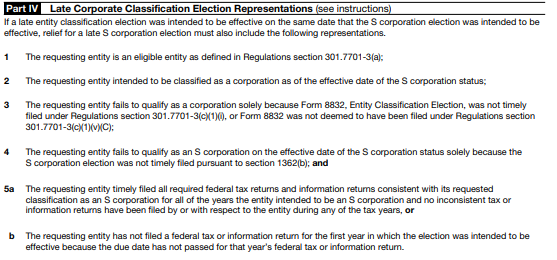

Part IV: Late Corporate Classification Election

Part IV applies to LLCs that have not yet filed Form 8832 but want to elect S corp status.

Avoiding Common and Costly Filing Mistakes

The IRS often rejects Form 2553 for simple errors. Ensure your Form 2553 is accepted on the first attempt by watching out for:

-

Missing or incomplete shareholder signatures.

-

Incorrect EIN or business name (must match IRS records exactly).

-

Filing past the deadline without a late relief statement.

-

Forgetting to mail or fax the form (it cannot be e-filed).

Form 2553 Filing Checklist

Before you submit your completed Form 2553 to the IRS, reference this checklist to ensure your information is in order.

-

EIN

-

Date and state of incorporation

-

Shareholder names and signed consents

-

Tax year selection (calendar or fiscal)

-

Mailing or fax address for IRS submission

-

Statement for late relief, if applicable

Make Your S Corp Election with Confidence

Electing S corp status can lower taxes, improve compliance, and set your business up for long-term success. But with strict deadlines and no margin for error, the process can feel overwhelming for owners who prefer to do it themselves.

At 1-800Accountant, America's leading virtual accounting firm, our team of dedicated CPAs, EAs, and tax professionals has helped numerous small business owners file Form 2553 accurately and on time. From coordinating shareholder signatures to handling late election relief, we take the stress off your shoulders, allowing you to focus on growing your new S corporation.

Ready to file Form 2553 with confidence? Schedule your free call today.

Frequently Asked Questions

Can I file Form 2553 online?

No. The IRS only accepts Form 2553 by mail or fax.

What is a “reasonable cause” for filing late?

Examples of "reasonable cause" include relying on incorrect professional advice, administrative errors, or unexpected events such as a serious illness. You must explain your situation clearly in your relief request to the IRS.

Can my LLC file Form 2553?

Yes, your LLC can file Form 2553, but you must first file Form 8832 to be taxed as a corporation before electing S corp status.

Where do I mail Form 2553?

Mailing addresses depend on your state of incorporation. Check the IRS website for the most up-to-date information.

How long does it take to get IRS approval?

Generally, it takes 45–90 days to obtain IRS approval; however, delays can occur if the documents are incomplete.

Can I expedite my Form 2553 filing?

No. There is no official expedited processing. However, submitting a complete, error-free form may speed up the process.

What happens if the IRS rejects my Form 2553?

If you're rejected, you’ll continue to be taxed under your prior classification (usually as a C corp or LLC) until you re-file correctly. Getting it right the first time is crucial, as approval times can be lengthy.