Form 941 Instructions for 2025: Step-by-Step Employer Guide

Filing IRS Form 941, Employer's Quarterly Federal Tax Return, is one of the most important responsibilities that U.S. employers must address. This form reports wages paid, federal income tax withheld, and Social Security and Medicare taxes. Filing it correctly and on time is crucial for maintaining business compliance and avoiding costly penalties.

If you’re a small business owner, the process can feel overwhelming, especially if you're inexperienced. IRS instructions are often written in complex language, and even small mistakes can result in penalties and distractions. This guide breaks down everything in plain language and walks you through the 2025 filing process step-by-step.

Key Highlights

Form 941 is required for most employers that pay wages subject to federal income tax, Social Security, and Medicare.

Due dates for 2025 are April 30, July 31, October 31, and January 31, 2026.

Employers must deposit payroll taxes on a monthly or semi-weekly basis, depending on their schedule.

Common mistakes include misreporting wages, missing deposit deadlines, and failing to reconcile with year-end W-2, Wage and Tax Statements.

Small employers may be eligible to file IRS Form 944, Employer's Annual Federal Tax Return, annually instead of Form 941 quarterly.

Partnering with a trusted accounting service can save time, reduce errors, and ensure compliance.

What is Form 941 and Who Needs to File in 2025?

Form 941 is the IRS’s quarterly return that ensures employers are accurately reporting:

Federal income taxes withheld from employee paychecks

Employer and employee portions of Social Security and Medicare taxes

Nearly all employers with staff on payroll are required to file Form 941 on a quarterly basis. This includes corporations, LLCs, non-profits, and partnerships that pay employees subject to federal withholding.

Exceptions include:

Seasonal employers, who only file during active quarters

Household employers (e.g., domestic help/household employees in a private home)

Certain agricultural employers, who may file IRS Form 943, Employer's Annual Federal Tax Return for Agricultural Employees, instead

For everyone else, filing Form 941 is a non-negotiable requirement. Failing to file can trigger immediate penalties.

2025 Form 941 Due Dates and Deadlines

IRS Form 941 must be filed four times for the 2025 tax year by the following deadlines:

Q1: April 30, 2025

Q2: July 31, 2025

Q3: October 31, 2025

Q4: January 31, 2026

Employers are also required to make payroll tax deposits throughout the year. The IRS follows two main schedules:

Monthly depositors: must deposit taxes by the 15th of the following month

Semi-weekly depositors: must deposit within three business days of payroll

Missing these deadlines is costly and can distract from your operations. Late deposits can result in penalties ranging from 2% to 15% of the unpaid taxes. Additionally, businesses that miss filing deadlines face a 5% failure-to-file penalty per month, up to a maximum of 25%.

Step-by-Step Instructions to Fill Out Form 941 (2025)

Review the following steps to learn how to fill out Form 941, the employer quarterly federal tax return.

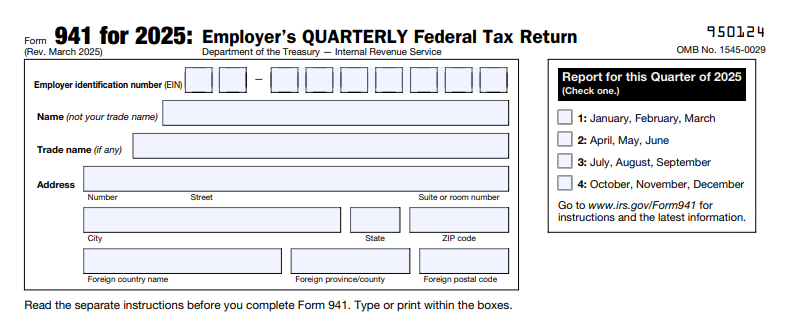

Step 1: Employer Information

For the employer information section, start with basic details:

Legal business name and trade name (if applicable)

Employer Identification Number (EIN)

Business address

Quarter you’re reporting (check the box for Q1, Q2, Q3, or Q4)

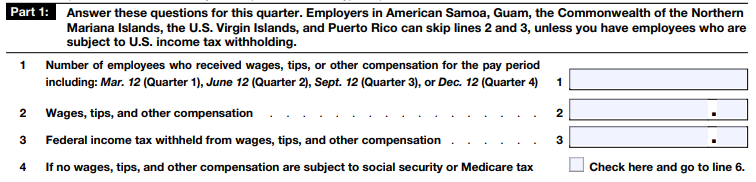

Step 2: Wages, Tips, and Compensation

This section covers all taxable wages, including salaries, bonuses, and tips paid to employees. You’ll report:

Total wages paid

Federal income tax withheld

Reportable tips, if applicable

Be precise — errors in this section have been known to trigger IRS notices.

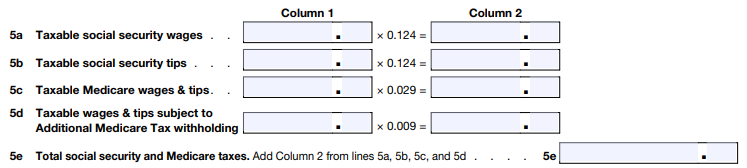

Step 3: Social Security & Medicare Taxes

For the Social Security and Medicare section, you’ll calculate both employer and employee contributions to FICA:

Taxable Social Security wages: 6.2% for employers and 6.2% for employees (on wages up to the annual wage base)

Taxable Medicare wages: 1.45% for both employer and employee

Additional Medicare tax withholding: 0.9% on wages over $200,000 for employees (not matched by employer)

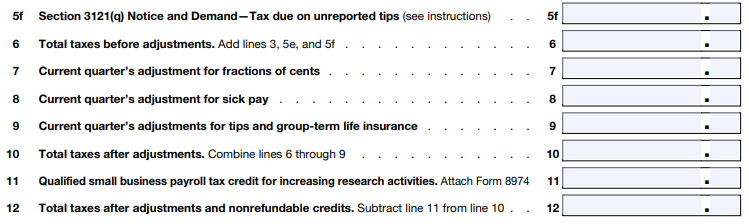

Step 4: Adjustments and Credits

As you fill out this tax form, keep in mind that adjustments may apply for:

Fractions of cents due to rounding

Group-term life insurance

Sick pay

COBRA premium assistance credits (if relevant)

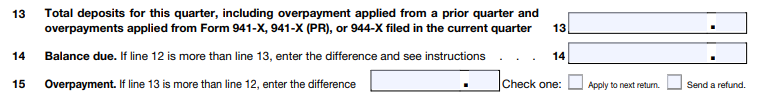

Step 5: Deposits and Balance Due

This section is where you reconcile deposits already made with the total taxes owed.

If deposits exceed the tax due, you can request a refund or apply the overpayment to the next quarter.

If you owe more than what you deposited, you must pay the balance to remain compliant.

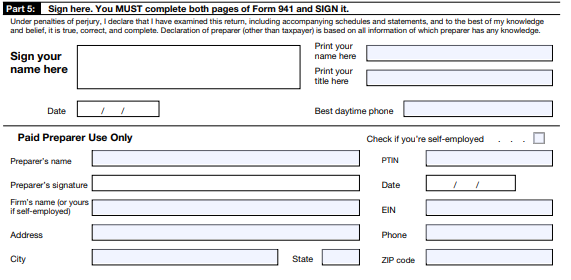

Step 6: Signing and Filing the Form

To complete this form, it must be signed by an authorized individual, such as a:

Business owner

Corporate officer

Authorized paid preparer

Employers may e-file through IRS-approved providers or mail a paper form. E-filing is strongly recommended for faster processing.

Common Mistakes to Avoid on Form 941

Even the most experienced small business owners occasionally make mistakes when preparing Form 941. Ensure you avoid these common mistakes as you prepare yours.

Misreporting Social Security/Medicare wages: Always double-check calculations.

Late payroll deposits: Missing even one deposit can lead to penalties.

Failing to reconcile with W-2s: Your Form 941 data must align with W-2 filings at year-end.

Alternatives and Special Cases

While most small businesses will regularly file Form 941, some employers may not need to file every quarter.

Form 944: Eligible for very small employers who owe less than $1,000 annually in small business payroll taxes.

Seasonal employers: Only file for quarters when wages are paid, but must notify the IRS of seasonal status.

How 1-800Accountant Helps with Payroll & Form 941 Compliance

Keeping up with payroll tax responsibilities while fulfilling other obligations can take time away from building your business. If payroll, taxes, and other financial tasks are distracting you from your operations, it's time to talk to 1-800Accountant, America's leading virtual accounting firm. When you trust us with this essential function, our payroll experts handle every aspect of your payroll tax compliance — from filing Form 941 to making deposits on time and issuing year-end forms.

With our payroll tax compliance services, you can:

Avoid costly IRS penalties

Ensure accurate and timely filing

Get payroll advice when you need it

Gain peace of mind knowing experts are managing your payroll

We also offer year-round business tax advisory services and ongoing small business tax support that ensures your finances are optimized.

FAQs about Form 941

Can I file Form 941 online?

Yes, you may e-file IRS Form 941. Most employers can file electronically using IRS-approved e-file providers, which reduces errors and speeds up processing.

What happens if I miss the deadline?

Missing deadlines may open you up to penalties and increased IRS scrutiny. You could face a 5% failure-to-file penalty for each month your return is late, up to 25% of the tax due. Late deposits also carry penalties from 2% to 15%.

Do I still need to file if I had no employees this quarter?

Typically, you must still file IRS Form 941 even if you don't have employees for the quarter. Unless your business is classified as seasonal and hires employees seasonally, you must file Form 941 even if no wages were paid.

How do Form 941 and Form 944 differ?

IRS Form 941 and Form 944 may seem similar, but they are used for distinct purposes. Form 941 is filed quarterly, while Form 944 is an annual return available only to very small employers approved by the IRS.

Next Steps

Staying compliant with payroll tax reporting is non-negotiable for small business owners with employees. Filing Form 941 correctly helps you:

Avoid penalties.

Maintain accurate payroll records.

Keep your business running smoothly with a minimal tax liability.

The good news? You don’t have to manage it all on your own. With expert support from 1-800Accountant, you can ensure your Form 941 is filed right, every quarter.

Schedule a free 30-minute consultation with a small business expert today to gain peace of mind knowing your business will always be compliant.