Small business owners often juggle multiple responsibilities simultaneously. Tracking business expenses is an essential part of that workload, yet it can quickly become overwhelming without a clear system. Using a simple and reliable expense report template removes guesswork and helps you stay organized throughout the year. It supports financial clarity, tax readiness, and stronger decision-making.

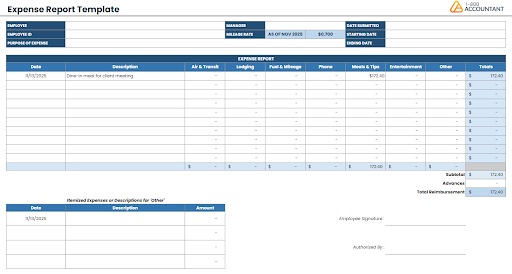

To help you stay in control, 1-800Accountant, America's leading virtual accounting firm, has created a free, downloadable expense report spreadsheet template specifically designed for small businesses, freelancers, and entrepreneurs.

Key Highlights

This free, ready-to-use template helps you track business expenses accurately and consistently.

Organized small business expense reports support budgeting, cash flow management, and tax deductions.

The template includes pre-built fields for dates, categories, payment methods, totals, and receipt references.

This article provides step-by-step instructions on how to complete the template.

Effective expense tracking enhances financial visibility and supports the IRS's expense documentation requirements.

Download the free template and use it with Excel, Google Sheets, or similar tools or software.

What Is an Expense Report?

An expense report is a document that records business-related expenditures during a specific period. It lists individual expenses along with:

The date

Category

Amount

Purpose

Supporting receipts

Small business owners, freelancers, and employees typically complete expense reports to organize their spending, track reimbursements, and support tax documentation.

Expense reports differ from financial statements, like a profit and loss report or balance sheet. Instead of summarizing overall business activity, an expense report focuses specifically on spending within a particular project, department, or time frame. This provides small business owners with a clearer understanding of where their money is going and why.

Using an expense report is an essential part of maintaining accurate books, preparing for tax season, and communicating with your accountant.

Why Small Businesses Should Use a Template Like Ours

A simple, easy-to-use template gives you structure and consistency. It eliminates the guesswork of expense tracking for small businesses, allowing you to avoid errors and stay on top of your financial responsibilities.

Improves financial visibility and budgeting

Tracking expenses helps you understand where your business spends money. When you record expenses consistently, you can compare spending patterns and adjust your budget more effectively.

Financial literacy is often a challenge for new entrepreneurs. Many business owners report feeling uncertain about financial management and cash flow, and low financial literacy costs them an average of $118,121 in lost profit. A structured expense report helps improve clarity and confidence.

Supports tax deductions and compliance

Accurate expense reports make it easier to claim deductions and comply with tax rules. If the IRS requests supporting documentation, your organized records and receipts will be ready for scrutiny.

Maintaining receipts and records is a requirement of the IRS for expense documentation. Having a clean expense report ensures you meet these standards and stay prepared for tax filings or potential audits.

Saves time and reduces errors

Manual expense tracking can lead to errors, such as duplicate entries and incorrectly categorized transactions. A template reduces manual effort and ensures consistency from one reporting period to the next. This saves time for small business owners who already juggle many daily responsibilities.

Gives your business a professional framework

A consistent reporting system enables clear communication with:

Accountants

Lenders

Team members

It also supports your relationship with your accounting provider. For example, if you use professional bookkeeping services from 1-800Accountant, your bookkeeper can quickly reference your expense reports and maintain accurate books.

Download Our Free Expense Report Template

Our free expense report template is now available and ready for use. It's compatible with Microsoft Excel and Google Sheets, and doesn't require special software or an account to experience a better expense reporting process. Simply download the file, start adding your expenses related to business spending, and keep your receipts in a dedicated location.

Free template key features:

Pre‐built categories

Date fields

Expense description

Amount

Payment method

Reimbursement status

Click here to download the template and start tracking your expenses

How to Fill Out the Expense Report Template (Step-by-Step)

The instructions below provide a clear and efficient guide through each part of the process of how to fill out an expense report, even if this is your first time using one.

Step 1: Enter basic information

Start by completing the top section of the template. Include:

Business name

Employee or preparer name

Date range for the expenses

Report number or identifier

Project or department name, if applicable

This ensures that your reports remain organized across different periods or projects.

Step 2: Record each expense line

For each recorded expense detail, include:

Date of purchase

Description of what you purchased

Expense categories, such as business trips, meals, office supplies, or subscriptions

Vendor or merchant

Payment method

Business purpose

Including the business purpose is vital for tax compliance and reimbursement approvals.

Step 3: Input amounts and currency

Add the amount for each expense. If an employee paid for the expense personally, note that amount as reimbursable, not an employee expense. If the business paid directly, list it as a company expense.

This step improves clarity when reviewing totals or preparing reimbursement payments.

Step 4: Attach or reference receipts

Attach digital copies of receipts or reference where they are stored. You may keep receipts in:

A shared drive

Email folder

Accounting software

Receipts verify the expense and support your ability to claim tax deductions. Good documentation is part of maintaining audit readiness and tax compliance.

Step 5: Review and total up the report

Look over the report to ensure each entry is accurate. Verify that the categories are accurate and that no duplicate expenses have been entered. The template will automatically total the expenses.

Step 6: Submit or file the report

If an employee prepares the report, they should submit it to the appropriate manager or accountant. Business owners should save the completed report and all attached receipts.

Store your files in a secure digital system that is easy to reference during tax season or financial reviews.

Tips for Best Practice When Using the Template

To get the most value from your expense report template:

Enter expenses promptly to avoid backlogs.

Use the same expense categories each period for consistency.

Reconcile expenses with bank statements.

Review your spending on a monthly or quarterly basis to identify trends.

Consider using software tools when your transaction volume increases.

Keep digital backups of expense reports and receipts.

Managing expenses well supports long-term cash flow health.

How This Template Fits Into Your Larger Financial Workflow

Your expense report feeds into:

Budgeting

Cash flow analysis

Tax preparation

Long-term planning

It gives your bookkeeping team the clarity needed to maintain accurate records.

Accurate expense data is also a crucial component of robust accounting systems. The benefits of expense tracking include improved financial accuracy and greater profitability.

Your expense report template (typically used as a weekly expense report template or a monthly expense report template) provides financial clarity, helps your accountant categorize transactions effectively, and contributes to more accurate and reliable financial records.

For growing businesses, this report becomes a foundational part of your financial workflow.

Download Our Free Expense Report Template

Our free expense report template is ready to use today, and no special software or account is required.

Click here to download the template and start tracking your expenses

Next steps after your business expense report template free download:

Fill in for the current period.

Keep receipts organized.

Consider affordable, tax-deductible full-service bookkeeping from 1-800Accountant.

Frequently Asked Questions (FAQ)

What if I already use accounting software?

The template can complement your existing system. It is invaluable for employee reimbursements and period-based reporting.

How often should I fill it out?

Record business-related expenses as they occur or update the template at least once per month.

Which expense categories should I include?

Common categories you should consider to help you manage expense reporting include business travel/travel expenses, meals, office supplies, subscriptions, equipment, and advertising.

What do I do with receipts?

Attach digital copies to your report or store them in labeled folders. Keep receipts for at least three years to comply with IRS requirements.

Can this template be used by freelancers?

Yes, freelancers and independent contractors can use this free template. Freelancers can add project codes, billable vs non-billable expenses, and client references to customize the report. Expense reporting for freelancers is a crucial aspect of compliance.

Next Steps

Using a structured expense report template is one of the simplest ways to strengthen financial organization in your business, helping you gain clarity and insight. It prepares you for tax season, supports accurate bookkeeping, and enables you to understand your spending patterns.

Your free template is available now. If you need support beyond the template, including bookkeeping, tax preparation, or advisory services, at an affordable and tax-deductible fee, 1-800Accountant is here to help.

Download your free expense report template and begin tracking your business expenses with confidence

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. 1-800Accountant assumes no liability for actions taken in reliance upon the information contained herein.