Free Income Statement Template for Small Businesses

Understanding your business’s financial performance shouldn’t require a finance degree. Whether you’re a freelancer, startup founder, or small business owner, understanding your income and expenses is crucial for advancing your operations. An income statement, also called a profit and loss (P&L) statement, summarizes that story.

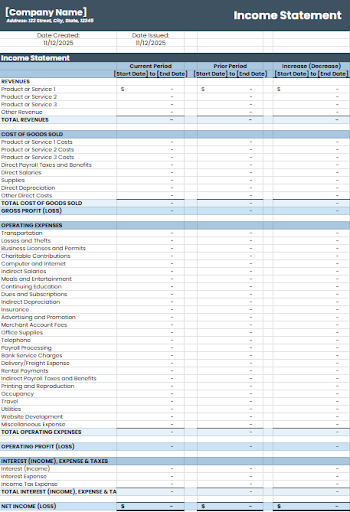

At 1-800Accountant, America's leading virtual accounting firm, we’ve created this free income statement template explicitly designed for small businesses and self-employed individuals. It helps you organize your revenue, expenses, and net profit clearly and accurately, allowing you to make informed decisions about the direction of your business.

Key Highlights

Download our free, editable income statement template built for small business owners and entrepreneurs.

Learn step-by-step how to fill out an income statement, from revenue to net income.

Understand what your income statement reveals about profitability and performance.

Avoid common mistakes that can distort your financial picture.

Use the statement to make strategic business decisions or prepare for tax season.

👉 Download the free income statement template 👈

What Is an Income Statement and Why It Matters

Definition of an Income Statement

An income statement, also known as a P&L statement, summarizes your revenue, expenses, and profits over a specific period:

Monthly

Quarterly

Annually

It answers one key question: Is your business profitable?

Income statements provide “an overview of revenue, expenses, and profitability during a period.” In other words, it’s a valuable snapshot of your business’s financial health.

Why Small Business Owners Need One

For small business owners, an income statement is more than a formality; it’s a roadmap for decision-making. It helps you:

Track whether your business is profitable or losing money.

Identify which expenses consume the most resources.

Spot growth trends in revenue and plan future investments.

Maintain accurate records for tax filing and financing purposes.

To provide context, Vena Solutions reports that the average annual revenue for a small business is $1.22 million, with a typical profit margin ranging from 7% to 10%. Knowing your own margins helps you see how your business compares to these averages.

Common Formats: Single-Step vs. Multi-Step

There are two main types of income statements:

Single-Step: Calculates net income in one step by subtracting total expenses from total revenue. It’s simple and ideal for smaller operations or freelancers.

Multi-Step: Breaks down gross profit, operating income, and net income separately. It's ideal for growing businesses that require more detailed information.

If your business has multiple revenue streams or cost categories, the multi-step version offers more in-depth insights.

How to Use the Free Income Statement Template

Downloading and Preparing the Template

You can download this free income statement template from 1-800Accountant in Excel or Google Sheets formats.

Once downloaded:

Save a copy of the file for each reporting period (e.g., monthly or quarterly).

Rename it clearly. For example, “Q1 2025 Income Statement.”

Select your reporting period. Monthly reports are most effective for new businesses.

If you’re not using accounting software, this template works perfectly with manual data entry or exports from your bookkeeping system.

Overview of Template Structure

The income statement template includes:

Header: Business name and reporting period.

Revenue section: Tracks income from sales or services.

Cost of goods sold (COGS): Direct costs of producing goods or delivering services.

Gross profit: Revenue minus COGS.

Operating expenses: Includes rent, salaries, marketing, utilities, and other related costs.

Non-operating items: Interest, one-time gains, or losses.

Taxes: Estimated or paid business taxes.

Net income: The “bottom line,” or your actual profit for the period.

Some templates include actual vs. budget columns to track performance variance, which can help identify over- or under-spending.

Step-by-Step Fill-Out Guide

Enter Total Revenue: Input all income earned during the reporting period.

Add COGS: If you sell products, record the cost of materials, manufacturing, or resale. Service-based businesses can note direct labor or subcontractor costs.

Calculate Gross Profit: Subtract COGS from total revenue.

List Operating Expenses: Include fixed costs (rent, payroll, insurance) and variable costs (marketing, utilities).

Enter Non-Operating Items: Record interest income, loan interest, or any one-time gains or losses.

Include Taxes: Input estimated or actual tax payments.

Review Net Income: This final figure indicates whether you generated a profit or incurred a loss during the period.

Each section automatically calculates totals and subtotals when entered correctly.

Tips for Accuracy and Best Practices

Review and implement these best practices and tips that encourage accuracy.

Keep business and personal finances separate.

Use consistent reporting periods (monthly or quarterly).

Pull figures directly from your bookkeeping software or receipts.

Reconcile bank and credit card statements before finalizing.

Remember: Profit doesn’t always equal cash flow, as cash inflows and outflows differ.

For ongoing support, consider our affordable, tax-deductible full-service small business bookkeeping solution to streamline record-keeping and ensure accuracy.

How to Interpret the Results and Take Action

Key Metrics from the Income Statement

Three key profitability metrics can reveal how your business is performing:

Gross Profit Margin: (Gross Profit ÷ Revenue) × 100Shows how efficiently you produce or deliver your offerings.

Operating Margin: (Operating Income ÷ Revenue) × 100Indicates how well you manage day-to-day expenses.

Net Profit Margin: (Net Income ÷ Revenue) × 100Reflects overall profitability after all costs and taxes.

What the Numbers Tell You

Use your results to spot patterns, such as:

Declining revenue may signal seasonality or a loss of customers.

Rising expenses can point to overspending or inefficiencies.

Comparing your profit margins to industry benchmarks (7%–10% typical) helps set realistic goals.

Next Steps for Improvement

If your margins are lower than expected, there are a couple of things you can do to help:

Review expense categories for possible cuts or renegotiations.

Revisit pricing to ensure costs are fully covered.

Allocate more funds to profitable areas, like marketing or top-selling products.

Your income statement can also prepare you for financing, investor discussions, or tax planning, as lenders and investors often request up-to-date P&L statements.

Using the Template Regularly and Staying Organized

Recommended Frequency for Updating

New businesses should update their income statement monthly, especially during the first year. Once stability is achieved, quarterly reviews may be sufficient.

Integrating with Bookkeeping Systems

If you already use accounting tools, sync your revenue and expense data to reduce manual entry. Many platforms allow easy export of line items into Excel for quick upload.

Version Control & Reporting

Maintain clear naming conventions for saved files, e.g., “2025-08 Income Statement.” Add simple charts or graphs to visualize trends when sharing reports with partners or lenders.

When to Ask for Professional Help

As your business grows, complexity increases. Multi-location operations, multiple product lines, or investors often require more detailed, multi-step statements. That’s when partnering with a CPA, EA, or tax professional from 1-800Accountant can save you time and stress.

Common Mistakes to Avoid

Incorrect revenue recognition or misclassified expenses

Recording refunds as revenue is a small business income statement example of incorrect revenue recognition that you should avoid.

Mixing personal and business expenses

While not a law, it's a best practice to separate personal and business expenses. Mixing the two complicates tax reporting and distorts your profits.

Ignoring non-cash items

Avoid ignoring non-cash items, such as depreciation or amortization, which can affect your taxable income.

Confusing profit on paper with cash available

Confusing profit on paper with cash available is another mistake to avoid. You can show profit on paper, yet face cash shortages due to unpaid invoices.

Avoiding these pitfalls helps maintain accurate financial insight and credibility with lenders or investors.

Template FAQs and Additional Resources

Can I use this for a service business with no inventory?

Yes, you can use it for that type of business. The template is suitable for both product- and service-based companies. Simply omit the COGS section if not applicable.

What period should I choose?

Monthly reports offer the most insight, although quarterly reports are suitable for stable businesses. The period you choose depends on the phase your business is in.

Should I use single-step or multi-step?

Selecting single- or multi-step depends on your operations. If your business has multiple income streams or higher expenses, choose multi-step for clarity.

How does this relate to my tax return?

Your income statement helps calculate taxable income and supports documentation for deductions and credits. This information is critical at tax time.

Additional Resources

Browse these additional resources for further insights and support.

Affordable flat-rate accounting and bookkeeping services from 1-800Accountant to support your operations year-round.

Guides from authoritative third parties, including Financial Solution Advisors, Vena Solutions, TD Bank, and KeyLin.

Subscribe to 1-800Accountant's blog and newsletter for additional updates.

Next Steps

Using this free income statement template provides a clear and reliable view of your business's financial performance. By tracking revenue, expenses, and profits, you gain the insights needed to make smarter decisions and grow sustainably into 2026.

Download the template today, complete it for your latest reporting period, and review your numbers. If you want professional support in reviewing or maintaining your books, the experts at 1-800Accountant are ready to help. Just schedule a free 30-minute consultation when you're ready.

At 1-800Accountant, we make accounting simple so you can focus on what you do best: building your business.