Running a small business often means wearing many hats, and managing expenses is one of the most important. If you use a personal or business vehicle for work, tracking mileage accurately can unlock meaningful tax deductions. The challenge is that mileage tracking needs to be consistent, detailed, and compliant with IRS rules. That is where a simple, reliable mileage log makes a difference.

This guide explains why mileage tracking matters, what the IRS expects, and how to use a free mileage log template designed for small businesses, courtesy of 1-800Accountant, America's leading virtual accounting firm. Whether you are a freelancer, rideshare driver, or growing business owner, the right system can help you stay organized and prepared for tax time while maximizing legitimate deductions.

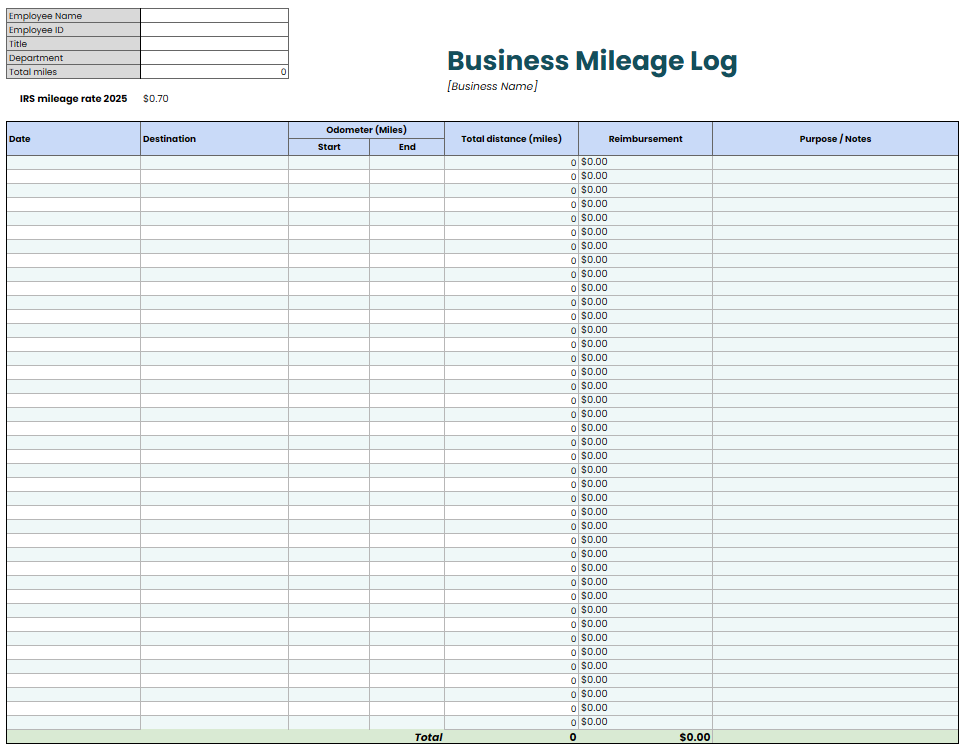

Download Our Free Mileage Log Template

Key Highlights

Business mileage can be deducted using the IRS standard mileage rate, which is 70 cents per mile for 2025.

The IRS requires clear and timely records that document when, where, and why a trip occurred.

A mileage log can be kept in a spreadsheet, on paper, or digitally, as long as the required details are included.

Using a consistent template simplifies year-end reporting and reduces audit risk.

Proper mileage tracking can significantly reduce taxable income for small business owners.

Why Mileage Tracking Matters for Small Businesses

Vehicle expenses are one of the most common deductions available to small business owners. If you drive to meet clients, visit job sites, deliver products, or run business errands, those miles may be deductible. When claimed correctly, mileage deductions directly reduce your taxable income, which can translate into substantial tax savings.

For 2025, the IRS standard mileage rate for business use is 70 cents per mile. That means 5,000 business miles could translate into a $3,500 deduction. Over the course of a year, those numbers add up quickly, especially for businesses that rely heavily on transportation. The standard mileage rate is expected to increase in 2026.

Mileage tracking is not just about savings. It is also about compliance. The IRS requires adequate records to support deductions in the event of an audit. Without a proper mileage log, deductions can be reduced or disallowed entirely. Keeping accurate records protects your business and ensures you can confidently claim what you are entitled to under the tax code.

Many small business owners work with professionals to make sure deductions are claimed correctly. Services like small business tax support from 1-800Accountant can help ensure mileage deductions are handled properly, along with other business expenses.

IRS Requirements for Mileage Logs

The IRS does not require a specific format for a mileage log, but it does have mileage tracking requirements. The goal is to clearly demonstrate that the claimed mileage was business-related and accurately recorded.

According to official IRS guidance, a mileage log should include enough detail to substantiate the deduction. This is often referred to as “adequate records” and is a key standard used in audits. You can review detailed guidance on IRS mileage log requirements.

At a minimum, the IRS expects your mileage records to show:

The date of each business trip

The destination or general location

The business purpose of the trip

The number of miles driven for business

One important concept is contemporaneous recordkeeping. This means logging mileage at or near the time the trip occurs, rather than estimating months later. Logs created long after the fact are more likely to be challenged.

The IRS accepts many formats for mileage logs. Paper notebooks, spreadsheets, PDFs, and digital apps are all acceptable as long as the required information is present and accurate. The key is consistency and completeness.

What to Track in Your Mileage Log

A well-structured mileage log makes it easy to capture the details the IRS requires. Whether you use a spreadsheet mileage log or a printable mileage log template, each entry should clearly document the trip.

Most mileage logs include the following fields:

Date of trip

Destination or starting and ending locations

Beginning odometer reading

Ending odometer reading

Total business miles driven

Notes or comments describing the business purpose

Some business owners prefer to track only total miles per trip, while others include odometer readings for added clarity. Both approaches are acceptable as long as the total business mileage is accurate and supported.

Here is an example of how mileage data is typically organized:

Date | Destination | Start Odometer | End Odometer | Business Miles | Purpose |

Jan 10 | Client office | 12,450 | 12,472 | 22 | Client meeting |

Jan 15 | Supply store | 12,472 | 12,488 | 16 | Purchase business supplies |

Using a consistent format like this throughout the year makes tax preparation faster and more accurate.

Free Mileage Log Template Download

To simplify mileage tracking, 1-800Accountant offers a free mileage log template designed specifically for small business owners. The template is provided in spreadsheet format and can be easily customized to fit your needs.

Download the Free Mileage Log Template

The mileage log template is available as an Excel file (.xlsx). If you prefer another format, it can be converted into Google Sheets or printed for manual use. The structure is simple and intuitive, making it easy to log trips consistently.

The template includes:

Clearly labeled columns for required IRS details

Automatic totals for business mileage

Space for notes to document business purpose

A clean layout that works for monthly or annual tracking

You can download and start using the template right away, making it easier to stay organized throughout the year rather than scrambling at tax time.

How to Use the Template

Using the mileage log template is straightforward, even if you are not comfortable with spreadsheets.

Start by entering each business trip as it occurs. Record the date, destination, mileage, and purpose immediately after the trip whenever possible. This habit supports contemporaneous recordkeeping and reduces errors.

At the end of each month, review your entries and confirm totals. Many business owners find it helpful to keep monthly tabs or summaries so mileage can be reviewed alongside other expenses.

At year-end, total your business mileage for tax reporting. This number is used to calculate your business mileage deduction using the standard mileage rate or actual expense method, depending on your situation. Store a copy of your completed log with your tax records, either digitally or in print.

Keeping mileage logs for taxes organized alongside receipts and financial statements can make preparation smoother and more efficient, especially when working with an accountant.

Tips for Accurate Mileage Tracking

Consistency is the most significant factor in successful mileage tracking. Small habits can make a big difference in accuracy and compliance.

Consider these best practices:

Log trips promptly rather than trying to reconstruct them later

Clearly separate business mileage from personal driving

Use descriptive notes to explain the business purpose

Review entries monthly to catch mistakes early

For businesses with frequent travel, digital mileage tracking apps can also be helpful. These tools often use GPS to record trips automatically, but it is still important to review and categorize trips correctly.

Rideshare drivers and delivery professionals often benefit from specialized support. For example, rideshare drivers, such as Uber contractors, often have unique mileage and expense considerations that require careful tracking.

Claiming Mileage on Your Taxes

Mileage deductions are typically claimed on your business tax return, depending on your business structure. Sole proprietors and single-member LLCs usually report mileage on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship), while partnerships and corporations include vehicle expenses on their respective forms.

Regardless of where the deduction is reported, the same recordkeeping rules apply. The IRS expects you to maintain supporting documentation for all deductions claimed. This includes mileage logs, receipts, and any additional records that support your return.

Mileage deductions generally reduce taxable income dollar-for-dollar, which can lower both income tax and self-employment tax in many instances.

Common Mileage Tracking Mistakes to Avoid

Even well-intentioned business owners can make mistakes that weaken their mileage deductions. Being aware of common pitfalls can help you avoid problems later.

Some of the most frequent mistakes small business owners make include:

Estimating mileage instead of keeping a precise log

Forgetting to document the business purpose of each trip

Mixing personal and business miles without a clear separation

Failing to keep records for the full tax year

Another common issue is inconsistent tracking. Logging mileage for a few months, but not the entire year, can raise red flags and undermine the credibility of your records.

How 1-800Accountant Can Help

Mileage tracking is just one piece of the broader picture for small business taxes. When handled correctly, it supports accurate filings, maximized deductions, and fewer surprises at tax time. When handled poorly, it can lead to missed savings or compliance issues that disrupt your operations.

1-800Accountant helps small business owners connect mileage tracking with ease, with affordable, professional bookkeeping and tax preparation. By pairing good records with expert guidance, business owners gain clarity and confidence in their financial picture. This proactive approach helps ensure that deductions are claimed correctly and in accordance with IRS rules.

Would expert business tax support make your 2026 easier? Schedule a free consultation to get started.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. 1-800Accountant assumes no liability for actions taken in reliance upon the information contained herein.