There are unique tax advantages and added responsibilities associated with operating your business as an S corporation. One area that often causes universal confusion among S corp owners is the balance sheet. Is it just another form among a sea of forms that the IRS requires, or is it a tool that can help you make smarter business decisions?

You should view your business's balance sheet as more than paperwork. It’s a snapshot of your company’s financial health and a guide for everything from distributions to loan applications. If you’re unsure of when it’s required or how to prepare yours, this guide breaks it down step by step.

Key Highlights

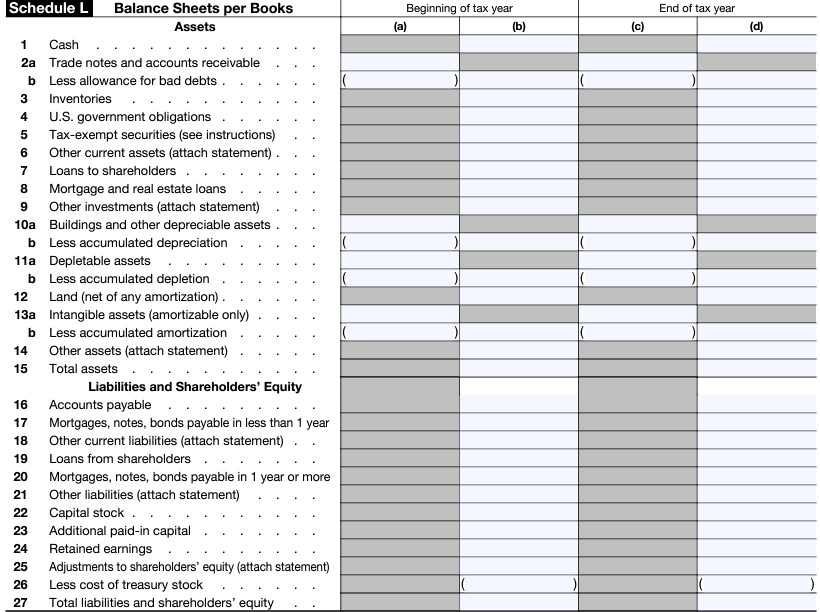

The IRS requires S corps to file a balance sheet, Schedule L (Form 990), if they meet the $250,000 receipts or assets threshold.

A balance sheet helps track assets, liabilities, and shareholder equity—essential for tax compliance and sound business strategy.

Even when not required, maintaining a balance sheet helps build lender credibility and aids in decision-making.

Balance sheets tie directly to shareholder basis calculations and IRS Form 7203, S Corporation Shareholder Stock and Debt Basis Limitations, making accuracy crucial.

Misclassifying equity, skipping reconciliations, and other mistakes can trigger audits or financing setbacks.

An accurate balance sheet isn’t just compliance—it’s a tool to secure funding and guide tax-efficient growth.

What Is an S Corp Balance Sheet (Schedule L)?

An S corp balance sheet is a financial statement that shows what your company owns (assets) and what it owes (liabilities) at a specific point in time. The difference between the two represents shareholder equity, or your ownership stake.

For tax purposes, this information is reported on Schedule L of IRS Form 1120-S, U.S. Income Tax Return for an S Corporation. The IRS uses it to verify that the income and deductions you report align with your company’s actual financial health.

The balance sheet is also tied to Schedule M-1 (reconciliation of income) and Schedule M-2 (retained earnings), making accuracy critical for avoiding discrepancies.

When Is a Balance Sheet Required by the IRS?

You must complete Schedule L if your corporation meets either of these conditions in a tax year:

Total receipts of $250,000 or more

Total assets of $250,000 or more at year-end

Maintaining a balance sheet is recommended even if you fall below these thresholds. Your detailed balance sheet is essential for tax filing, lenders often require it for loan applications, and shareholders benefit from the transparency it provides.

How to Prepare an S Corp Balance Sheet

Accurate balance sheet preparation requires the right documents and reconciliations. At a minimum, you’ll need to gather:

Bank and credit card statements

Loan agreements

Depreciation schedules, which must align with IRS Form 4562, Depreciation and Amortization (Including Information on Listed Property)

Your prior year’s balance sheet

Example Balance Sheet Template

Assets | Liabilities & Equity |

Cash: $50,000 | Accounts Payable: $20,000 |

Inventory: $15,000 | Business Loan: $40,000 |

Equipment: $30,000 | Capital Stock: $5,000 |

Retained Earnings: $30,000 | |

Total: $95,000 | Total: $95,000 |

Step 1: List Your Assets

Assets are resources your company owns that hold value:

Current assets: Cash, accounts receivable, inventory

Fixed assets: Property, buildings, vehicles, equipment (listed at cost and reduced by accumulated depreciation)

Step 2: List Your Liabilities

Liabilities are obligations your business owes:

Current liabilities: Accounts payable, credit card balances, short-term loan portions

Long-term liabilities: Business loans and other debts due beyond one year

Step 3: Calculate Shareholder Equity

This is the most important and often most confusing portion, particularly for S corp owners. Key equity accounts include:

Capital stock: Initial value of issued shares (S corps can only issue one class of stock)

Additional paid-in capital (APIC): Investments from shareholders above par value

Retained earnings: Profits kept in the business rather than distributed

Distributions: Cash or property paid to shareholders, which reduces equity

The Critical Link Between Your Balance Sheet and Shareholder Basis

Your shareholder basis determines whether distributions are tax-free or taxable. It starts with your initial contribution and adjusts annually:

Increases: Income earned, additional contributions

Decreases: Distributions taken, share of losses

Since 2021, the IRS has required S corp shareholders to file Form 7203, S Corporation Shareholder Stock and Debt Basis Limitations, to report their basis. That means your balance sheet and Form 7203 must line up, as discrepancies can raise IRS red flags.

How the Balance Sheet Impacts Distributions

Keep in mind that distributions in excess of your basis are taxed as capital gains. For example:

Basis: $40,000

Distribution: $50,000

Excess $10,000 is taxable

Accurate, up-to-date tracking ensures distributions remain tax-advantaged.

Common Balance Sheet Mistakes to Avoid

Maintaining your balance sheet is detail-heavy work that requires sidestepping common mistakes. Avoid these frequent errors that can misstate your financials and invite IRS scrutiny:

Misclassification errors: Recording shareholder contributions as loans instead of equity.

Data entry mistakes: Transposed numbers or omitted transactions.

Failure to reconcile: Beginning balances don’t match the prior year’s ending balances.

Poor tracking of shareholder activity: Undocumented loans or distributions.

Ignoring accrual vs. cash basis adjustments: IRS rules require consistency, even if your books are cash-based.

How Lenders and Investors Use Your Balance Sheet

Banks and investors will want to analyze your balance sheet to evaluate solvency and liquidity. Strong equity and properly reconciled accounts improve your chances of securing funding.

An incomplete or inaccurate balance sheet, on the other hand, can delay or block financing. For startups and growing businesses, this could mean missing out on critical opportunities.

Turn Your Balance Sheet Into a Strategic Tool

Think of your balance sheet as more than compliance—it’s a financial version of GPS. It shows you where your business stands today and helps guide future salary, distribution, and investment decisions.

With proactive bookkeeping and tax planning from 1-800Accountant, America's leading virtual accounting firm, your balance sheet transforms from a chore into an essential tool for growth, not just a once-a-year form. Partnering with trusted experts ensures your statements are accurate and decision-ready year-round.

S Corp Balance Sheet FAQs

What’s the difference between a balance sheet and a profit & loss (P&L) statement?

A balance sheet shows assets, liabilities, and equity at a single point in time. A P&L shows income and expenses over a period. Both are essential, but they answer different questions: “What do we own/owe?” vs. “How much did we earn/spend?”

What is the Accumulated Adjustments Account (AAA) on Schedule M-2?

The AAA tracks the accumulated, undistributed earnings of the S corp. It’s used to determine the tax treatment of distributions, ensuring they come from previously taxed income before being withdrawn from other accounts.

Can I prepare the S corp balance sheet myself?

Yes, but mistakes are common and can be costly. Misclassifying equity or failing to reconcile prior-year balances can lead to IRS issues. Many owners find it worthwhile to outsource their bookkeeping to a professional service to ensure accuracy.

Do I need a balance sheet if my S corp has no activity?

If your receipts and assets are under $250,000, you may not need to file Schedule L. However, keeping a balance sheet is still a good practice—it demonstrates financial discipline and may be required for filings in some states.

How often should I update my S corp balance sheet?

Update your balance sheet at least quarterly, but ideally on a monthly basis. Regular updates make it easier to manage cash flow, track shareholder basis, and prepare for taxes or loan applications.

What happens if my balance sheet doesn’t balance?

An unbalanced balance sheet indicates errors in recording assets, liabilities, or equity. It could be as simple as a missed entry or as complex as a misclassified shareholder transaction. Inaccuracies should be corrected promptly to prevent compliance issues.

Can shareholder loans affect my balance sheet?

Yes, shareholder loans affect your balance sheet. Loans from shareholders must be documented as liabilities, not equity. Failing to track them properly can distort both the balance sheet and shareholder basis calculations.

Do lenders look at S corp balance sheets when approving loans?

Lenders look at many aspects of your business when approving a loan, including your balance sheet. Lenders rely on them to evaluate your creditworthiness. A well-prepared balance sheet improves your ability to attract and secure financing.

How do retained earnings differ from shareholder distributions on the balance sheet?

Retained earnings are the profits that a business keeps. Distributions are profits paid out to shareholders, which reduce retained earnings and overall equity.

Can errors on my balance sheet increase the risk of an IRS audit?

Yes, errors tend to increase audit risk. Inconsistencies between your balance sheet, income statement, and filed forms are a common trigger for IRS scrutiny.

Final Thoughts

For S corp owners, the balance sheet isn’t just another IRS form. It’s a window into your business’s financial health and a tool for making more intelligent decisions. Done right, it helps you:

Stay compliant

Secure financing

Optimize shareholder returns

Ready to simplify your balance sheet and put your business on firmer financial footing? Schedule a free 30-minute consultation with 1-800Accountant today.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. 1-800Accountant assumes no liability for actions taken in reliance upon the information contained herein.