1099-MISC Instructions: How to Read the Tax Form (Explained Simply)

For many small business owners and freelancers, tax season can introduce a stack of unfamiliar forms that can feel overwhelming. One of the most common — and confusing — is IRS Form 1099-MISC, Miscellaneous Information. Whether you’re a business issuing the form or an individual receiving it, understanding how to read and file it correctly is crucial for maintaining compliance while avoiding IRS penalties.

This guide breaks down IRS Form 1099-MISC in simple, practical terms so you can approach it with confidence. We’ll walk through what it is, when you need to file it, how to read each section, and what recent updates mean for the 2025 tax year and beyond.

Key Highlights

Form 1099-MISC is used to report miscellaneous income, such as rents, royalties, prizes, and certain types of legal payments.

Businesses must file a 1099-MISC for most cash payments of $600 or more, with royalties starting at $10.

Filing deadlines are strict — January 31 each year — and penalties apply for late or incorrect forms.

Each box on the form has a specific meaning, from rents (Box 1) to state tax information (Boxes 12–17).

Common mistakes include confusing Form 1099-MISC with IRS Form 1099-NEC, Nonemployee Compensation, or entering incorrect taxpayer IDs.

Starting in 2026, the reporting payment threshold will increase from $600 to $2,000.

Professional, tax-deductible support from 1-800Accountant can simplify compliance and help you avoid costly errors.

What is Form 1099-MISC?

Form 1099-MISC is an IRS information return used to report certain types of payments not covered by Form 1099-NEC.

Businesses issue it to individuals or entities who received:

Rents (for office space, equipment, or land)

Royalties (as little as $10)

Prizes and awards

Other miscellaneous income

If your business paid at least $600 in these categories during the tax year, you must file a 1099-MISC. Recipients include landlords, prize winners, attorneys for legal services, and other non-employees.

1099 key distinction:

1099-NEC reports non-employee compensation (independent contractor tax forms).

1099-MISC reports other payments, including rents and royalties.

When Do You Need to File Form 1099-MISC?

The IRS requires businesses to fileForm 1099-MISC by January 31 each year, both with recipients and the IRS.

Recipient copy due: January 31

IRS filing deadline: January 31 (whether filing by paper or electronically)

Penalties for late or incorrect filing:

$60 per form if filed within 30 days of the deadline

$130 per form if filed after 30 days but before August 1

$330 per form if filed after August 1 or not filed at all

Missing or incorrect taxpayer identification numbers (TINs) may also trigger backup withholding obligations.

Whether you're formed as a limited liability company (LLC) or a C or S corporation, working with a qualified accountant helps you avoid these mistakes and ensures timely, accurate filings. 1-800Accountant offers tax planning and compliance services to help alleviate this burden for an affordable, tax-deductible fee.

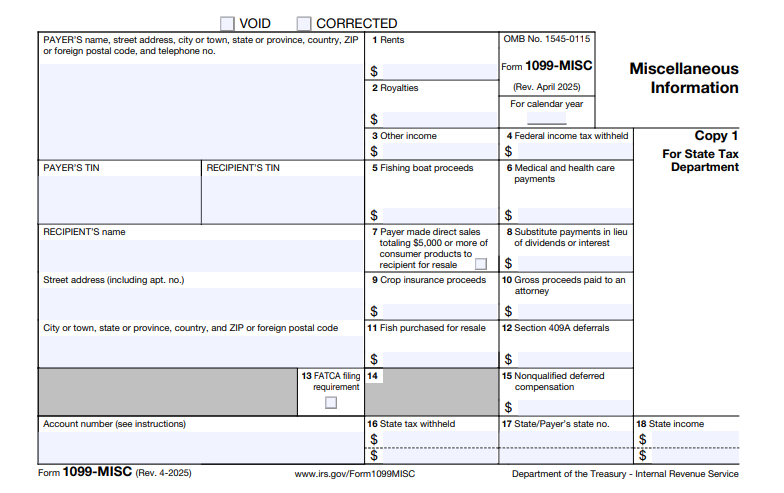

Step-by-Step Guide to Reading Form 1099-MISC

Use this section to view IRS form instructions and learn how to read 1099-MISC and its various sections.

Payer and Recipient Information

The top of IRS 1099-MISC form lists:

Payer’s name, address, and TIN

Recipient’s name, address, and TIN

Why it matters: Errors here can cause IRS mismatches and trigger backup withholding. Always double-check for accuracy.

Breakdown of Key Boxes

Box | What It Reports | Filing Threshold | Examples |

Box 1 | Rents | $600+ | Office rent, machinery leases, and farmland rent |

Box 2 | Royalties | $10+ | Book royalties, mineral rights |

Box 3 | Other Income | $600+ | Prizes, awards, and lawsuit settlements |

Box 4 | Federal Income Tax Withheld | N/A | Backup withholding |

Box 7 | Direct Sales of $5,000+ | $5,000 | Consumer goods for resale |

Boxes 12–17 | State Tax Information | Varies | State tax withheld, payer ID numbers |

Common Errors to Avoid

Avoid these common errors when preparing your Form 1099-MISC.

Confusing 1099-MISC with 1099-NEC.

Forgetting that royalties of $10 or more must be reported.

Entering incorrect TINs can result in IRS notices.

Missing the January 31 deadline.

1099-MISC vs. 1099-NEC: What’s the Difference?

The IRS reintroduced Form 1099-NEC in 2020 to alleviate confusion that had been occurring.

1099-NEC = Nonemployee compensation (wages paid to freelancers and independent contractors).

1099-MISC = Miscellaneous payments like rents, royalties, and prizes.

Both forms may be issued to the same person if they received different types of income.

2025–2026 Updates to 1099 Reporting Rules

Currently, businesses are required to issue a 1099-MISC for payments exceeding $600. However, starting in 2026, the threshold rises to $2,000, adjusted annually for inflation.

2025: $600 threshold still applies.

2026: $2,000 threshold, backup withholding applies only above $2,000.

Business owners should prepare for this change now, ensuring accounting systems can track new thresholds and reporting requirements.

How 1-800Accountant Can Help with 1099 Filing

Preparing and submitting each tax form yourself can be stressful and time-consuming, which is where expert support comes in. With 1-800Accountant, America's leading virtual accounting firm, you get:

Year-round support from a dedicated CPA, EA, bookkeeper, or tax professional

Accurate and timely filings for 1099s, W-2s, and other compliance forms

Integrated services including bookkeeping, payroll, and tax preparation

Peace of mind knowing you’re IRS-compliant

Schedule a free consultation today and let our experts simplify your 1099 filings so you can focus on what you do best: running your business.

FAQs About Form 1099-MISC

Do I need to send a 1099-MISC to my landlord?

If rent paid is $600 or more during the year, and your landlord is not a corporation, you must send them a 1099-MISC by January 31. You may need to obtain their individual taxpayer identification number and information related to their business account.

What if I made payments under $600?

If you made personal payments below the $600 threshold, you typically won't need to file. However, if you made royalty payments of $10 or more, you will need to file.

Can I issue both a 1099-MISC and 1099-NEC to the same person?

If they received different types of reportable payments, such as broker payments for fair market value or excess golden parachute payments, you should issue both forms to the same person.

How do I correct a mistake on a 1099-MISC?

If you notice a mistake, file a corrected 1099-MISC with the IRS as soon as possible. It's better to address 1099-MISC errors proactively.