Many small business owners monitor their profit and loss statements, but, frustratingly, still find themselves short on cash. In fact, 82% of small businesses fail due to poor cash flow management, according to research from Krieger Analytics. Understanding how cash moves in and out of your business is one of the most essential steps you can take toward financial stability.

This guide explains how to build a clear cash flow statement, what to include, and how to analyze the results. You’ll also get access to a free monthly cash flow template for businesses like yours.

Download your free small business cash flow statement template now

Key Highlights

A cash flow statement tracks real money movement — not just profits on paper.

Over 60% of small businesses experience cash flow challenges each year.

Learn how to build a cash flow statement, read, and customize it using our free template compatible with Microsoft Excel and Google Sheets.

Identify red flags early and use proven strategies to maintain healthy liquidity.

Apply cash flow insights to guide smarter business decisions — from hiring to investing.

Why the Cash Flow Statement Matters for Small Businesses

Cash Flow vs. Profit: The Key Difference

Profit measures income after expenses, but it doesn’t show when cash actually changes hands. Cash flow, on the other hand, reflects real inflows and outflows.

For example:

You might record $5,000 in revenue for an invoice sent in March, but if it isn’t paid until May, your March cash flow is still zero.

Depreciation reduces profit but does not affect cash.

That’s why tracking both your income statement and cash flow statement is crucial — profit can look healthy while your bank balance tells a different story.

Common Cash Flow Pitfalls Among Small Businesses

Many small businesses operate with dangerously thin cash reserves, with half of small firms having fewer than 15 days of cash buffer. 60%+ of small businesses report cash flow challenges each year, with 22% struggling to pay basic bills due to cash shortages.

Common issues include:

Overestimating available funds by checking only the bank balance

Delayed receivables and slow customer payments

Large, unexpected expenses

Seasonal dips in revenue

Even a profitable company can run out of cash without a clear picture of these dynamics.

How a Cash Flow Statement Helps

A detailed cash flow statement gives small business owners control and foresight. It allows you to:

Identify periods of cash surplus or shortage

Forecast when to borrow or reduce discretionary spending

Demonstrate transparency to investors or lenders

Plan confidently for hiring, inventory, and capital investments

Tracking cash flow monthly or quarterly can reveal trends that help you make proactive decisions before problems arise.

Components of a Cash Flow Statement (and How to Build It)

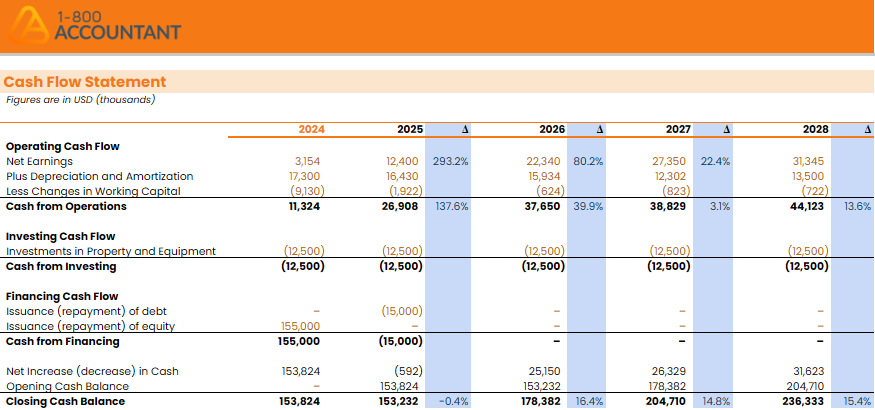

Overview: Operating, Investing, and Financing Activities

A standard cash flow statement is divided into three sections:

Category | Description | Example Transactions |

Operating Activities | Day-to-day business operations generate cash inflows or outflows. | Cash received from customers, supplier payments, payroll, and taxes. |

Investing Activities | Purchases or sales of long-term assets. | Buying or selling equipment, property, or software. |

Financing Activities | Funding sources and repayments. | Loans, owner contributions, dividend payments. |

The statement, including our free template, reconciles opening cash + net cash flows = ending cash for each period.

Direct vs. Indirect Method

Direct vs. indirect cash flow method. You can prepare a cash flow statement using either:

Direct Method: Lists all actual cash receipts and payments — ideal for smaller businesses using simple bookkeeping systems.

Indirect Method: Starts with net income and adjusts for non-cash items, such as depreciation and changes in working capital (accounts receivable, accounts payable, inventory).

Most accounting software supports the indirect method because it aligns easily with your income statement and balance sheet.

Line Items and What to Include

Operating Activities: cash from sales, vendor payments, rent, payroll, taxes, and interest.

Investing Activities: asset purchases, software subscriptions, and the sale of equipment.

Financing Activities: new loans, debt repayments, owner draws, or capital infusions.

Under the indirect method, remember to add back non-cash expenses, such as depreciation or amortization. And remember that reconciliation is opening cash + net cash flows = ending cash.

Common Variations and Customization

Every business has unique cash patterns. Review these common variations and customization of your business's patterns.

Monthly templates are best for tight cash monitoring.

Quarterly or annual templates may suffice for stable businesses.

Seasonal operations (like landscaping or retail) may want to include “buffer” months.

Forecasted statements can help plan future spending or capital investments.

If you’d like professional help customizing your version, our bookkeeping experts can assist for an affordable, tax-deductible fee.

Using the Template: Step-by-Step Guide

Review this step-by-step guide to using our cash flow statement template.

Open the Template – Download the Excel or Google Sheets version.

Enter Beginning Cash Balance – Start with your bank balance from the first day of the period.

Input Actuals – Add cash received from sales and other sources. Then record outflows for expenses, payroll, and taxes.

Add Forecasts – Estimate upcoming receipts and payments for the next few months.

Check Totals – Ensure the totals reconcile (Opening Cash + Net Cash Flow = Ending Cash).

Review Trends – Watch for consistent deficits, large swings, or seasonal dips.

A properly maintained template will highlight where cash bottlenecks are forming so you can act before they become serious.

Download your free small business cash flow statement template now

Analyzing and Acting on Your Cash Flow Results

Review the following sections to understand key metrics and what to watch for, actions to take when you encounter a cash flow shortfall, and best practices to maximize your success.

Key Metrics and Signs to Watch

Net Cash Flow: The bottom line increase or decrease in cash.

Operating Cash Flow to Revenue: A shrinking ratio signals potential trouble.

Cash Flow to Debt Ratio: (Operating Cash Flow ÷ Total Debt) shows how easily your business can service obligations.

Days of Cash on Hand: How many days your cash reserves can cover expenses — an essential liquidity measure. Small business liquidity management is crucial.

What to Do When You See a Cash Shortfall

If your template shows negative or declining cash balances:

Accelerate Collections: Send invoices promptly and shorten payment terms.

Cut Nonessential Spending: Delay upgrades or optional projects.

Negotiate with Vendors: Request longer payment terms.

Secure Short-Term Funding: Use a business line of credit judiciously.

Monitor Burn Rate: Track how quickly you’re spending cash each month.

Best Practices to Maintain Healthy Cash Flow

Review your cash flow monthly.

Maintain at least 3 to 6 months of expenses in reserve.

Set alerts for low-cash thresholds.

Cross-check cash flow with your income statement and balance sheet.

Use rolling 90-day forecasts to anticipate needs in advance.

For a broader financial organization, explore our free balance sheet template.

Template Download and Customization Tips

Tips for your free cash flow statement Excel download format, which is also available for Google Sheets, include:

Customize categories that fit your business model (e.g., “Equipment Leasing” or “Software Subscriptions”).

Avoid hard-coding totals — use formulas to prevent manual errors.

Back up your file regularly and save historical versions for comparison.

When in doubt, consult your accountant before making structural changes.

Need extra help tailoring the template? Talk to our team at 1-800Accountant.

Common FAQs and Troubleshooting

What if my template shows a large negative cash flow?

If you've observed large negative cash flow, look at operating vs. investing cash flows. A temporary dip may be fine if it’s due to planned equipment purchases or growth.

Why is profit positive but cash negative?

In this scenario, it's because profit includes accruals and non-cash items — like unpaid invoices or depreciation.

How often should I update the template?

Target monthly updates, although more frequent updates help identify issues early.

What if I change accounting methods (e.g., switch software)?

When switching software, identify candidates that offer compatibility with your current bookkeeping environment for maximum efficiency. Our proprietary bookkeeping platform, ClientBooks, is compatible with leading accounting software, including QuickBooks Online, FreshBooks, and Wave.

Can I use this with accounting software like QuickBooks or Xero?

Yes, this free template can be used with QuickBooks and Xero. Export cash flow data or integrate reports for a complete view.

How do I handle one-off or irregular cash flows?

Create a “Non-Recurring Items” line to keep them separate from regular operations to handle one-off and irregular cash flow events.

Conclusion and Next Steps

A clear view of cash flow is one of the best tools for running a successful small business. Our free downloadable template shows where your money truly goes, helps you plan ahead, and prevents unpleasant surprises.

If you’d like expert help customizing it — or want professional support with bookkeeping, payroll, or tax planning — schedule a free consultation with 1-800Accountant, America's leading virtual accounting firm. Our team of CPAs, EAs, bookkeepers, and tax professionals is here to help you keep your business on solid financial ground, and we look forward to your feedback and demand for additional small business bookkeeping templates.

Download your free small business cash flow statement template now

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. 1-800Accountant assumes no liability for actions taken in reliance upon the information contained herein.