Creating an invoice may seem like a straightforward process, but small business owners and freelancers know that even minor invoicing mistakes can delay payments or lead to disputes. A clear, accurate invoice not only helps you get paid faster but also strengthens your professional image and supports smooth bookkeeping practices.

In this guide, 1-800Accountant, America's leading virtual accounting firm, walks you through six easy steps to create an invoice that works every time. We also provide a free small business invoice template that you can download and personalize to save time and effort. By the end, you’ll have a ready-to-use invoice and know precisely how to bill clients with confidence, contributing to smooth operations.

Key Highlights

Learn how to invoice clients by creating and customizing a professional invoice in six easy steps.

Understand what details to include to avoid payment delays.

Discover common invoicing mistakes and learn how to avoid them.

Use our free, customizable invoice template to simplify your workflow.

Apply best practices that help small businesses get paid faster.

What Is an Invoice and Why It Matters

Creating an invoice format for service providers from scratch can be challenging, which is why we offer a contractor invoice sample template that can also be used by freelancers, entrepreneurs, and small business owners.

Definition of an Invoice

Before you learn how to create invoices, you need to know what they are. An invoice is a formal document that's a part of the billing process requesting payment for goods or services you’ve provided. It details services rendered along with payment terms and due dates:

What was sold

When

For how much

Accuracy and clarity are essential because they establish your professionalism and serve as a legal record of your transaction.

Impact on Your Business

Timely and detailed invoices are critical for maintaining a positive cash flow and client trust. Waiting over 30 days typically harms cash flow, so time is of the essence.

A well-structured invoice also helps shorten the pay cycle. Professional invoices also:

Reduce disputes

Simplify accounting

Helps keep your financial records organized for tax time

Common Mistakes Small Businesses Make

Many small businesses struggle with:

Inconsistent templates

Missing details

Vague payment terms

Late invoicing or unclear descriptions can result in delays and lost revenue. The key is to create a reliable process and use consistent formats.

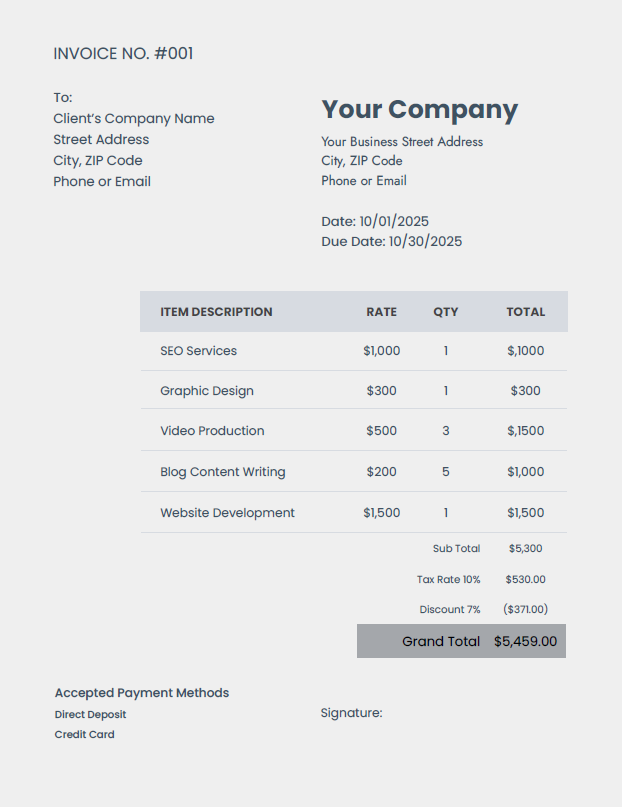

Step 1: Download and Personalize the Free Invoice Template

Start with the free invoice template from 1-800Accountant, available in Microsoft Word, Microsoft Excel, and PDF formats. Whether it's invoice creation for freelancers or business owners, this template includes key components and all essential invoice fields, so you don’t have to start from scratch.

Add essential information, including your company name, logo, and contact details, at the top. Then include your:

Customer's name

Address

Unique invoice number

You can also customize the color schemes and fonts to align with your brand. Using the same standardized template each time makes your invoicing process faster and more consistent, while ensuring you never omit key information. Whether it's a debit invoice, a credit invoice, a timesheet invoice, or a recurring invoice, our free templates support your ongoing initiatives.

Step 2: Enter Essential Invoice Details

Header Information

Each invoice should clearly display both parties’ details:

Your information: business name, address, email, and phone number.

Client information: full name or business name, address, and contact info.

Invoice details: invoice number, issue date, and due date.

Create a numbering system for tracking (for example: 2025-ClientName-001). This makes it easy to organize records and avoid duplicates.

Description of Goods or Services

List each product or service separately and include:

A brief description

Quantity or total amount of hours

Rate

Total per line item

Be clear and specific about services provided to avoid confusion on your standard invoice. For example, instead of writing "consulting," use "Business strategy consultation, 3 hours."

Payment Terms and Due Date

Define accepted payment methods (such as bank transfer, check, or online payment) and set your invoice date (Net 15, Net 30, etc.). Be sure to mention any late fees or discounts for early payment.

Transparency in terms reduces confusion and strengthens client relationships.

Step 3: Calculate Totals, Taxes, and Any Adjustments

Sum up all items, then add any applicable taxes, such as sales tax or VAT. If you’re offering discounts or applying additional fees, clearly display them. A best practice is to display:

Item Description | Rate | Quantity | Total |

Business Consulting | $100 | 3 hrs | $300 |

Subtotal | $300 | ||

Sales Tax (6%) | $18 | ||

Total Due | $318 |

Accurate calculations reduce disputes and build client trust.

Step 4: Add Professional and Legal Touches

Branding and Presentation

Your invoice should reflect your professionalism, so be sure to use:

Your company logo

Consistent fonts

Colors that align with your brand identity

Clean, visually appealing invoices stand out and reinforce your business's credibility.

Terms and Notes Section

Use this space for brief notes, such as “Thank you for your business!” or reminders about upcoming due dates and late fees. Contractors can include purchase order numbers or project references for clarity.

Legal and Compliance Considerations

Keep a copy of every invoice for your records. This is a smart bookkeeping habit that helps with tax reporting and audits. If your industry has specific invoicing requirements, be sure to comply with them.

For added accuracy, you can rely on 1-800Accountant’s bookkeeping services to help manage your records.

Step 5: Send the Invoice and Track It

Send invoices as soon as a service or product is delivered. Prompt invoicing helps improve small business cash flow and enables you to get paid faster. You can:

Email a PDF

Use invoicing software

Send a physical copy

Track when each invoice was sent, note the payment status, and follow up on any overdue balances. More than half of small businesses wait over 30 days for payments, so tracking and timely reminders are essential.

Step 6: Follow Up and Record Payment

Reminder Process

Create a polite but firm follow-up schedule. For example:

5 days past due: Friendly reminder.

15 days past due: Second notice with payment options.

30 days past due: Formal notice referencing any late fees.

Automated reminders through your invoicing system help maintain consistency and ensure timely payments.

Record Payment and File the Invoice

Once payment is received, mark the invoice as “Paid” and issue a receipt if necessary. File the document, either digitally or in hard copy, for tax reporting purposes. Good recordkeeping helps at year-end and supports cash flow visibility.

Bonus Tips for Better Invoicing Efficiency

It's important to follow billing and invoicing best practices for small businesses. Utilize these bonus tips to enhance invoicing efficiency and promote smoother operations.

Consider using e-invoicing tools to automate repetitive tasks (read more about e-invoicing benefits).

Maintain consistent invoice numbering and templates to streamline bookkeeping.

Offer early payment discounts to encourage faster transactions.

Accept multiple payment methods, such as ACH, credit card, or PayPal, to reduce friction.

Periodically review and optimize your invoicing process to identify bottlenecks or outdated terms.

Sending Your First Invoice

By following these six steps, you can create custom invoices that are:

Accurate

Professional

Designed to help you get paid on time

Using our free invoice template simplifies the process, so you can focus on running your business instead of chasing payments.

A clear invoicing system leads to improved cash flow, reduced client disputes, and more accurate bookkeeping. If you’re ready to take your small business finances to the next level, explore 1-800Accountant’s bookkeeping and accounting services to stay organized and compliant year-round.

Schedule a free 30-minute consultation to get started.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. 1-800Accountant assumes no liability for actions taken in reliance upon the information contained herein.