Imagine a small business owner who recently discovered that electing S corporation status could have saved thousands in self-employment taxes — but the deadline passed months ago. The good news? It may not be too late. The IRS allows some businesses to retroactively elect S corporation status, effectively backdating their tax treatment as if they had filed on time.

A retroactive S corporation election (also called a late S election) can correct missed opportunities and align your business structure with your intended tax strategy. In this guide, we’ll explain what it is, how it works, who qualifies, and when it makes sense to seek professional help.

Key Highlights

A retroactive S corporation election allows eligible businesses to apply S corp status for a prior tax year after missing the original deadline.

The IRS provides late-election relief under Rev. Proc. 2013-30, allowing businesses to backdate their elections if they meet specific conditions.

Eligible entities must demonstrate reasonable cause for the late filing and confirm that all shareholders consistently reported income as S corporation shareholders.

Businesses can generally request relief within 3 years and 75 days after the corporation's intended effective date.

If relief isn’t available under the simplified process, the company must file a Private Letter Ruling (PLR) request.

Working with an experienced tax professional helps ensure compliance, proper documentation, and ongoing S corporation status.

What Is a Retroactive (Late) S Corporation Election?

A retroactive S corporation election lets an eligible business request S corp treatment for a past tax year. Typically, a business must file IRS Form 2553, Election by a Small Business Corporation, within two months and 15 days after the start of the tax year the election should apply to. Missing this window makes the election “late.”

To accommodate legitimate mistakes or misunderstandings, IRS late S election relief is available (Rev. Proc. 2013-30). This procedure consolidates previous rules and allows late S corporation elections when a business can demonstrate reasonable cause for the delay.

Timely vs. Retroactive Election Rules

Type of Election | Filing Deadline | Effective Date | Example |

Timely Election | Filed within 2 months + 15 days of the start of the tax year | Retroactive to the first day of that tax year | Formed Jan 1 → File by Mar 15 for current year |

Retroactive (Late) Election | Filed after the deadline, with a reasonable-cause statement | Retroactive to prior tax year(s) if approved | Formed Jan 1, 2023 → File in 2025 under relief rules |

The IRS allows retroactive entity classification elections to reduce hardship for legitimate small businesses — acknowledging that entity elections can be confusing for new owners managing multiple compliance tasks.

Eligibility and Requirements for a Retroactive S Election

Relief for late elections is governed by Revenue Procedure 2013-30, which streamlines prior guidance. To qualify:

The entity must have intended to elect S corp status from the effective date.

It must meet S corporation eligibility rules — including being a domestic entity, having no more than 100 shareholders, and maintaining only one class of stock (see S corporation eligibility rules for further details).

All shareholders must have reported income consistent with S corporation treatment for the period in question.

No disqualifying events, such as ineligible shareholders or multiple stock classes, occurred during the retroactive period.

The relief request must be properly filed, including Form 2553 and a reasonable-cause statement.

Relief is generally available for up to 3 years and 75 days after the intended effective date.

If your business satisfies these criteria, the IRS may treat your election as timely.

When Relief Is Not Available

Simplified late filing relief isn’t always possible. The IRS won’t grant relief if:

More than 3 years and 75 days have passed since the intended effective date.

The company fails one or more eligibility requirements.

Prior shareholder returns are inconsistent with S corp reporting.

In those cases, a PLR must be requested, which is a more formal and costly process that requires a user fee and IRS approval.

How to File a Retroactive (Late) S Election

Filing for retroactive S corp status involves several steps. When it comes to how to file late S corp election, accuracy and documentation are key.

Complete Form 2553 Late Election. Identify the intended effective date and ensure all shareholder information is correct.

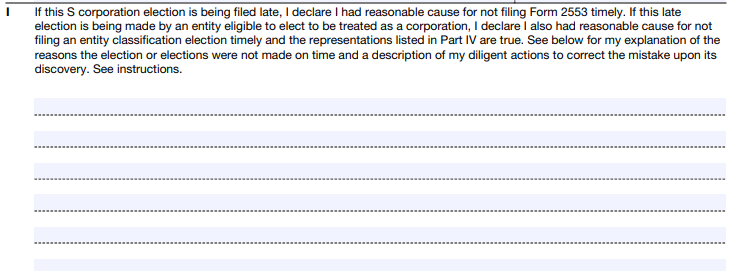

Attach a Reasonable-Cause Statement. Explain why the election wasn’t filed on time (e.g., reliance on professional advice, misunderstanding of filing requirements). Keep the explanation factual and concise.

Include Shareholder Consents. Each shareholder must sign and consent to the retroactive election.

Mark the Filing Clearly.

On the top margin of Form 2553, write: “FILED PURSUANT TO REV. PROC. 2013-30.”

Submit to the IRS. The form can be mailed or faxed to the appropriate IRS service center, or attached to the first filed IRS Form 1120-S, U.S. Income Tax Return for an S Corporation, if applicable.

For specific line-by-line instructions, review the official IRS Form 2553 instructions.

Example Walkthrough

Let’s say GreenTech LLC was formed on January 1, 2022, but didn’t file Form 2553 by March 15. The owners always intended S corp treatment and reported income accordingly on their 2022 and 2023 returns.

In 2025, they discover the oversight and file under Rev. Proc. 2013-30. Because they meet all conditions and are within 3 years and 75 days, the IRS accepts the election, retroactively effective as of January 1, 2022. The company can then file amended returns and Schedule K-1 distributions as needed.

Tax Implications and Adjustments for Retroactive Election

Successfully electing S corp status for your business comes with tax implications and adjustments. When the IRS grants retroactive S corporation status:

The entity’s past corporate income and losses are passed through to shareholders as if the S election had always been in effect.

The business may need to amend prior Form 1120-S filings or file initial returns for those years.

Shareholders may need to amend their personal returns to reflect the adjusted K-1s.

Certain tax attributes, such as depreciation or carryforwards, may require recalculation.

Businesses should also review potential built-in gains tax or passive income limitations.

Additionally, an accepted election can impact Qualified Business Income (QBI) deduction eligibility and payroll tax planning strategies. This is a top reason why a professional review is essential.

Risks, Pitfalls, and When It Fails

While relief is common, mistakes can lead to IRS rejection or future issues, potentially disrupting your operations.

Common Pitfalls

Missing the relief window: Filing beyond the 3-year + 75-day period.

Incomplete documentation: Missing shareholder consents or unclear explanations.

Inadvertent termination S corp election: Even after approval, S status can be lost if eligibility rules are violated, such as issuing a second class of stock or admitting an ineligible shareholder. The IRS offers inadvertent termination relief for those cases.

State conformity issues: Some states have different deadlines or rules for recognizing S corporations. Check with your Secretary of State or other authorities for more details.

Audit exposure: Retroactive elections may trigger a review of prior returns.

If an election is rejected, the business remains taxed as a C corporation or partnership until a valid election takes effect.

Best Practices and Tips

While mistakes and pitfalls are common in the retroactive S corp election process, embracing these best practices and tips will help minimize potential issues.

Act quickly. File as soon as the oversight is discovered.

Maintain documentation. Keep proof of intent to elect S status (emails, meeting minutes, prior tax drafts).

Secure all consents. Ensure every shareholder signs Form 2553.

Review eligibility carefully. Double-check shareholder types and stock structure.

Engage a professional. Complexities around amended returns and IRS communication are best handled by experts.

When to Consult a Professional

Making a late or retroactive S election can significantly affect your business's tax position. While you may be able to navigate the process yourself, expert support ensures efficiency. An experienced accountant can:

Evaluate your eligibility for relief under Rev. Proc. 2013-30.

Prepare Form 2553 and the reasonable cause statement correctly.

Review prior-year filings for consistency and potential amendments.

Communicate with the IRS on your behalf.

Help you maintain compliance going forward to prevent inadvertent terminations.

At 1-800Accountant, America's leading virtual accounting firm, our CPAs, EAs, and tax professionals specialize in helping small businesses navigate entity elections and IRS relief processes. Whether you need guidance on forming an S corporation, filing a late election, or restructuring from an LLC, we make the process simple, accurate, and stress-free.

Schedule a free 30-minute consultation to review your situation and learn how much you could save by optimizing your business structure.

Next Steps

A retroactive S corporation election gives small business owners a valuable second chance to claim missed tax advantages. While the IRS offers flexibility through Rev. Proc. 2013-30, the process still requires careful documentation, timely action, and a solid understanding of eligibility rules.

If you believe your business should have been an S corporation in prior years, don’t navigate the process alone. Connect with the professionals at 1-800Accountant to ensure your election is handled correctly — so you can focus on what matters most: growing your business.

FAQ

Can an LLC retroactively elect S corp status?

Assuming the LLC meets eligibility and other conditions, it can retroactively elect S corporation status. LLCs and S corps feature pass-through taxation, which means owners or shareholders address their share of business profits and losses from the preceding tax year on their personal income tax returns.

What if one shareholder disagrees with the S corp election?

All shareholders must consent to the business's retroactive S corp election. The election cannot move forward even if a single shareholder objects. Some action may be taken by the other shareholders in the event of a holdout.

Is there a guarantee that the IRS will accept a retroactive S corp election?

There is no guarantee that the IRS will accept a retroactive S corp election. However, you'll have a good chance of achieving S corp tax status if your business is eligible and you meet IRS requirements.

What’s the cost of applying for a PLR?

A standard PLR fee is nearly $44,000, while fees for a small business can start at a little under $3,500. While applying for a PLR may seem expensive, the tax benefits of operating as an S corporation outweigh initial fees.

What if the entity no longer qualifies for S corporation status?

S corp eligibility requirements must be maintained throughout the life of your business, or for however long you operate as an S corporation. Failing to maintain S corp eligibility requirements typically results in termination of the election.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. 1-800Accountant assumes no liability for actions taken in reliance upon the information contained herein.