Accounting, Bookkeeping, & Tax Blog

Your small business resource for accounting, bookkeeping, and taxes from our experts.

Summer is just around the corner, which means Q2 quarterly taxes are due for many small businesses. While some businesses use a service to calculate and su [...]

Navigating tax return transcripts can be tricky, especially when you’re uncertain about the right forms to use. If you’ve ever needed tax retur [...]

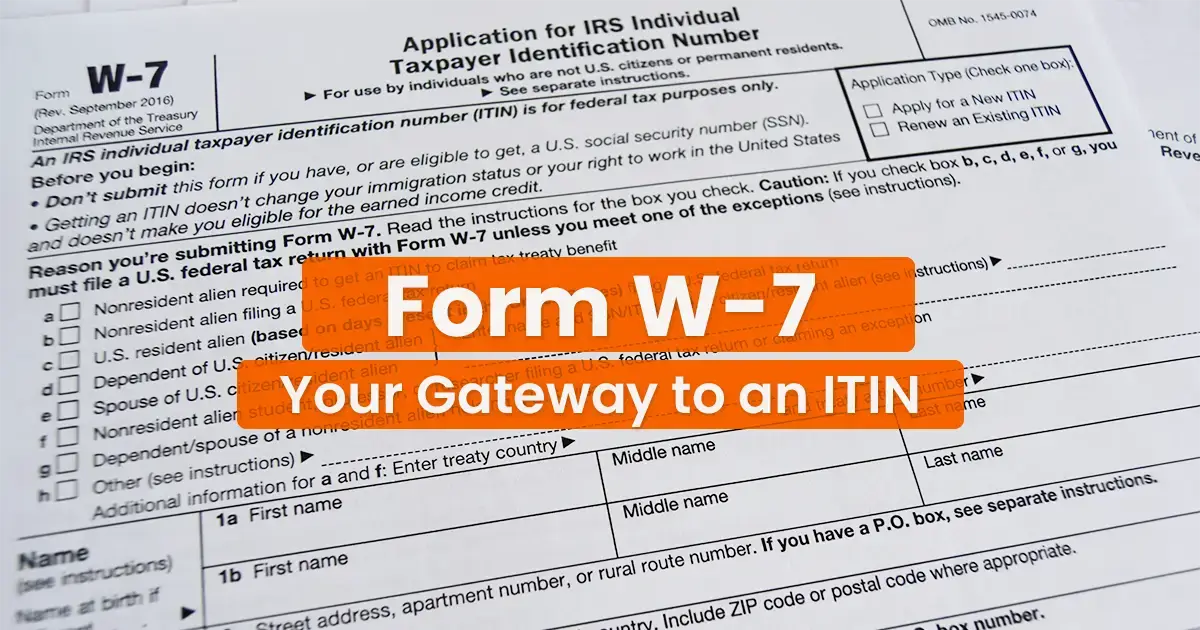

For tax purposes, the IRS requires non-U.S. citizens to file for an ITIN. Form W-7 is used to apply for or renew an Individual Taxpayer Identification [...]

Whether you’re an entrepreneur, a freelancer looking to establish your own business, or a small business owner seeking to restructure, the single-mem [...]

Special tax deductions are available to proprietors of e-commerce businesses. Take advantage of the following e-commerce tax deductions to maximize your ta [...]

When tax time arrives, many small businesses will need to complete tax forms. The exact form the business needs will depend on several factors. There [...]

The clock is ticking, and tax season is right around the corner. As you gear up to confront the daunting task of filing your taxes, it’s essential to [...]

For small business owners and taxpayers, one of the most inconvenient things to happen is to receive a notice of an IRS audit. For many people, it’s not al [...]

Etsy is an essential platform for many small businesses in today’s e-commerce era. But with that unique challenges and advantages. While offering inc [...]